The FBM KLCI opened at 1,482.08 as compared to last Friday’s close of 1,481.80.

At the time of writing, the benchmark index was traded in the range of 1,481.16 – 1,482.08.

According to analysts, the KLCI would be likely to challenge the 1,500-point level due to improved sentiment.

Technical Analysis on KLCI Futures (FKLI)

RHB Retail Research has maintained long positions on KLCI futures.

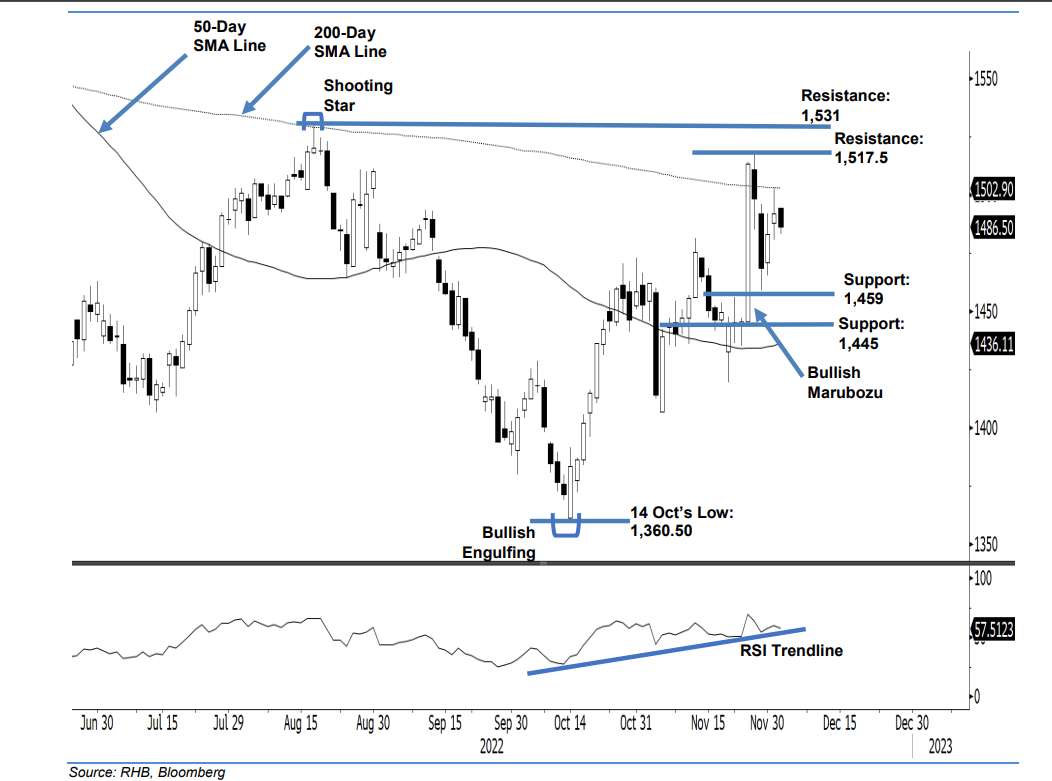

The FKLI pauses its upward movement on Friday, and progressed sideways below the 200-day SMA line while maintaining its uptrend “higher low” bullish posture. That day, it opened at 1,494.5 pts but lost momentum as it immediately dropped to print the intraday low of 1,483 pts before rebounding mildly at the close.

The latest bearish candlestick that engulfed the previous session’s white body candlestick indicates that traders may take profit further in the coming sessions, before bullish momentum re-emerges after that – supported by the “higher low” bullish pattern.

As the 50-day SMA line is curving higher, thereby enhancing the bullish setup, the index may likely climb above the 200-day SMA line to test the immediate resistance of 1,517.50 points. Towards the downside, strong support has been established at the 1,459-point level. Due to the medium bullish momentum, we stick to a positive trading bias.

Traders should maintain the long positions initiated at 1,475.50 points (11 Nov’s close). To manage the downside risks, the stop-loss is set at 1,459 points.

The immediate support is at 1,459 points – 29 Nov’s low – followed by 1,445 points. Towards the upside, the immediate resistance remains at 1,517.5 points – 25 Nov’s high – followed by 1,531 points.