By Poovenraj Kanagaraj

“We sincerely regret any confusion and anxiety that the announcement may have caused,” Bank Negara Malaysia (BNM) said in a FAQ issued today, referring to the announcement the central bank made yesterday.

BNM had stated in a statement on their Facebook page that interest rates will be charged on the six-month moratorium.

In its FAQ, the central bank clarifies that the payment deferment is still automatic for Hire Purchase (HP) and fixed rate Islamic financing.

“We later removed the example when FIs provided their own illustrations. Our illustration was not intended to preclude interest charges accrued on the deferred loans,” the central bank said in its FAQ.

However, an additional step to comply with the procedural requirements under the Hire-Purchase Act 1967 (HP Act) and Shariah is required.

Interest will also accrue over the deferment period for other loans as well and will also need to be repaid once payments resume post-deferment.

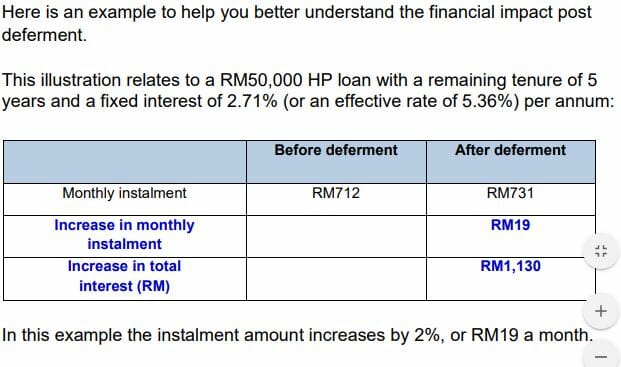

BNM had also illustrated an example for bank customers to better understand the financial impact post-deferment.

Customers who have had their HP loans and fixed-rate Islamic financing accounts automatically deferred since April 1 will continue to benefit from the payment deferment until Sept 30.

According to BNM, HP loan and fixed-rate Islamic financing borrowers or customers who initially accepted the moratorium but have since changed their mind can still opt out of the deferment.