olar seems to be the most convenient form of electricity due to the geographical location of Malaysia being situated along the equator with sunlight throughout the year. It would certainly complement renewable energy producers which ranges from hydropower, wind, geothermal, biogas, without much doubt.

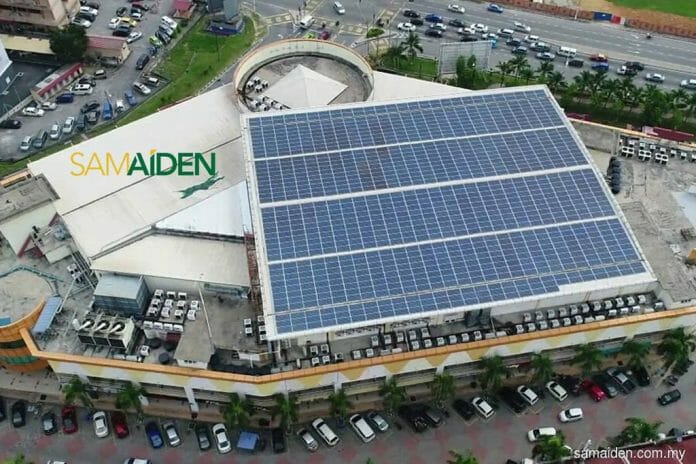

There has also been a surge of Malaysian engineering, procurement, construction and commissioning (EPCC) of solar photovoltaic (PV) systems and power produces who have been listed on the Bursa Malaysia stock exchange.

In light of these two points, BusinessToday spent time with Samaiden Group Berhad Group Managing Director Chow Pui Yee exclusively to discuss the production into the solar power industry in Malaysia and its challenges faced by end-users.

The discourse also delved into the industry’s producers’ perspectives and the challenges they faced.

BT: What are the main challenges faced by consumers in Malaysia in adopting Renewable Energy (RE)? What initiatives can be taken to address the problems?

Chow: The main challenges cited as barriers to greater adoption of RE in Malaysia deals with the factors of cost and awareness. Where cost is concerned, it has to be said that the actual for solar system has significantly reduced since 2017 and no longer requires to be subsidised by the Feed in Tariff (FIT) scheme. Additionally, in addressing the cost factor, there is the Net Energy Metering (NEM) 3.0 by the Sustainable Energy Development Authority (SEDA) Malaysia programme catered for residential consumers in which residential users who consume the energy produced from the solar PV installation will be consumed first, and any excess will be exported to TNB at prevailing displaced cost.

In order to boost the adoption of RE for residential, financial support schemes by financial institutions and banks are crucial as most of the residents are not willing to incur the upfront cost for the solar PV systems installation. Awareness and promotional activities are important to make the residents understand that the adoption of RE not only supports the government net carbon emission target but can assist them to minimise the risk of electricity cost increases due to the rising fossil fuel cost in the long run.

BT: Low RE adoption has often been said to be due the lack of infrastructure or grid connectivity. How far behind is Malaysia on this? If this is true, how long this would take for the nation to catch up to a reasonable level?

Chow: Lack of infrastructure or grid connectivity for RE adoption is not really applicable in Peninsular Malaysia as our grid connectivity is well planned and ready for RE adoption. The issue that the RE industry is facing now is the government policy or lack of programmes needed to speed up its implementation. Recently, the government launched the National Energy Policy (DTN) 2022 – 2040 outlining the direction of the energy sector in the coming years. This should help with the objectives of RE implementation.

BT: Why is Malaysia lagging behind in the adoption of RE? Is it due to the lack of regulatory support or framework or private FDI?

Chow: There are several plausible reasons behind the lag of RE adoption, one of which would be the continuous RE programme or quota awarded by the government to support the energy market development. For instance, the progress of implementation of the Large-Scale Solar 4 (LSS4) programme has been slowing down due to the low bidding price associated with the increase in material cost due to global demand and the strength of the US dollar which has significantly impacted the return of investment of the proposed projects.

Another major reason is the prevailing electricity prices in Malaysia which is partially subsidsed by the government. Due to these factors, we are not facing the actual cost impact due to the significant increase of fossil fuel cost globally as the government is still maintaining the imbalance cost pass-through (ICPT) mechanism. Whereas in other countries, the demand for RE or solar energy has surged progressively as the consumers call for a lower reliance on fossil fuels to generate energy which is subject to cost fluctuations and as solar energy that is virtually free since it is obtained from the sun’s rays.

Lastly, it is about political uncertainty which further curb investments from abroad.

BT: How does the recent tie-up with Thingnario help Samaiden?

Chow: The partnership with Thingnario is part of our digitalisation strategy to help us enhance operations and maintenance works through the deployment of technology which can help us manage plant operations and maintenance more efficiently. Moreover, we also believe that the expertise from Thingnario can help is propel into the energy efficiency business.

BT: Let’s talk about LSS (Large Scale Solar) – the quota, feasibility, competition and hiccups. What more can be done?

Chow: Ministry of Energy and Natural Resources (KeTSA) recently announced the 600MW Corporate Green Power Programme (CGPP) to encourage the private sector to use green electricity sources through the installation of solar PV systems as part of the national energy transition plans. Many market players have started to secure the potential land for the development of LSS farms through the CGPP programme to sell the electricity to willing corporate buyers at a fixed price and duration.

While the solar developers or generators can participate in the electricity market operated by Single Buyers through the New Enhanced Dispatch Arrangement (NEDA) mechanism and trading of the Renewable Energy Certificate (REC) and/or any green attributes to the corporate buyers available, the electricity cost structure to be sold to the corporate buyers will take into consideration the increased raw materials cost such as panel and inverters linked to the upward trend of the US dollar.

As such, our group always works hand in hand with the relevant stakeholders and continuously review the market factors and adjust our strategy accordingly in order to support the national agenda while ensuring the investment is technically and financially viable.

BT: As we know, China has now dominated PV production, in terms of quality and quantity. How does this affect your company? What would be Samaiden’s edge?

Chow: We have seen global supply chain disruptions related to the production of solar panels and accessories resulting from various lockdown measures; not just from China but also from other countries. The result is higher material prices impacting total project cost.

However, the costs and supply have been manageable as we have undertaken several initiatives to address this issue. We are not dependent on any particular manufacturer. We have strong business relationships with a pool of manufacturers over the years. If there are disruptions, we can always go to alternative suppliers or manufacturers not affected by such disruptions.

On cost, if there are material price hikes, we will update our actual selling price to our customers base to reflect the latest cost of materials. For contractual projects, in which we have secured and signed, we will act swiftly in placing orders for materials to mitigate the risk of material cost increases. For projects with longer implementation durations such as LSS, we will have a variation cost clause in our contracts for potential price adjustments. In this way, we are able to pass on the cost increases to customers, allowing us to maintain our margins.

At the same time, we are also enhancing our project management and execution by strengthening our supply chain management and forecasting the required purchases and stocks for materials in advance to prepare for upcoming projects. This will also mitigate the risk of delivery lead time due to shortage of materials.

Apart from that, we also focus on efficient project planning and sub-contractors’ management to minimise the installation period, leading to greater cost savings. We believe that efficient and effective project planning and management is crucial in maintaining our competitive position at this juncture.