RHB Retail Research has maintained long positions on HSI futures.

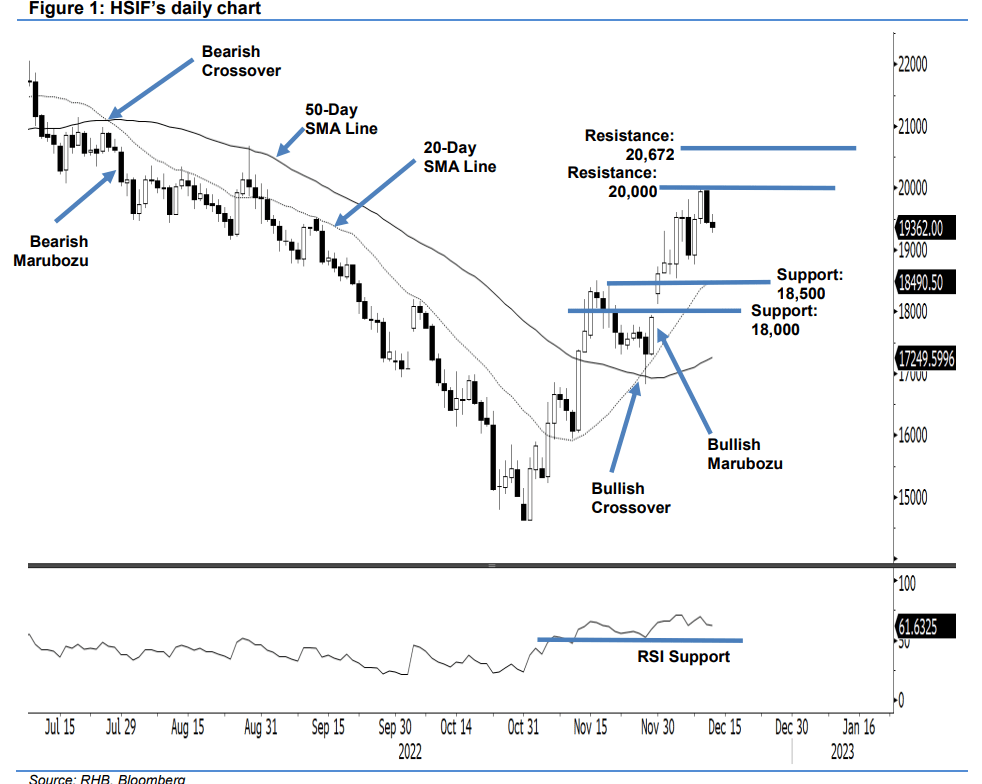

The positive momentum on the HSIF did not follow through, and the index retraced by 504 points on Monday to close at 19,442 points. The index opened at 19,962 points, and dropped to the day’s low of 19,411 points before the close. In the evening, it declined by 80 points and last traded at 19,362 points. The latest bearish candlestick on Monday affirms that the 20,000-point resistance is still intact. As long as the index continues to trade below this level, it may move sideways for consolidation.

If the selling pressure increases, the index should pull back towards the 20-day SMA line. The moving average line or the 18,500-point level will provide an immediate support. Meanwhile, should the index breach above the immediate resistance, expect strong trading momentum to follow through.

During this consolidation phase, the research house makes no change to our bullish trading bias.

Traders should remain in the long positions initiated at 18,617 points (30 Nov’s close). To mitigate trading risks, the stop-loss has been adjusted upwards to 18,500 points from 18,000 points.

The immediate support is still at 18,500 points, followed by 18,000 points. Towards the upside, the nearest resistance remains at 20,000 points, followed by 20,672 points or the high of 29 Aug.