MIDF is of the view that the banking sector is robust with overall loan growth still going strong. Sep-22 saw system loan growth rise by a solid pace of +6.4%yoy, rising by +0.6% mom. On an annualised basis, loan growth was +5.8%. Loan growth is likely to have peaked at +6.8%yoy in the previous month. However, loan growth should continue tapering down in 1HCY23 in the presence of less cheap liquidity.

Retail loans maintain still going strong… Retail loans grew by an excellent +7.5%yoy, its strongest performance since the start of the pandemic. This translates to +0.7%mom and an annualised growth figure of +6.5%. Hire purchase and residential mortgages continue to act as core drivers, though unsecured loans scored a stellar +4.8%mom increase. Credit card loans make up 1.9% of system loans, up +15.5%yoy. Total purchases in Malaysia by local cardholders dipped slightly from Aug-22’s peak, while purchases by foreign cardholders are flattish, comfortably at pre-pandemic levels. …but business loans dip. Business loans dipped to +5.3%yoy (Annualised: +5.2%) – it rose by +0.5%mom. Working capital remained

flattish on a mom basis, although non-residential mortgages, construction, and securities loans saw decent growth.

Leading indicators moderate. Despite reporting robust figures, system loan applications contracted by -7%mom. Core contributors to the steep decline were contractions in hire purchase loans, and residential mortgages.

Working capital loan applications registered decent +5.4%mom growth, having contracted by -20%mom in Aug-22. System loan approvals dropped by a steeper -14%mom following more restrictive financing from banks. Approval rates have gone down to 56.5% (from Aug-22’s peak of 61.0%), with a notable reduction in business loan approval rate.

Deposit growth trajectory maintained. Sep-22 system deposits rose by a fast pace of +7.5%yoy, +0.5%mom

(Annualised: +6.7%). Growth was primarily driven by FDs (+1.0%mom), with CASA growth (-0.9%mom) reporting steady

contractions. Coupled with dwindling loan growth, L/D ratio has fallen to 88.7%.

GIL volume fell by -0.4%mom, with the system GIL ratio falling by -2bps mom to 1.82%. Retail and Business loan GIL ratios declined by -1bps and -3bps respectively. Expect GIL ratio to creep up – the peak of which depends on the extent of the economic downturn. Interest spread narrowed by -4bps mom. ALR rose by +19bps mom. The 3-month FD rate rose by +23bps mom. Interest spread will likely peak in 3QCY22 or 4QCY22, depending on how fast deposit competition is able to stabilise.

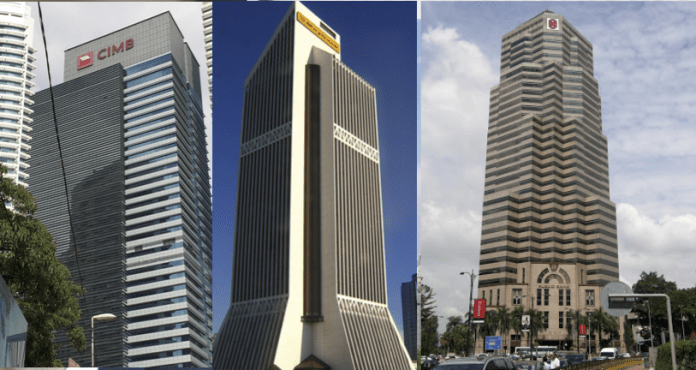

The research house maintains a positive stance on the sector while noting that the sector must contend with rising deposit competition, normalisation of OPEX, and potential economic-downturn-induced provisioning and asset quality surprises in the following year, MIDF nevertheless makes the positive call premised on OPR-hike uplift to NII, improved fee income outlook, and attractive dividend yields and valuations. Top picks for the sector remain CIMB (BUY, TP: RM6.16) and RHB (BUY, TP: RM6.94).