MIDF gives its views on Bank Negara’s Financial Stability Report for 1H 2023. According to the investment house, the financial institutions business segment will continue to face headwinds. Overall firms-at-risk saw a minor uptick – while deteriorations were across the board, the real estate segment saw tremendous improvement.

Interest-coverage ratio continues to normalise (moving lower) concurrent to OPR hikes. External headwinds remain bleak: Commodity-and-building-material-related fears (most notably Crude Oil) and labour shortages continue to cast uncertainty over the financial health of businesses in the next couple of quarters. Notably, agriculture SMEs have seen a sharp increase in loans-in-arrears in the last two quarters as CPO conditions are far from ideal.

Motor vehicle and residential mortgages continue to drive debt growth. Unsecured loans were also very in trend. HH debt continued to outpace household financial assets despite higher financial asset growth rates, following the reduction of EPF withdrawals. Increases in lower-income group floating rate loans rose relatively sharply, though this was largely within banks’ expectations.

Financial Institution resilience: Banks are more than well-equipped to handle any major shocks. Asset quality has been kept

well under control with writebacks – do expect, however, provisioning downside from more vulnerable smaller banks. The latest BNM banking stats showed continued issues with Islamic FD rates – but Islamic banks should keep it manageable with alternative forms of funding for now.

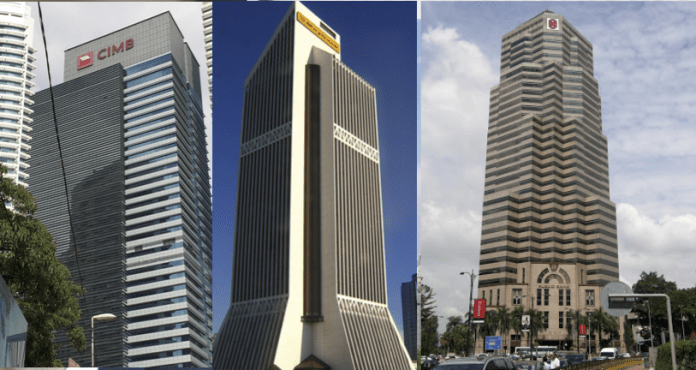

The house maintains a POSITIVE call on the sector with a possible economic headwind ahead, MIDF expects asset quality issues may persist, though negative effects should affect smaller banks harder than others. Overlay writebacks will likely be limited. Positive drivers should include more impressive NOII, loan, and deposit figures in 2HCY23 – while NIM is expected to recover (slowly), end-year deposit competition could put a damper on things. Top Picks: CIMB (BUY, TP: RM6.43) and Public Bank (BUY, TP: RM4.76).