Asian bourses were traded higher on Friday as market participants cheered a softer U.S. inflation print.

Meanwhile the Japanese yen hit a seven-month high and Japanese bond yields broke above the central bank’s target as markets challenged Tokyo’s commitment to loose monetary policy.

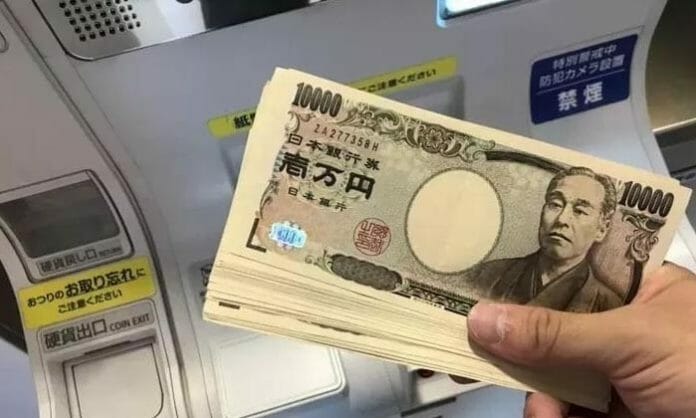

The yen surged 2.7% against the greenback overnight, kept going and rose about 0.2% further to 128.65 per dollar. It is up 6% in little more than three weeks since the Bank of Japan stunned markets by widening the band around its 10-year bond yield target.

However, the Nikkei 224 fell over 1% at press time.

The possibility of more flexibility has redoubled bets on a coming shift out of ultra-easy policy that seeks to pin yields near zero, according to newspaper report.

The yield on 10-year Japanese government bonds breached its new cap of 0.5% on Friday morning trade at 0.53%. The BOJ was making unscheduled bond purchases in response.

The BOJ had described its December move as aimed at addressing distortions in the bond market, and defended the new target with bond purchases – but that is under immense pressure now as traders have a sniff of a shift at next weeks’ meeting.

The BOJ will likely raise its inflation forecasts next week and debate whether further steps are needed, according to sources familiar with the bank.