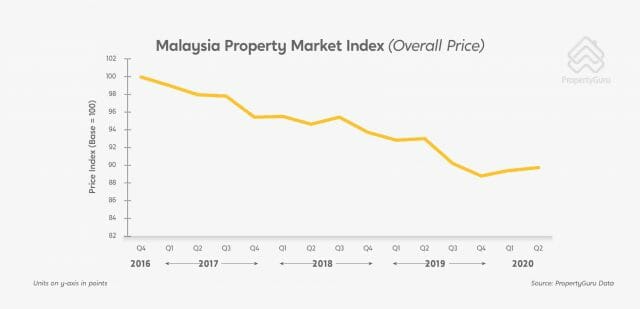

The PropertyGuru Malaysia Property Market Index has risen to 89.80 points in Q2 2020, up from 89.46 points in the previous quarter.

This growth was led by a 1.05 percent increase in asking prices in Selangor, propping up weaker performances in Penang, Johor and Kuala Lumpur, with growing interest in secondary markets in Perak as decentralisation trends accelerate. While the incoming supply index took a dip by 3.6 percent, this was a substantial improvement over the 10.47 percent drop in Q1 2020.

Malaysians also cited property portals as preferred sources of information to start their home ownerships during the Covid-19 outbreak and resulting Movement Control Orders (MCOs), with social media and developer websites popular as well.

“We’ve seen Selangor’s price index grow from 93.20 points in Q1 2020 to 94.18 in the second quarter. This, coupled with Kuala Lumpur’s 1.28% drop from 96.62 points to 95.38 points over the same period, points towards a dispersion of interest from urban areas to city outskirts and satellite townships,” says Sheldon Fernandez, country manager, PropertyGuru Malaysia.

Developers have leveraged on this trend through a range of digital initiatives and incentives, many of which apply to projects in Selangor, driving interest there despite Covid-19 impacts in the state. As the effects of the outbreak reverberate throughout the market, PropertyGuru also observed an 8.7 percent rise in enquiries for properties in Perak, particularly Ipoh and Taiping.

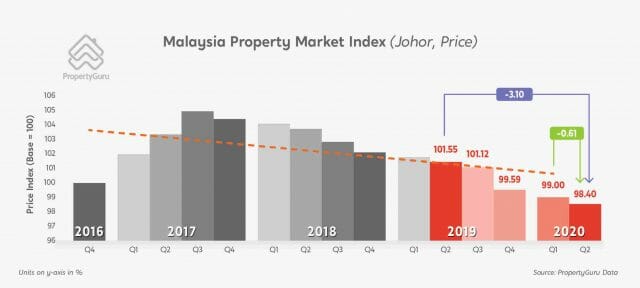

Selangor’s growth buoyed weaker figures not just in Kuala Lumpur, but in Penang and Johor as well, which saw prices decline slightly by 0.17 percent and 0.61 percent respectively. The largely sideways movement in major markets came despite projections of property price drops due to weak sentiment and industry restrictions following the Covid-19 outbreak.

“Price resilience here mirrors situations in regional markets, with sellers balking at price reductions, particularly in the auction space. However, this came with corresponding impacts on transactions, as buyers opted out of purchases in anticipation of future price drops,” says Fernandez.

“Such price drops are strongly indicated by factors such as rising unemployment and a projected contraction in GDP, both of which have been linked to property price movements in the past. With the 1997/8 recession and Nipah virus outbreak as a worst case scenario, we project an upward limit of 10% on price impacts – with discounts under the reintroduced Home Ownership Campaign driving immediate change here.”

Despite the resumption of economic activities in June, the supply index in Q2 2020 continued to drop overall, though this contraction was smaller than in the previous quarter. Year-on-year, the 1.98 percent supply drop in Q2 2020 this year contrasts with consistent year-on-year growth since Q4 2017.

This declining contraction rate was evident in Kuala Lumpur, Selangor and Penang. Selangor was the only market to showcase year-on-year supply growth in Q2 2020, with its supply index rising 5.12 percent relative to the same quarter last year.

In contrast, Johor was the only market where the incoming supply contraction rate rose quarter-on-quarter, from 8.09 percent in Q1 2020 to 9.18 percent in the second quarter. This decline reflects large market corrections in the southern state, which has traditionally relied on incoming investment for growth.

“Global trade tensions as well as the Covid-19 outbreak have impacted international investor appetite, as seen in recent price and supply movements in Johor. This places it on a healthier footing to cater to domestic demand, and it is in fact the third highest location for property searches and enquiries in Malaysia now according to PropertyGuru data,” says Fernandez.

Meanwhile, uptake of online platforms has increased significantly during the MCO period, with 75 percent of Malaysians citing property portals as a preferred starting point for their home ownership journeys, according to the PropertyGuru Malaysia Consumer Sentiment Study H2 2020.

“This trend reflects a larger shift to digital tools in the wake of the Covid-19 pandemic. In its role as Malaysia’s largest property site with the most home choices, PropertyGuru is catering for this demand with over 450,000 listings and an emphasis on virtual tours and other virtual initiatives moving forward,” says Fernandez.

More users are turning to social media as well, up from 64 percent in H1 2020 to 66 percent in H2 2020. Developer websites were the third-most popular sources of property information, rising from 57 percent to 62 percent over the same period.