With HSI hitting 21,000 level yesterday, RHB Retail Research has maintained long positions on HSI futures.

The HSIF climbed for the third consecutive session, closing at 21,217 points – the highest since 11 Jul 2022. The index began Thursday’s session at 20,918 points. It then rose to the 21,475-point intraday high before closing at 21,217 points.

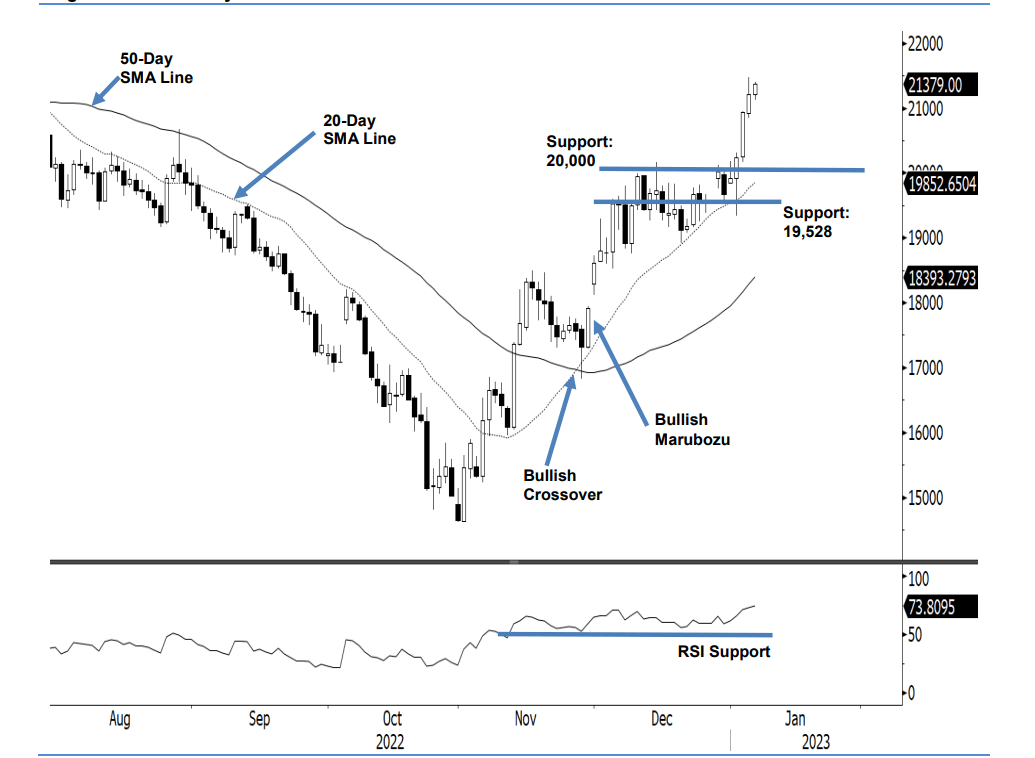

In the evening, the index rose 162 points and was last traded at 21,379 points. It is observed that since the index climbed above the 20,000-point level, bullish momentum has gotten stronger, and the index is charting a “higher high” candlestick pattern. If the momentum sustains, it should extend its upside movement and test the 22,000-point resistance level. So far, the index has not shown any sign of fatigue – showing that the bulls are still in control. As such, no change bullish trading bias.

Traders should stay with the long positions initiated at 18,617 points (30 Nov 2022’s close). To mitigate the trading risks, the stop-loss is set at 19,528 points.

The immediate support is marked at 20,000 points, followed by 19,528 points (29 Dec 2022’s low). On the upside, the immediate resistance is pegged at 22,000 points, and the higher resistance is at 22,500 points.