The Special Report on Impact of Floods in Malaysia 2021 issued by the Department of Statistics Malaysia reported overall losses of RM6.1 billion incurred by the floods that affected several Malaysian states in late December 2021 and early January 2022. Flash floods in Malaysia over the last few months have caused much damage to property and losses to people nationwide. With the year-end monsoon season picking up its pace in December this year, more floods are inevitable.

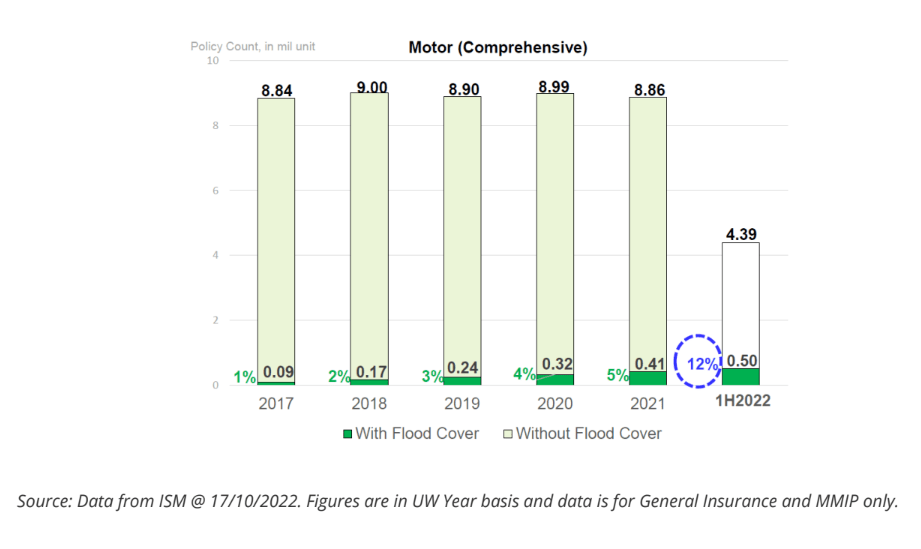

Owing to a raised consumer awareness of the risks of damage to property and assets that arose from recent flash floods, the Motor (Comprehensive) insurance flood take-up rate has more than doubled in 1H2022 to 12% compared to 5% for the full year 2021.

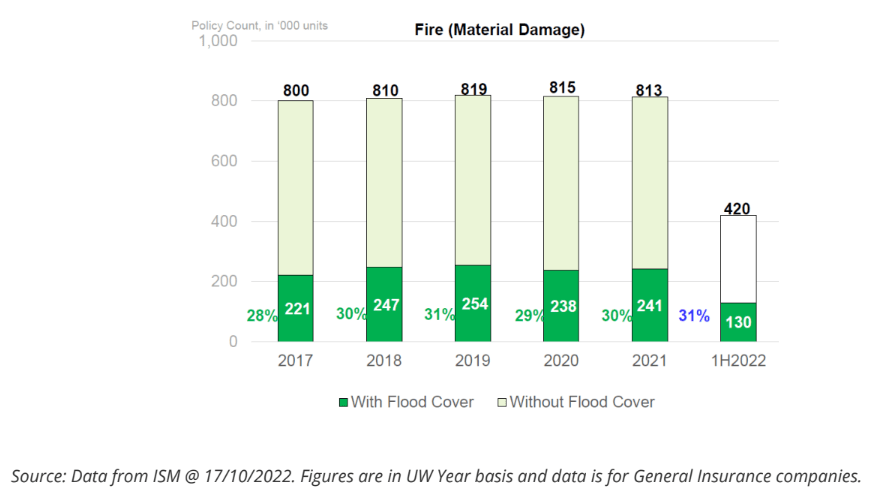

On the other hand, the Fire (Material Damage) insurance flood take up rate also increased

slightly to 31% in 1H2022 as compared to the full year 2021 at 30%.

All PIAM member companies offer an extension for flood coverage under the comprehensive motor and fire policies with an additional premium and at the individual insurer’s underwriting discretion. Consumers are advised to review their policies and check on the coverage offered with their intermediaries who are ready to assist in providing the necessary information as the coverage, terms and conditions may differ between one insurer and another.

Flood coverage is more affordable than you think. Based on a comparison of three different types of vehicles as per the illustration below, the additional premium for flood extension coverages ranges from 8 sen to RM1.74 per day.

The rate for flood extension coverage under a standard tariff policy for risks below RM10million is 0.086% – an affordable sum given the amount of protection provided for losses resulting from floods. For instance, a property with Sum Insured of RM200,000 would incur an additional premium of approximately RM172 per annum (47 cents per day or RM14 per month). Homeowners are encouraged to take up houseowner insurance and also consider including householder (home contents) cover as flood and various other perils (extension cover) are usually included.

According to a report by Malaysian Re on Malaysian Insurance Highlights 2021:

“The Great Malaysian Flood in December illustrates the rising risk that Malaysia faces as the

impact from climate change aggravates. Malaysia’s population might be more than ever aware of the risk, but still underestimates its severity. Insurance penetration is still low, as only few

businesses and people are insured, and often only in regions that are perceived as flood prone.”

“Climate change has become a driver to purchase more flood protection with more people

realizing that weather patterns have changed, and catastrophes occur more frequently.”

In conclusion, in an effort to safeguard assets against flood, natural disasters and fire damage, Malaysians are strongly encouraged to review their existing insurance coverage to ensure that their needs are adequately met.

Article by: Persatuan Insurans Am Malaysia (PIAM)