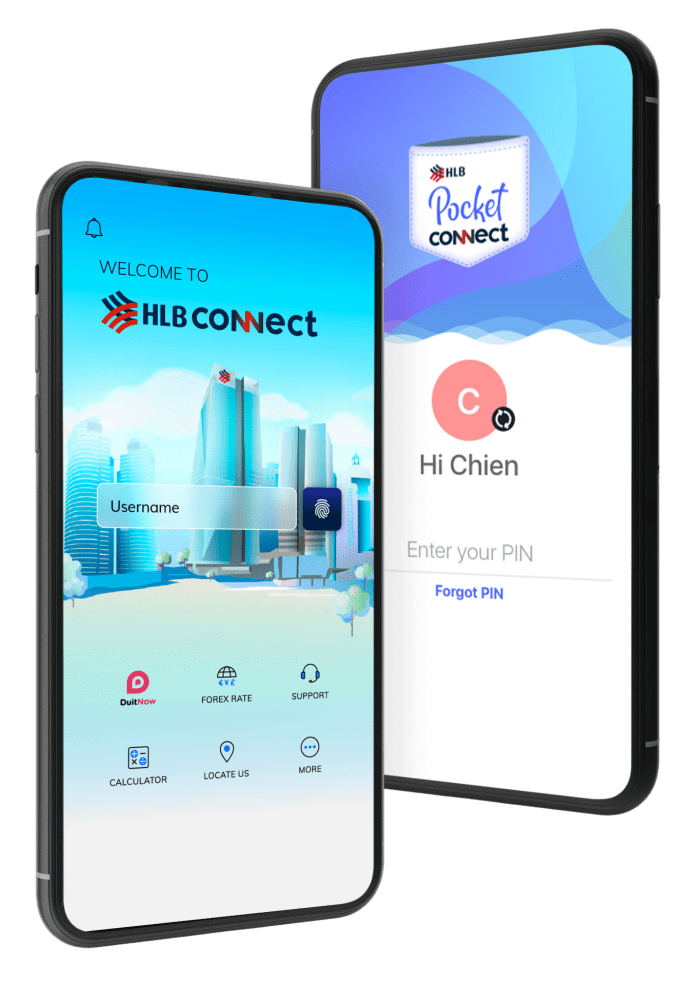

Hong Leong Bank (“HLB” or “the Bank”) has unveiled the HLB Pocket Connect which is the first in-market interactive digital banking platform to serve both young savers and their parents.

The HLB Pocket Connect which is available for HLB 3-In-1 Junior Account customers in a simple to use mobile app for the bank’s young users, which also enables them to learn the value of money and good money habits through its proprietary Earn, Save and Spend interactive features.

These features can be customized and controlled on their parents’ HLB Connect online banking seamlessly, allowing them to manage and monitor their children’s savings and pocket money usage anytime, anywhere.

Under the Earn feature, parents can set tasks or goals and reward their children with extra pocket money when they complete them. Not only does this teach children the value of hard work and earned money, it also gives them sense of achievement when they are able to meet their goals.

As the account comes with reloadable Junior Debit Card for children to Spend, parents can have a peace of mind knowing that they can monitor and control their children’s pocket-money spending. Not only can they top-up the pocket money through seamless transfer from their HLB Connect, they can set spending limits, control where and what their children can spend on as well as monitor real-time spend of their children.

Parents can also block or freeze the Junior Debit Card instantly if they suspect any fraudulent or improper spend, all done through their HLB Connect. To inculcate a savings habit, HLB Pocket Connect will soon have a customizable Save feature which allows children to set their savings goals for things that they want and allowing them to track their savings through progress report.

According to Domenic Fuda, Group Managing Director and Chief Executive Officer of HLB, “ We upgraded our flagship HLB Connect with a clear intention to move from being an efficient transactional tool to an integrated and personalised banking platform that can help our customers take control of their financial management. HLB Pocket Connect is the manifestation of a fit-for-purpose digital banking experience for our customers who are raising a family consisting of young digital natives who are exposed to hyperpersonalisation, real-time gratification and highly interactive content and experiences.

As of June 2020, almost 80 percent customers are regularly using HLB Connect, an increase of over a quarter over the past year alone. Customers aged above 50 had the biggest year-on-year increase at 42 percent from June 2019 to June 2020. Mobile banking transactions recording an impressive spike across the board with an 80% increase in total transaction amount and a 75 percent increase in the number of transactions conducted over the same time frame.

The Bank also saw a 13-fold increase in the total transactional value of e-wallet top-ups via HLB Connect over a period of 2-months March-May 2020, compared to the same period last year.

The introduction of HLB Pocket Connect also underscores the Bank’s commitment towards its sustainability initiatives in environmental protection, financial literacy, cashless agenda as well as expanding financial access and inclusivity amongst Malaysians.

“We believe digital banking platform like HLB Connect and HLB Pocket Connect not only add value to our existing and new customers but also contribute towards making financial services accessible, affordable and sustainable for society at large. With our highly customisable features, we are able to scale and expand our services to serve different communities’ needs, giving them greater social and economic empowerment,” added Fuda.