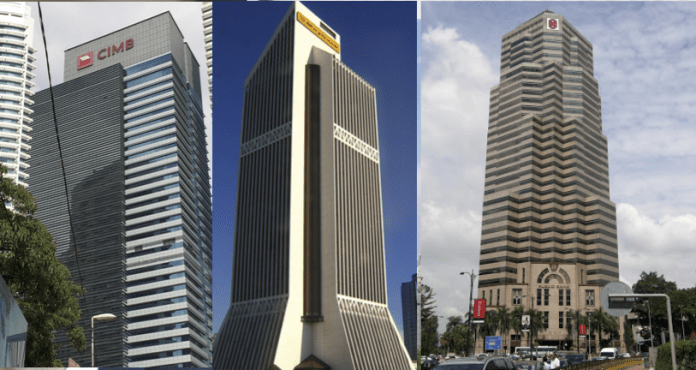

While acknowledging headwinds in the economy, BNM assures, in its Financial Stability Report (FSR) 2H22, that business and household risks are manageable for the banking system, which continues to exhibit sound and prudent financial and operational practices. Kenanga says it maintains a POSITIVE on the sector with BUYs on CIMB, RHB, HLFG, HLBK, AMMB and ABMB.

Elevated costs a challenge for businesses

In the business sector, rising input costs have been the challenge, resulting in a decline in the median interest coverage ratio to 6.0x in 4Q22 from 7.9x in 2Q22. The share of firms-at-risk edged up to 25.1% in 4Q22 from 24.6% in 2Q22, driven by firms in the construction and manufacturing sectors, and it remained elevated in the real estate sector. BNM’s stress

test nevertheless shows that the median Interest Coverage Ratio for listed non-financial corporates is expected to remain well above prudent thresholds, at 4.5x, under stressed macroeconomic scenarios. The sensitivity analysis assumes, among others, a depreciation of the MYR by up to 20% and an increase in the average corporate bond yield by 400bps.

HH debt-to-GDP ratio declines Household (HH) debt grew at a faster pace of 5.5% in 2H22 from 5.3% in June 2022 and 4.1% in Dec 2021, but with faster GDP growth, the HH debtto-GDP ratio declined to 81.2% in Dec 2022 from 84.5% in June 2022 and 89.1% in Dec 2021. According to BNM’s stress tests, if the unemployment rate rises to as high as 6%, up to 4.3% of household loan exposures could be at risk of default by end-2025. This nevertheless remains comfortably within banks’ excess capital buffers.

Liquidity remains ample

The banking system’s funding position remained strong with an aggregate Liquidity Coverage Ratio and Net stable Funding Ratio of 154% and 118% respectively, end-2022. Loans under repayment assistance programmes stood at 4.2% of total system loans end-2022 with a gross impairment ratio of 1.7%. According to BNM, marked-to-market losses from a 200bps

increase in yields scenario, would reduce the banks’ aggregate capital base by 6.2% or total capital ratio by 1.1%-pts from 18.8% end-Dec 2022.