Trailing stop triggered; RHB Retail Research has initiated short positions on HSI futures.

The HSIF failed to retain the 22,000-points support as strong selling pressure has emerged. The index opened at 21,657 points yesterday. After recording the intraday high of 21,803 points, it slid to the day’s low of 21,124 before closing at 21,243 points. In the evening, the index recopued 17 points and last traded at 21,260 points. The latest negative price action saw the index charting a fresh “lower high” together with a “lower low”.

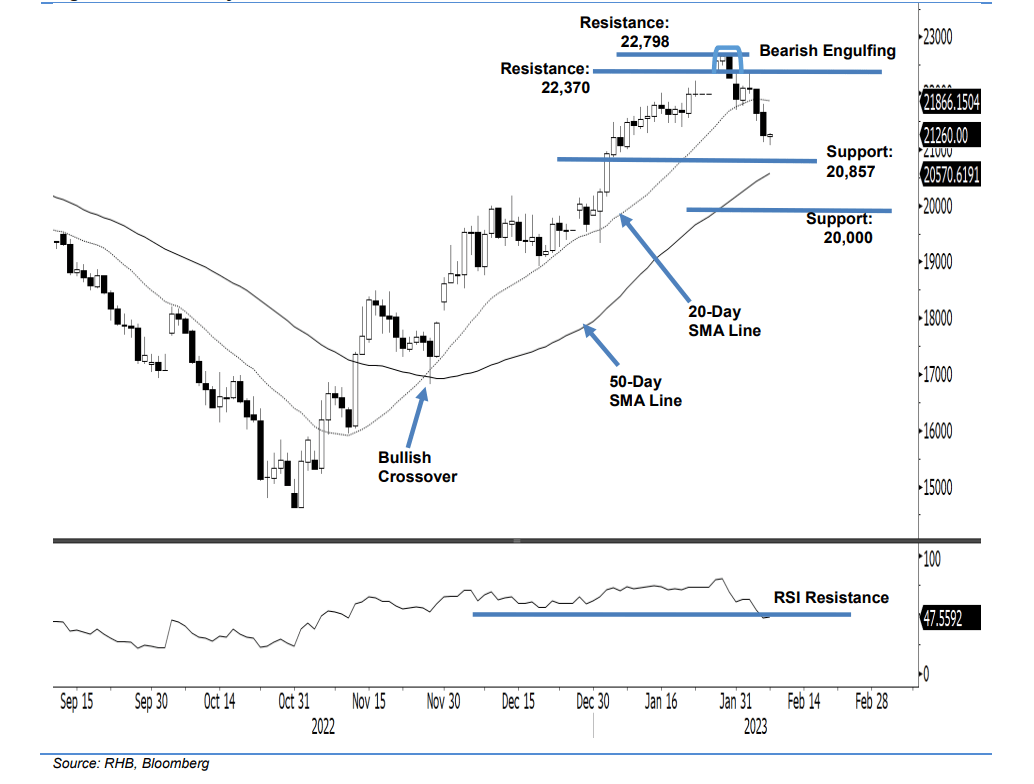

The HSIF is currently trading below the 20-day SMA line. The technical signals show that the bearish structure has formed. As long as the index remains below the 20-day SMA line, selling pressure will drag it towards the 20,857-point support or retest the 20,000-point level. Meanwhile, should it undergo a rebound, it may see resistance at 22,370 points.

For now, the research house has switched over to a negative trading bias.

It closed out the long positions initiated at 18,617 points (30 Nov 2022’s close) as the trailing stop at 22,000 points has been triggered. Conversely, RHB Research has initiated short positions at 21,643 points, ie the closing level of 3 Feb. To manage the trading risks, the initial stop loss is set at 22,370 points.

The immediate support is now at 20,857 points – 5 Jan’s low – followed by 20,000 points. Towards the upside, the immediate resistance is at 22,370 points – 2 Feb’s high – and followed by 22,798 points ie the high of 30 January.