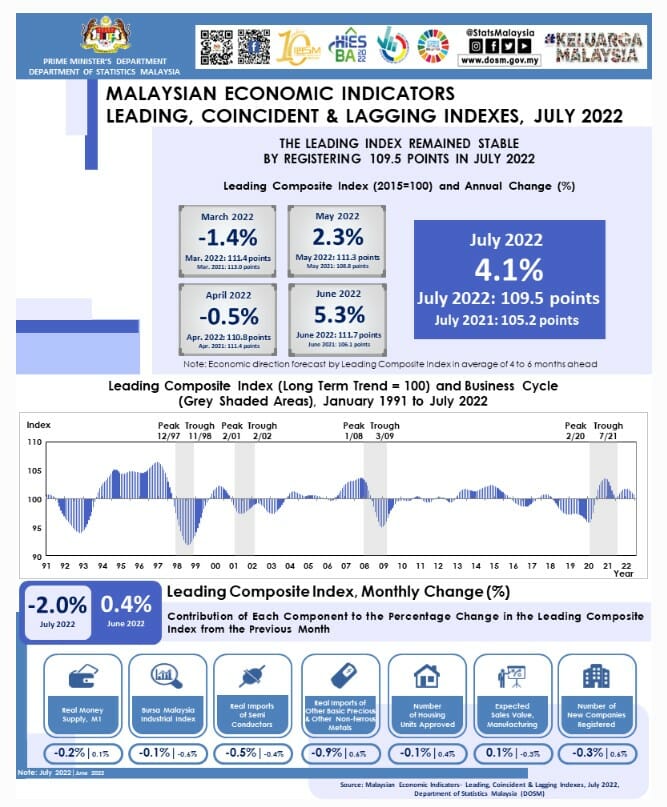

The Leading Index (LI) used to predict the direction of global economic movements in future months., remained stable by registering 109.5 points in July 2022 (July 2021: 105.2 points).

This corresponds to LI growth of 4.1 per cent year-on-year, lower than 5.3 per cent in June 2022.

The Department of Statistics Malaysia (DOSM) released its Malaysian Economic Indicators: Leading, Coincident & Lagging Indexes July 2022 report today, which tabulated real Imports of other basic precious and other non-ferrous metals persisted as the main impetus to the growth due to an increase in demand related to platinum-based metals.

Looking at month-on-month performance, LI posted a negative 2.0 per cent in the reference month as against an increase of 0.4 per cent in June 2022.

The downturn trend was particularly influenced by the Real Imports of other basic precious & other non-ferrous metals, which contributed by negative 0.9 per cent to the percentage change of LI in the said month.

Even though LI’s performance was slightly lower in July 2022, it indicates that Malaysia’s economic prospect is expected to remain optimistic ahead as the smoothed long-term trend index continues above 100.0 points. This is in line with various government initiatives and administrations that are responsive to the current situation.

For the current economic standing, the Coincident Index (CI) in July 2022 showed a downward trend for the first time this year to record 119.6 points (June 2022: 121.5 points).

A coincident index is a single summary statistic that tracks the current state of the economy. The index is computed from a number of data series that move systematically with overall economic conditions.

In terms of year-on-year comparison, the CI narrowed by 0.1 percentage points to 12.5 per cent in July 2022 compared to 12.6 per cent in the previous month.

On a monthly basis, the CI weakened to a negative 1.6 per cent mainly due to a negative 0.9 per cent declined in Capacity Utilisation in Manufacturing sector and a negative 0.5 per cent in Industrial Production Index.

The Diffusion Index for LI posted 42.9 per cent.

A Diffusion Index measures how many stocks are advancing within an index, typically on a daily time frame. In other words, it measures how many stocks advanced from the close of the prior session.

Meanwhile, five out of six components for the Diffusion Index of CI increased to record 83.3 per cent in the reference month.