Rising interest rates, slowing economic activity and a normalization of COVID-19-era consumption habits pressured the technology sector in 2022. While the past year has been difficult, we remain optimistic because we continue to see signs of enduring quality, sustainable growth and supportive valuations.

Looking to 2023, we expect enterprises to continue many of their Digital Transformation initiatives, albeit at a slower pace, even in the face of moderating rate increases and slowing economic activity. This is because these investments are driving needed productivity gains, especially in an inflationary environment. We have found opportunities in high-quality platform-like companies—that are essential to their customers’ operations—in enterprise software and information technology (IT) services companies and the sub-themes of Secure Cloud and Software-as-a-Service (SaaS), Artificial Intelligence (AI)/Machine Learning, Future of Work and Cybersecurity.

Conversely, we anticipate greater uncertainty in consumer technology as COVID-19 tailwinds continue to abate, energy prices rise in Europe and global economic activity slows. We believe areas such as consumer IT hardware, gaming, eCommerce, and digital advertising may have a slightly longer road to recovery. We also expect consumer discretionary spending to weaken as unemployment rises and as excess household savings that had built up during the pandemic decline amid persistently high inflation. In fact, this began to play out during the second half of 2022, which led to negative estimate revisions across the semiconductor, consumer personal computer (PC), gaming and internet industries. While we believe below-trend growth will likely continue for these industries into 2023, we also think we are nearing the point at which valuations incorporate this view. In these consumer-facing categories, we remain focused on businesses that have achieved meaningful scale and are levered to sub-themes such as Digital Media Transformation, New Commerce and Electrification and Autonomy.

In our analysis, our strategy is well positioned for a recovery once rates stabilize and investors return to more enterprise-centric technology names. These are high-quality companies that demonstrate superior long-term growth potential, de-risked estimates and improved valuations. In our opinion, for investors who share our long-term mindset, the risk/reward profile in the technology sector is likely the best it has been in several years. If rates stabilize in the coming months, we believe the technology sector can offer an appealing combination of “offense” and “defense” in this environment, given higher levels of durable secular growth and strong balance sheets and margins.

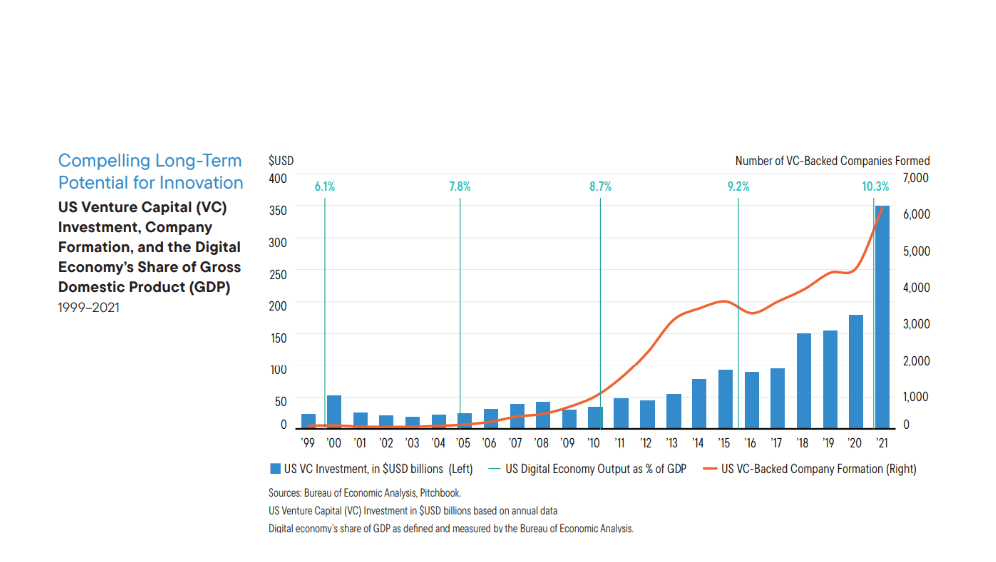

Ultimately, we think Digital Transformation is still in its early stages, with long-term secular growth tailwinds, which we believe extend well beyond the current economic cycle. As seen in the chart above, Digital Economy businesses have steadily outpaced overall gross domestic product (GDP) growth in the United States for the last 20 years, due to steady venture capital (VC) investment across cycles. Yet, these businesses still only account for roughly 10% of total GDP. In our analysis, this will continue to trend much higher across all geographies for the foreseeable future, and we will likely continue to own what we think are high-quality businesses that are best positioned to capture this growth.

Article attributed: Jonathan Curtis, Portfolio Manager, Franklin Equity Group