Main Market bound SkyWorld Development Berhad released its unaudited fourth quarter and full-year results for the financial year ended 31 March 2023 posting a revenue of RM226.0 million and profit before tax of RM72.6 million, clocking in a gross profit margin of a whopping 43.22%.

In addition, the company also recorded a profit after tax of RM59.3 million and a profit after tax attributable to owners of the Company of RM58.2 million.

For FYE2023, SkyWorld recorded a revenue of RM841.4 million. Revenue generated was attributable to progressive revenue recognition from on-going projects namely SkySierra Residences (The Valley), EdgeWood Residences, SkyVogue Residences, SkyAwani III Residences, SkyAwani IV Residences, SkyAwani V Residences and the sales of completed inventories mainly from SkyMeridien Residences. On top of that, SkyWorld’s PBT and PAT for FYE2023 clocked in at RM204.8 million and RM150.7 million respectively. Net profit margin was strong at 17.9% for FYE2023.

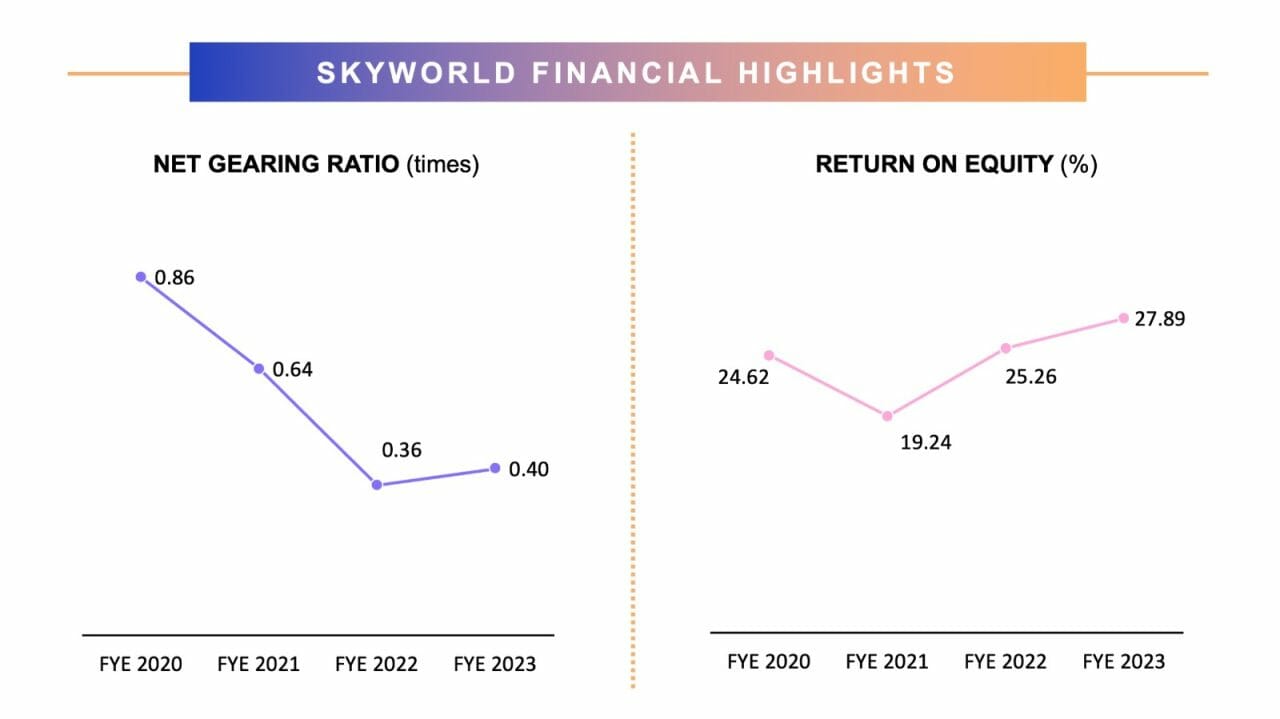

SkyWorld founder and non-independent executive chairman Datuk Seri Ng Thien Phing said, “As we closed the books for our 2023 financial year, I feel humbled and immensely proud to announce that SkyWorld has achieved unprecedented heights in its financials. SkyWorld has surpassed all previous records and achieved its highest ever revenue and net profit in the company’s history. To add on, our return on equity continues to remain strong as it clocked in at 27.9% for 2023. This momentous achievement is a testament to the hard work, dedication, and ingenuity of our exceptional team, as well as the unwavering support from the homeowners.”

“Moving forward, we remain committed to uphold our reputation for excellence, innovation, and customer satisfaction, as we continue to focus on our on-going and future developments. As of 22 May 2023, SkyWorld has a total sold and unbilled gross development value of RM968.28 million which will be recognised progressively between 2023 and 2026. SkyWorld’s completed developments have a collective take-up rate of 98% and our QLASSIC score exceeds the overall average scores for the industry which ranged between 69% and 73% from 2017 to 2020,” he added.

SkyWorld will be listed on Main Market of Bursa Malaysia Securities Berhad on 10 July 2023. Based on the IPO price of RM0.80 and 2023 PATAMI, SkyWorld’s price-to-earnings ratio stands at 5.56 times. In addition, the company has declared a first interim single-tier dividend of 3.00 sen per share on 1 billion ordinary shares, translating to a dividend yield of 3.75% based on the IPO Price.