The Malaysia stock market has moved higher in three straight sessions, collecting more than 15 points or 1 percent along the way.

The Kuala Lumpur Composite Index now sits just above the 1,550-point plateau and its expected to open to the upside again on Tuesday.

At 9.16am, the FBMKLCI dipped -2.20 points to open at 1,551.59.

RHB Retail Research in a note today (Mar 19) the FKLI’s recent bullish momentum paused on Monday to settle 2.50 pts lower at 1,552 pts.

The index opened lower at 1,552 pts and oscillated in a tight range of between 1,545.50 pts and 1,558 pts, then closing at the opening level.

Despite yesterday’s neutral momentum, the technical setup remains bullish, and the momentum will likely resume in the coming sessions – lifting the index towards the 1,563-pt immediate resistance.

If a breakout occurs, the FKLI will continue to trend higher, towards the resistance at 1,600 pts.

The RSI indicator remains steady at 60% (positive territory), positive price action may follow through in coming sessions.

Meanwhile, the index is firmly supported by the ascending 50-day and 200-day SMA lines.

As the uptrend is still intact, we maintain our bullish trading bias.

Traders should maintain the long positions initiated at 1,455 pts (the close of 3 Nov 2023).

To minimise the downside risks, the stop-loss threshold is fixed at 1,500 pts.

The immediate support remains unchanged at 1,533 pts – 20 Mar’s low – followed by 1,520 pts.

Conversely, the immediate resistance is eyed at 1,563 pts –28 Feb’s high – followed by the higher resistance level of 1,600 pts.

Malacca Securities (MSSB) the FBMKLCI (+0.05%) ended flat, despite with the positive performance in the regional stock markets, boosted by selected Utilities and Banking heavyweights.

On the broader market, the Utilities sector (+2.21%) was the leading sector, while the Telco & Media sector (-1.08%) declined.

The Day Ahead

The FBMKLCI traded flat for the session as Telco heavyweights were beaten down.

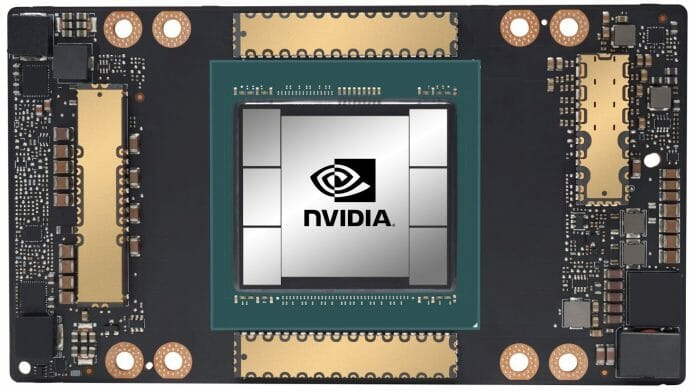

Meanwhile, overall US stock markets headed higher as investors digested news from Nvidia’s AI conference and traded more positively ahead of the FOMC meeting that will be concluding this week.

However, based on Bloomberg, the market is positioning for a delayed rate cut, probably by 2H2024.

Given the more positive sentiment in the US, they believe buying support could spillover towards stocks on the local front.

On the commodity markets, Brent oil rose strongly, near a 5-month high amid heightened geopolitical tensions after Ukraine attacks on Russian refineries, while China reported better-than-expected economic data.

Sectors focus: Still, the house likes the commodities sector like the O&G sector as Brent oil is trading firmly above the USD85/bbl level.

Also, they noticed significant momentum building up within the construction sector, with the resurfacing of KL-SG HSR over the weekend.

They expect smaller contractors that have positive QoQ growth in their recent earnings may be a more decent pick.

Besides, they like selected Technology and Packaging stocks such as FPI and PPHB at least for the near term.

Bloomberg FBMKLCI Technical Outlook

The FBMKLCI index ended flat after a 2-day rebound.

However, the technical readings on the key index were mixed, with the MACD Histogram hovering flattish along 0, while the RSI is above 50.

The resistance is envisaged around 1,565-1,570 and the support is set at 1,535-1,540.

CGS International said Asian stock markets finished higher on Monday ahead of the monetary policy meetings in Japan and the US.

The local benchmark FBMKLCI (KLCI) inched up 0.81pts or 0.05% to end the day at 1,553.64.

Most sectors rallied with the largest gains coming from utilities (+2.21%), energy (+1.35%) and property (+1.19%).

Top laggards included telecommunications (-1.08%), REIT (-0.34%) and healthcare (-0.19%).

Trading volume reduced to 4.24bn (down from 4.53bn on Friday) while trading value decreased to RM2.79bn (down from RM4.82bn previously).

Market breadth stayed positive six days in a row with 546 gainers beating 480 decliners.

The benchmark formed its third white candle yesterday, shaping a pennant consolidation in the process.

A breakout above the said pattern translates to a bullish continuation which may send the bulls up to retest the 20-month high at 1,559 and beyond.

The longer-term resistance is placed at 1,570-1,583.

Otherwise, the index may continue to trade in a sideways manner.

The 1,525- 1,531 level acts as the minor support, followed by the 1,508-1,521 band.

Their portfolio stays in risk-on mode this week.