Kumpulan Wang Persaraan (KWAP) announces its financial highlights for the year 2017, showing an impressive performance as it registered a gross income of RM9.03 billion which is the highest since its inception in 2007. The total fund size increased to RM140.80 billion from RM125 bullion while the overall gross ROI advanced to 5.77%, an increase from 0.42% from the previous year’s ROI of 5.35%. The time weighted rate of return (TWRR) for the year was at 9.09%, almost double from preceding year’s rate of 4.59%.

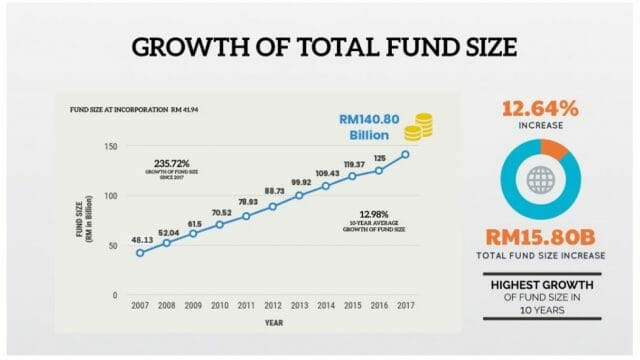

Datuk Wan Kamaruzaman Wan Ahmad, Chief Executive Officer of KWAP says,”We continued to deliver and outperform our benchmark, subsequently surpassing our target, resulting in double-digit growth of our fund size at 12.64% compared to the previous year. In the last 10 years, the fund recorded an average growth of 12.98% per annum, with investment income continuing to be the largest contributor to asset growth.”

Comprising RM3.01 billion of pernsion contribution and RM0.5 billion of Federal Government’s contribution, total collection for 2017 also increased by 4.96% which amounted to RM3.51 billion. While the portion from the Federal Government only made up the 4%, investment remained the highest contributor in 2017 at 69% followed by employers’ contribution at 27%. KWAP’s fund size has grown substantially by 235.72% in a span of a decade with an average gross ROI of 6.14% annually.

Datuk Kamaruman adds, “We will be reviewing our Strategic Asset Allocation soon. This is to ensure that it remains vigorous and dynamic, while in tune with KWAP’s long term investment aspirations and the current realities. We will continue to seize new opportunities that could help us grow the fund, without compromising our risk appetite. We are now adopting the Total Return approach as our sole and primary performance metric, a more dependable method for retirement income strategies and in mitigating certain risks that are inherent to the investment portfolio, while generating consistent returns.”

The performance of KWAP’s pension services is being monitored by the Government through a Service Level Agreement which requires the organisation to achieve a minimum score of 90%.