The FBM KLCI opened 1.14 points lower at 1,473.55 as compared to yesterday’s close of 1,474.69.

At the time of writing, the main index was traded in the range of 1,472.99 – 1,475.98.

At 9:15 am, the KLCI inched up 2.12 points or 0.14% at 1,476.81

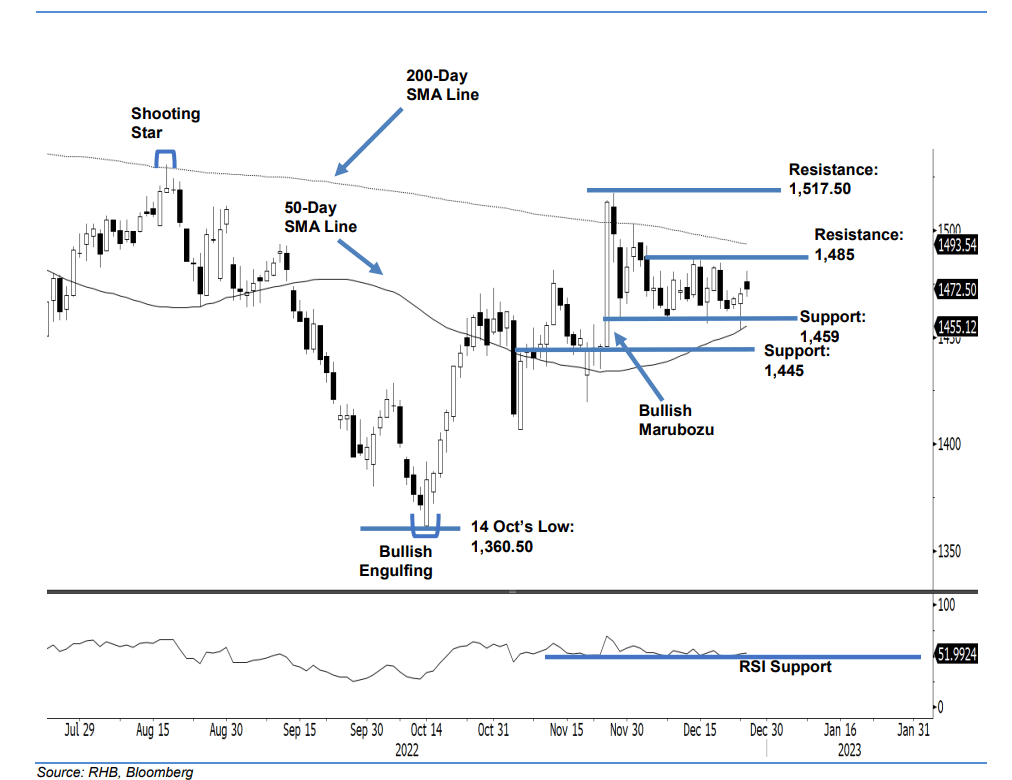

Technical Analysis on FKLI

RHB Retail Research has maintained long positions on FKLI.

The FKLI attempted to rebound further yesterday, having jumped upwards in the early session before traders took profit and led it to cede most of the day’s gains and close 2 points higher at 1,472.5 points – below the opening level. The index opened at 1,476 points, then climbed towards the intraday high of 1,481 points before profit-taking kicked in. It ceded most gains but still close 2 points higher at the close.

The mildly positive closing indicates that the positive rebound has yet to be fully negated. The buying interest is likely to be renewed in the later sessions, taking the index towards the resistance of 1,485 points. The medium-term bullish outlook remains intact, as the index is trading above the 50-day average line – this is coupled with the RSI stabilising at 51%. As such, the research house is sticking to a bullish bias – unless the momentum is reversed.

Traders remain in the long positions initiated at 1,475.50 points or 11 Nov’s close. To manage the trading risks, the stop-loss threshold is set at 1,459 points.

The immediate support is still at 1,459 points – 29 Nov’s low –followed by 1,445 points. Towards the upside, the immediate resistance is at 1,485 points – 25 Nov’s low – followed by 1,517.50 points, ie the high of 25 Nov.