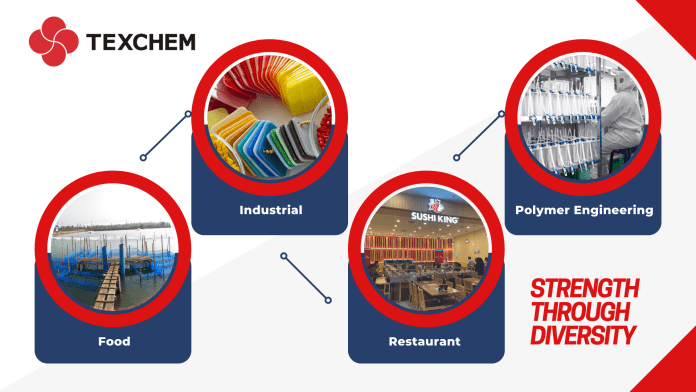

Texchem Resources’ revenue for the financial year under review reached RM1.14 billion, reflecting a 5.2% year-on-year improvement from RM1.09 billion last year. The growth it said was predominantly due to higher sales from its polymer engineering, food, and restaurant divisions.

On the back of improved efficiency and cost controls, the group reported an improvement in profit before tax margin to 3.4% as compared to 2.8% in the previous year. As a result, FY22 PBT rose by 27.2% YoY to RM39.0 million from RM30.7 million earlier.

Meanwhile, Texchem’s FY22 profit after tax and non-controlling interest stood at RM21.9 million as compared to RM25.4 million in the previous year. The bottom line was impacted by the accounting treatment of employee share option scheme, referred to as share-based payments in the financial statements totalling RM9.4 million (ESOS) and higher effective tax rate. The higher effective tax rate arises from certain tax expenses that are not tax deductible including ESOS and withholding tax on foreign dividend income. Tax expenses for the year stood at RM14.7 million against RM4.7 million in the previous year. For clarity, the net profit before accounting treatment for ESOS is RM31.3 million.

Texchem’s 4QFY22 revenue was at RM251.8 million with a net loss of RM0.3 million. For the current quarter under review, the performance was impacted by weaker demand and sentiment along with higher input costs.

The board is declaring a second interim dividend of 5.0 sen per share for the quarter. Total dividend per share for the current financial year amounts to 13.0 sen, representing a 50% payout of net profit before ESOS. The Group has a dividend policy of 50% payout of net profit.