By purchasing residential real estate, Malaysian homebuyers contributed a total of RM42.5 billion to the economy in 2022 – equivalent to about 2.7% percent of Malaysia’s 2022 gross domestic product of RM1,791.4 billion.

Juwai IQI Co-Founder and Group CEO Kashif Ansari (pic) said: “The fact that homebuying stimulates the economy means that governmental policies that support homebuyers have much bigger benefits for economic growth.

“Real estate remains the best way for Malaysians to build wealth and obtain economic security, but it also is good for the economy. The money we spend on fees, duties and expenses when buying a home also stimulates consumption and production in everything from manufacturing to transport.

“The RM42.5 billion of economic benefits is only part of the full impact of the entire housing sector, because it leaves out the tens of billions of ringgits that materials production, property management, rental property, maintenance and renovation and other real estate activities add to the economy. It also leaves out the value of the real estate itself.

“We also looked at the GDP impact on four states: Kuala Lumpur, Selangor, Johor and Penang. In Selangor, the benefits of home purchases add up 3.1% of GDP, the largest of any state. The benefits of home purchases contributed the least to GDP in Kuala Lumpur, where they add up to 1.7% of GDP. In Johor and Penang, the GDP benefits are relatively high, at 2.9% and 3.0% respectively.

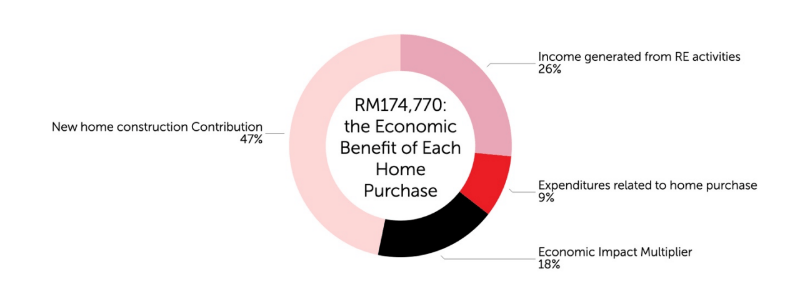

“On average, each time you buy a home, you generate for the economy an average benefit of around RM175,000, but the amount varies by state. In Johor, each transaction adds about RM 150,000 to the economy. The benefits are about RM294,000 in Kuala Lumpur, about RM201,000 in Selangor and about RM174,000 in Penang.

How Juwai Calculated RM42.5 Billions of Spending

“To estimate how much you add to the economy when you buy a home, our team used the statistical method developed by the economists at the United States’ National Association of Realtors (“NAR”), which has nearly 1.5 million members.

“In its ‘State by State Economic Impact Reports,’ the NAR used the same approach to estimate how much housing transactions contribute to the American economy annually.

“In the NAR’s model, four elements make up the total economic benefit of home purchases:

• “Income generated from real estate activities. This consists of commissions, fees, duties and moving expenses. They add up to about 10% of the average home price.

• “Related expenditures. These include furniture and remodelling, related retail purchases, and other goods and services that we determined equal about 3.5% of the average home price.

• “Housing purchase multiplier. Like other economic activity, housing expenditures circle through the economy. Households buy from companies. These companies pay their workers and suppliers. Workers and suppliers also buy goods from other firms, and so on. The multiplier seeks to account for the total impact of the amount spent.

• “New home construction. Home purchases lead to the construction of new homes, and in Malaysia one new home is constructed for every six purchased. The new home construction component of each purchase transaction thus equates approximately 17% of the average home price.”