RHB Retail Research has reiterated its long positions on HSI futures.

The HSIF continued to trend sideways yesterday after it rose 247 points and closed at 19,689

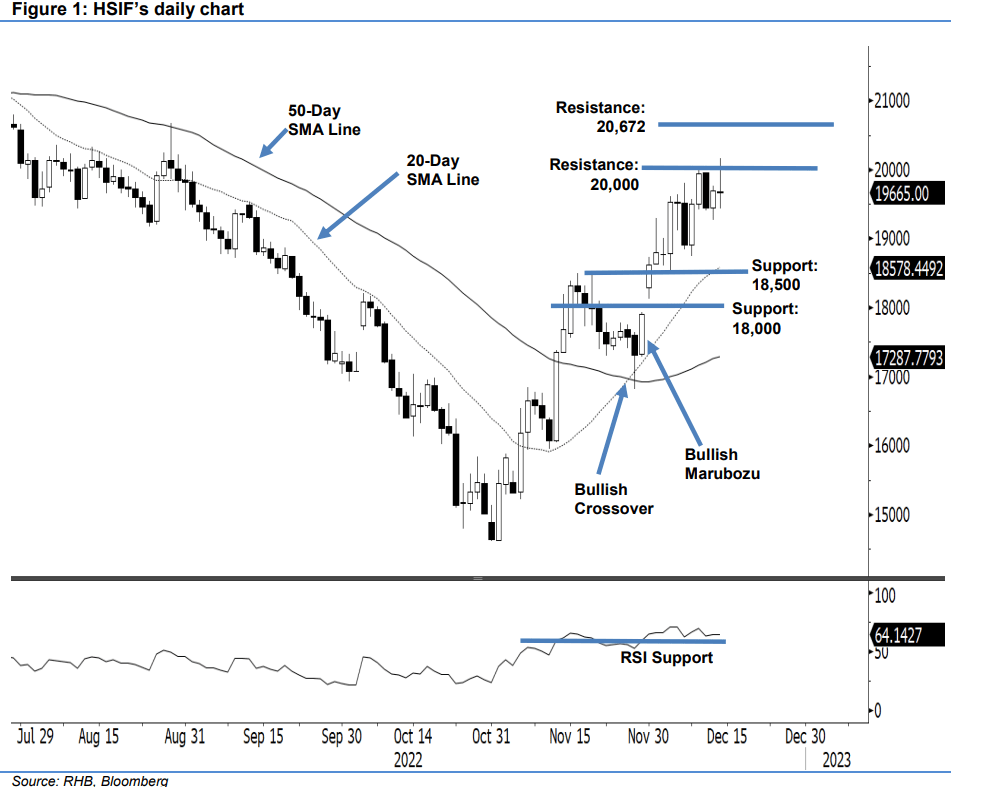

pts. The index began Tuesday’s session at 19,442 points. At one point, it fell to the day’s low of 19,273 points. The bulls then lifted it towards the day’s high of 19,759 points before the close. In the evening, the index retraced 24 points and last traded at 19,665 points.

Even though Tuesday’s session printed a bullish candlestick, the momentum was not strong

enough to push the index through the 20,000-point resistance. The index should continue to consolidate before staging a fresh attempt to cross above the immediate threshold. Meanwhile, the 20-day SMA line continues to trend higher, indicating that the bullish setup is still intact. As long as the index continues to trade above the 20-day SMA line, the research house will hold on to a bullish trading bias.

Traders should remain in the long positions initiated at 18,617 points (30 Nov’s close). To minimise the trading risks, the stop-loss is pegged at 18,500 points.

The immediate support is marked at 18,500 points, followed by 18,000 points. Conversely, the first resistance stays at 20,000 points, followed by 20,672 points ie the high of 29 Aug