The 5G situation in Malaysia is rather unique and requires a bit of an explanation. In February 2021, the Malaysian Ministry of Finance announced during the launch of the Prime Minister’s Malaysia Digital Economy Blueprint that a government-owned Special Purpose Vehicle (SPV) would be responsible for rolling out a nationwide single wholesale network (SWN) to deliver 5G. This led to the establishment of Digital National Berhad (DNB), responsible for the 5G network rollout and providing wholesale services to operators on an open, fair, and non-discriminatory basis over the next 10 years.

The DNB has been assigned spectrum in the 700 MHz, 3.5 GHz, and 26-28 GHz bands. Currently, the 5G network has been deployed utilizing 3.5 GHz spectrum across selected areas of Putrajaya, Cyberjaya, Johor and Selangor, and Kuala Lumpur. However, the DNB has aggressive timelines to reach 80% of populated areas by 2024, while the goal is to cover 40% of the population by the end of 2022.

There are still a few pieces of the puzzle that need to fall into place before 5G can be widely available in Malaysia. First, in March 2022, the government upheld its position that the SWN will in fact be the model for the 5G network deployment. Despite backing an alternative — the Dual Wholesale Network (DWN) rather than SWN — the four leading telcos (Celcom Axiata, Digi, Maxis, and U Mobile) have announced that they are supporting the government’s decision. On its part, the government offered up to 70% of DNB equity to operators, while it will retain a 30% stake. The four operators, although open to the proposal, would prefer to go through a merger and acquisition process. Only two local operators, Telekom Malaysia (TM) and YTL Communications signed agreements to acquire an equity stake. The discussions are currently in place with a target date to be completed by the end of June 2022.

On March 31 2022, DNB Reference Access Offer (RAO) was released. Despite hopes that the concerns raised by the operators regarding the RAO could be sorted out within weeks, there are still ongoing discussions around RAO. In a joint statement, the operators stated that RAO will not enable affordable and good-quality 5G services.

The big four telecom operators are eager to provide commercial 5G services and test different 5G use cases. For instance, Maxis partnered with Malaysia Airports Holdings Berhad and Proton for 5G services and solutions, as well as the deployment of 5G use cases. The operator also launched a 5G and AI innovation lab.

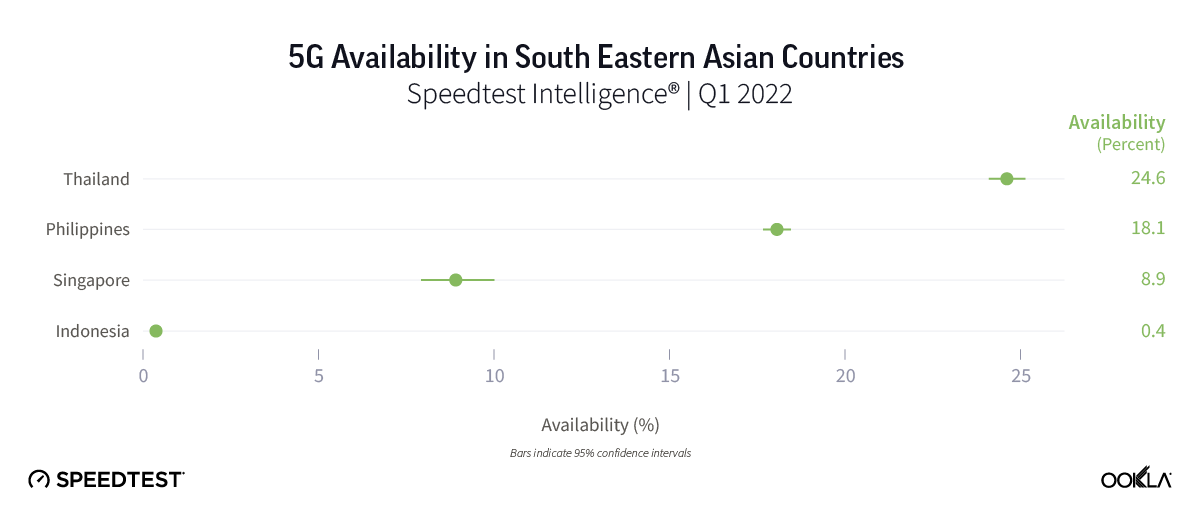

While Malaysians eagerly wait for 5G, nations in Southeast Asia have deployed theirs and charging the way into a new horizon.

By Sylwia Kechiche, Currently Principal Industry Analyst, Enterprise at Ookla. Previously Principal Analyst, IoT and Enterprise at GSMA Intelligence, where she was responsible for the development of IoT & Enterprise product, including market sizing, custom consulting, survey work and report writing.