The FBM KLCI opened flattish manner at 1,476.39 as compared to yesterday’s close of 1,476.38.

At the press time, the index was traded in the range of 1,476.34 – 1,478.02.

At 9:15am, the index inched higher by gaining 2 points or 0.14% at 1,478.38.

Following positive cue of Wall Street overnight, the main index is expected to rebound. Investors cheered to Federal Reserve Chair Powell’s latest remarks that the labour market’s strength underscores why it could take time to bring inflation down.

Technical Analysis on FKLI (KLCI futures)

Trailing-stop triggered; RHB Retail Research has initiated short positions on FKLI.

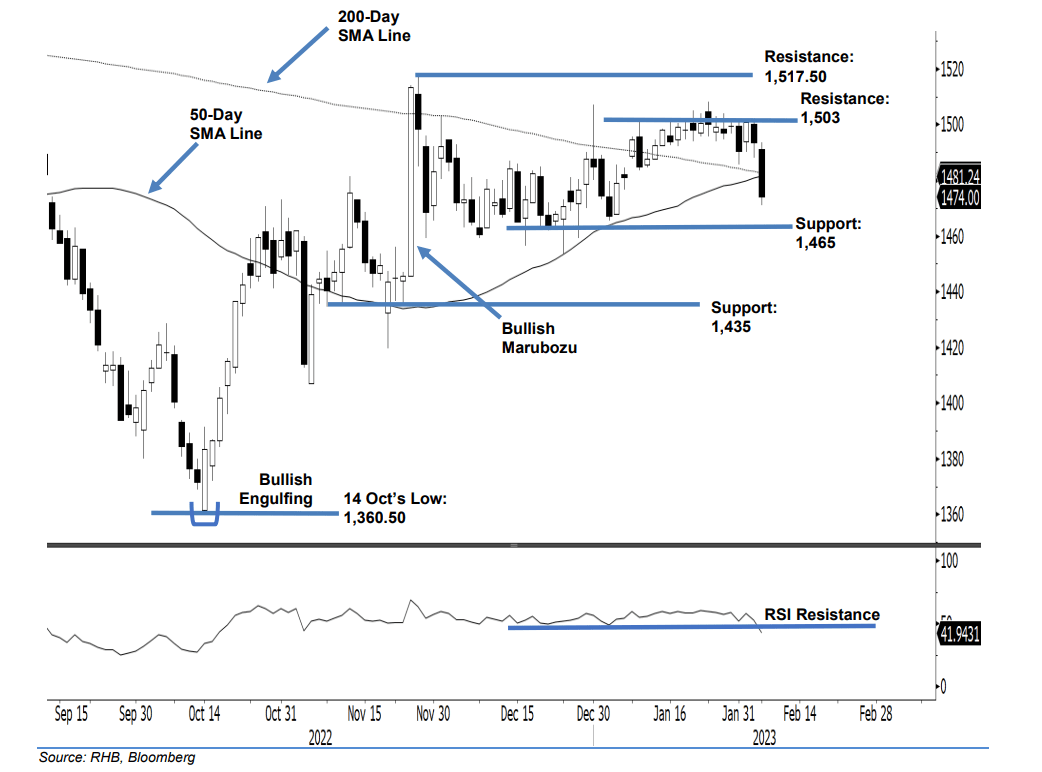

The FKLI turned bearish yesterday, falling 19.50 points to close at 1,474 points – breaching below the previous support level and the medium and-long term average lines. It opened weaker at 1,491 points, and briefly touched the day’s high of 1,493.50 points before strong selling pressure kicked in to dominate the rest of the session. It fell sharply towards the end of the session, hitting the 1,471-point low before the close.

Yesterday’s strong bearish candlestick, which formed a “lower low” bearish structure below the 50- and 200-day average lines, suggests that the bears are back in control. It is expected the index to trend lower towards the 1,465-point immediate support level in the coming sessions, before resuming its downward movement towards 1,435 points in the medium term. This is backed by a negative RSI at 41%. As the trailing-stop was breached, the research house has shifted to a negative trading bias.

RHB Retail Research has closed out the short positions initiated at 1,475.50 points or 11 Nov 2022’s close, after the trailing-stop at 1,483.50 points was triggered. Conversely, it initiated long positions at the closing level of 7 Feb (1,474 points).

To minimise downside risks, the initial stop-loss is set at 1,503 points. The immediate support is now at 1,465 points (15 Dec 2022’s close), followed by 1,435 points, or 23 Nov 2022’s low. The immediate resistance stays at 1,503 points (1 Dec 2022’s high), followed by 1,517.50 points, or the high of 25 Nov 2022.