The FBM KLCI opened marginally higher at 1,471.30 as compared to yesterday’s close of 1,470.75.

At the press time, the index was traded in the range of 1,465.69 – 1,471.30.

At 9:56am, the index fell lower by 4.14 points or -0.28% at 1,466.61.

Following the negative cue from the Wall Street performance overnight weighed down by persistent worries over US interest rate hikes, the KLCI would face downward pressure too.

Technical Analysis on FKL

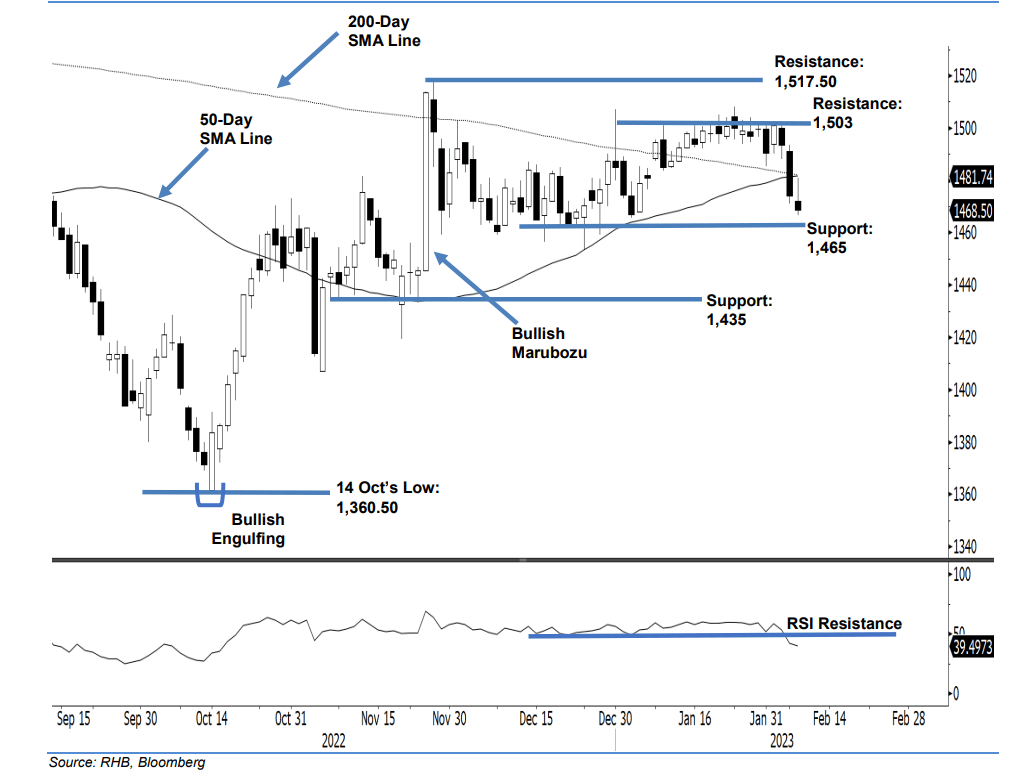

The FKLI reversed its intraday rebound and closed negative yesterday, settling 5.50 pts lower at 1,468.50 pts. It opened mildly weaker at 1,472 pts but then jumped higher during the early session to test the 1,481-pt high. Strong selling pressure then kicked in from the day’s top to reverse its direction southwards towards the end of the session. The FKLI hit the 1,466.50-pt low as it closed below the opening level.

Yesterday’s bearish candlestick with long upper shadow suggests the bears are firming up their position beneath the 50- and 200-day average lines. The late intraday selling pressure yesterday is expected to persist in the coming sessions, dragging the index lower towards the 1,465-pt immediate support. As the RSI leading indicator is printing lower below the 40% level,

the FKLI is expected to extend downwards movement towards 1,435 pts in the medium term.

As such, RHB Retail Research is sticking to a negative trading bias. Hence, it is maintaining short positions on FKLI.

Traders should keep to the short positions initiated at 1,474 pts or at the closing level of 7 Feb. To minimise the downside risks, the initial stop-loss threshold is set at 1,503 pts.

The immediate support is now at 1,465 pts – 15 Dec 2022’s close – and followed by 1,435 pts, ie 23 Nov 2022’s low. The immediate resistance stays at 1,503 pts – 1 Dec 2022’s high – and is followed by 1,517.50 pts or the high of 25 Nov 2022.