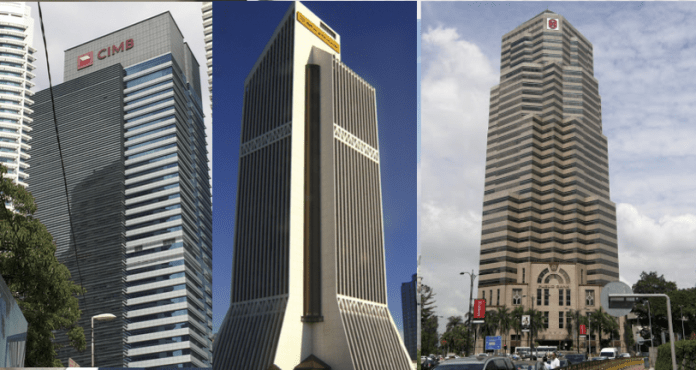

CGS CIMB has an “Overweight” rating for the banking sector with its top picks being HLB, RHB Bank, and Public Bank as its top picks.

It said that the issuance of new digital banking licences would not materially alter the competitive landscape of the banking sector over the next 3-4 years adding that they will only focus on the unserved /underserved segments.

The stockbroking firm said that the news digital banks are only allowed to provide products/services to unserved/underserved segments, which are not the target markets for incumbent banks. “The asset size of the new digital banks is limited at a maximum of RM3billion per bank within 3-5 years after the inception, “it said.

It said that as such it continues to rate Malaysian banks as overweight, premised on the potential re-rating catalyst of continuous earnings recovery (our projected core net profit growth of 4.1% in CY22F and 18.3% in CY23F).

On RHB Bank, the stockbroking firm said that it is the only Malaysian bank that secured a new digital banking licence (through its joint venture with Boost). It said that this would be negative for RHB Bank in the short term due to the potential operating losses over the next 2-3 years from its new digital bank.

“However, the potential net loss per year would be small – assuming an RM30million-50million yearly net loss for its digital bank (against minimum paid-up capital of RM100m for digital banks), RHB Bank would only suffer a net loss of RM12m-20m from its 40% stake in this joint venture, accounting for only 0.3-0.6% of our projected FY23F net profit for RHB Bank,” the stockbroking firm said.

CGs CIMB said that it expects the venture to be positive for RHB Bank in the long term when its digital bank turns profitable. Furthermore, it can learn the ropes of running a purely digital bank, which could help it to improve its existing operations.