RHB Retail Research has reiterated its long positions on HSI futures.

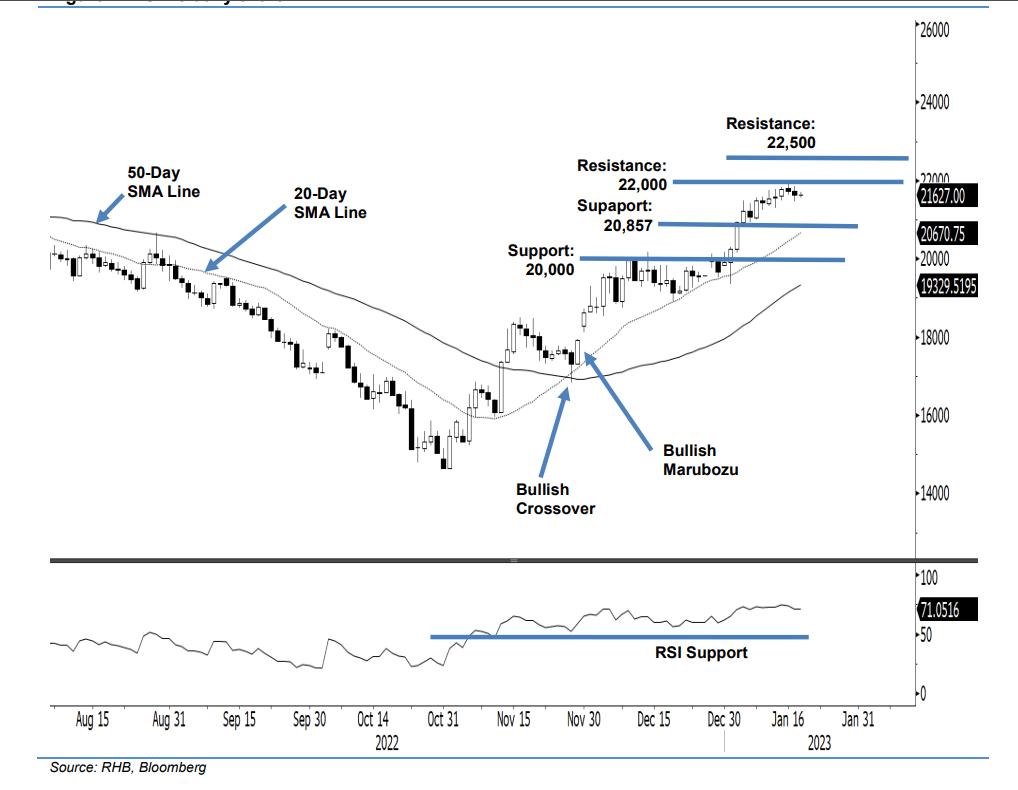

On Tuesday, the HSIF retraced 95 points and closed at 21,631 points – consolidating below the

22,000-point level. Yesterday, the index opened at 21,723 points and after trading between 21,842 points and 21,459 points, it closed at 21,631 points. During the evening session, it fell 4 points and last traded at 21,627 points. The negative price action saw the formation of a bearish candlestick.

However, it is observed the candlestick comes with a long lower shadow indicating that the bulls still possess a technical advantage. For the immediate term, the index will likely resort to consolidation and pull back to retest the 20-day SMA line, or the 20,857-point support. As long as it stays above the 20-day SMA line, the bullish setup will remain valid. Post consolidation, expect the index to resume an upward movement to test the 22,000-point resistance. For now, no change to bullish bias.

Traders should stick with the long positions initiated at 18,617 points, ie 30 Nov’s close. To mitigate the downside risks, the stop-loss is placed at 20,857 points.

The immediate support remains unchanged at 20,857 points – 5 Jan’s low – and is followed by 20,000 points. Meanwhile, the immediate resistance is pegged at 22,000 points, followed by 22,500 points.