The GE15 ended with a hung parliament. At the time of writing, MIDF says it reckons the various political parties are busy trying to form a majority coalition to be presented to the YDP Agong by 2pm today. While equally hopeful that this process would end quickly, however, cannot be ruled out the possibility that it may take days or even weeks to conclude.

In the meantime, expect the equity market to react adversely to this situation with a negative kneejerk reaction

pulling the FBM KLCI lower and possibly breaching its psychological support level of 1,400 points. This is based on previous

experience in GE14.

Followed by a relief recovery. However, once a new government is formed, the market is expected to duly recover. The

strength of the relief rebound would nevertheless be dependent on how stable the new coalition government is perceived

by the market.

Baseline assumption is for PN to form a majority government together with GPS, GRS, and also BN in short order. At this juncture, MIDF says it is keeping the FBM KLCI 2022 year-end target at 1,520 points.

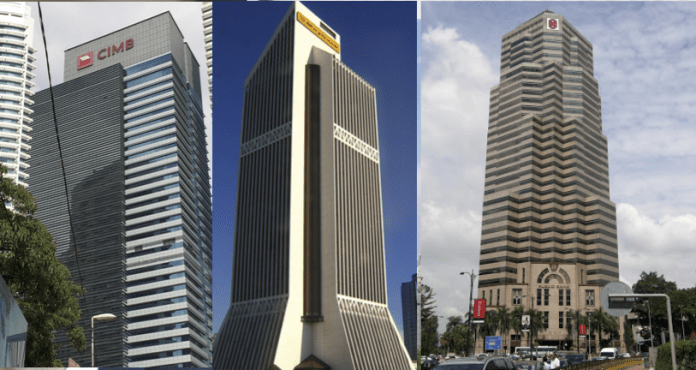

Look for sectors that are more agnostic to politics. Given that market, sentiment may be weak due to the hung parliament in GE15, tactically (at least for this week) the research house believes that investors should look for sectors that are more agnostic towards the result of the election and with good fundamentals that are closely tied with the performance of the economy, such as the banking sector.

MIDF continues to be POSITIVE on the banking sector and going forward, expect banks’ core earning drivers to remain with strong loan growth and leading indicators, an environment still rich with liquidity to support the said loan growth, lower credit costs and OPR hike-related benefits to net interest margins. Additionally, the banking sector is often synonymous with high deposit yields, with several names offering yields above >4%. This should offset headwinds: namely asset quality concerns, normalization of operating expenses, heightened deposit competition, and still weak non-interest income sources.