Malaysia has emerged as an essential player in the global data centre market, attracting billions of dollars of investment from global tech companies. Kashif Ansari, Co-Founder and Group CEO of Juwai IQI, Asia’s largest real estate technology company, today released this forecast for the data centre market in the country.

Why Demand Is Soaring for Data Centres in Malaysia

Mr Ansari said, “The pandemic has made broadband connectivity and cloud-based productivity tools more important than ever in the daily lives of Malaysians. And the reshuffling of supply chains during reduced business travel has made cloud-based tools and services a more critical element of economic growth than before the pandemic. These two factors underlie the growing demand for data centres, which make cloud-based services possible.

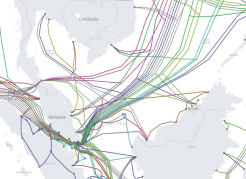

Source: Juwai IQI, Submarine Map by TeleGeography

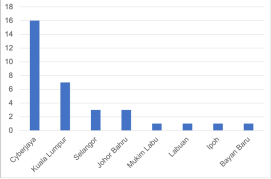

There are already 33 data centres in Malaysiai, with at least a dozen more in the development pipeline. Cyberjaya, Kuala Lumpur and Selangor are by far the top locations for data centres, followed by Johor.

“Malaysia has emerged as a top Asia Pacific region (“APAC”) data centre market because of supportive government policy, high levels of connectivity, a large population, abundant cost competitive land, inexpensive sustainable energy, and its geographical position at the heart of ASEAN and next-door to Singapore.

Number of Co-Location Data Centres

Source: Juwai IQI, Data Center Map

“Malaysia has excellent connectivity to the rest of Asia and the world through 29 submarine cable networks with 14 landing stations. Three additional submarine cables may come online in the next few years.

“Our population is young, digitally savvy and upwardly mobile. Only about 8 per cent are of retirement age, while 23% are aged 14 and younger. Meanwhile, 89% of Malaysians are smartphone and internet users. That is one of the highest rates in Southeast Asia. This youthful and digital population drives the country’s booming e-commerce market. Most analysts expect the e-commerce market to grow at a 13.6% compound annual growth rate through 2027. By 2027, e-commerce could be worth US$17 billion to Malaysia.

“Malaysia is on the fast track towards further digitalization. For example, the JENDELA initiative will lead to the investment of RM21 billion in fast broadband services. It will also ensure that just about every Malaysian can at least access 4G broadband service.

“The business community is also fast embracing the benefits of digitalization. Three-quarters of Malaysian companies have already adopted some type of cloud service.

“Malaysia’s strong push towards deploying 5G benefits the data centre market and is already increasing demand. The announcementthat Malaysia may launch a second 5G network will likely increase uptake.

Land and Energy Costs Favour Malaysia

“You can’t build a data centre without a parcel of land, so it is more difficult to build data centres in markets with high land costs. Malaysia has a significant advantage over other markets when it comes to land costs. Malaysia’s Johor and Kuala Lumpur have the lowest land costs of top data markets in the APAC. Land in Johor and Kuala Lumpur can be acquired for data centres at about one-quarter the cost of comparable land in the world’s number 1 data centre market, which is Northern Virginia, in the USA. Malaysia has approximately 600 industrial estates with robust connectivity that might make them appealing as sites for data centres.

“Another significant cost in data centre operations is energy. Operators are very sensitive to their contribution to climate change and don’t want dirty energy. Data centres are tremendous consumers of energy. They consumed 190.8 terawatt-hours of energy usage worldwide in 2021. They also contribute approximately 1% of energy-related greenhouse gas emissions every year.

“Data centre operators are under constant pressure to reduce their energy usage costs and environmental impact. Malaysia has an advantage in both energy and land. Malaysia is attractive because green energy will account for approximately 40% of all power generation by 2035. Also, in other key data centre markets across the globe, utility costs are expected to rise by a median of 16% in the years ahead.

“Malaysia’s strategic location at a chokepoint along the routes of submarine cables and next door to Singapore is also an advantage. Singapore is one of APAC’s largest consumers of data and the world’s third-ranked data centre market. The challenge for Singapore is a scarcity of both land and affordable green energy.

“Singapore only recently removed a moratorium on new data centre construction but has retained some strict rules on what can be built. Therefore, Singapore’s data centre vacancy rate is just 2%, a worldwide low for major markets. This gives Malaysia an opportunity.

Billions in Economic Value for Malaysia

“A thriving data centre market in Malaysia directly and indirectly impacts economic growth. It leads to the direct investment of billions of dollars and the creation of tens of thousands of new jobs. Indirectly, data centres enable the digital transformation of the economy. Researchers believe the transformation could deliver up to RM257.2 billion in annual economic value by 2030.

“The data centre market is expected to grow at a compound annual growth rate of 9.4% to 12% in 2028, depending on the forecast. The market will attract new inbound investments worth US$2 billion to US$3.1 billion by 2028.

“Behind this growth are some of the biggest companies in the world. Google Cloud, Microsoft Azure, and Amazon Web Services are all establishing bigger and better infrastructure in the country.

“Amazon Web Services is a great case study because they are investing US$6 billion in Malaysia over the next 14 years to create data centres that will prevent potential disruptions and provide low latency to local businesses. Other players continue to pile into the sector. Just last week, Australian data center operator NEXTDC said it would accelerate its expansion plans in Malaysia, and is raising US$419.2 million in part to do so.

“An example of what growth in the data centre market will look like in the years to come can be found at the YTL Green Data Centre Park in Johor. Sea will be the anchor tenant for this RM1.5 billion project providing green energy and advanced facilities.

“This example shows that the data centre boom is bringing the most advanced construction techniques, sustainable practices, and innovative technology to Malaysia.

“Data centres mean more than billions of dollars of growth. They also mean high-quality jobs and a green economy.”