RHB Retail Research has reiterated its maintenance of long positions on HSI futures.

The HSIF underwent mild profit-taking yesterday as it shed 62 points to close at 21,430 points.

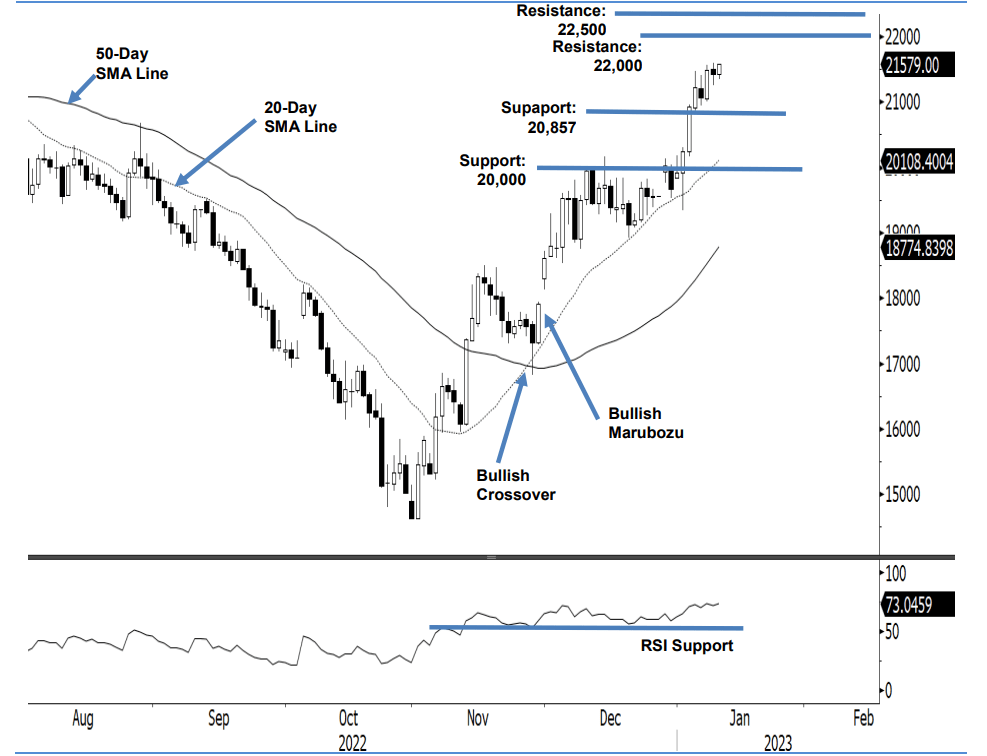

On Tuesday, the index opened at 21,497 points. After whipsawing between 21,595 points and 21,250 points, it closed at 21,430 points – below the opening price. Then, in the evening, the HSIF rose 149 points and last traded at 21,579 points.

Based on the day session’s price action, the bulls hesitated to charge higher since momentum failed to follow through. The index should be moving sideways for a consolidation before it staged an upward movement.

In the event profit-taking activities are extended, the index may retrace towards the 20,000-point support. As long as it stays above the 20-day SMA line, the bullish structure should remain put. Although bulls are taking a breather now, the research house is keeping its positive trading bias.

Traders are advised to hold on to the long positions initiated at 18,617 points (30 Nov’s close). To mitigate the trading risks, the stop-loss is set at 20,000 points.

The immediate support is at 20,857 points (5 Jan’s low), followed by 20,000 points. Conversely, the immediate resistance remains at 22,000 points, followed by 22,500 points.