Fitch Ratings’ through-the-cycle analysis has revealed that most Chinese issuers would face a medium- to high risk of lower Standalone Credit Profiles (SCPs) or, if rated on a standalone basis, Issuer Default Rating (IDR) downgrades under a hypothetical scenario of a severe slowdown in the Chinese economy.

The rating agency said the current base-case assumption, which forms the basis of its rating assessments, is that China’s real GDP will expand by 4.6% in 2024, picking up to 4.8% in 2025 and 2026.

The hypothetical stress scenario deviates materially from its base case it said, assuming that real GDP growth falls to 1.5% in 2024, sparked by a prolonged and deeper property slump as well as a delayed or ineffective policy response, and only recovers to 2.0% in 2025. Credit conditions tighten, with resulting defaults further undermining confidence and the funding environment. Fitch believes this would, in turn, induce more central government-driven and aggressive policy responses, leading real GDP growth to recover to 4.8% in 2026.

Slower economic growth in the stress scenario would push up China’s general government debt/GDP ratio, as would fiscal stimulus, particularly as the government ramps up its policy response later in the scenario, likely prompting negative action on China’s sovereign rating (A+/Stable). The crystallisation of contingent liabilities on the government’s balance sheet would also accelerate.

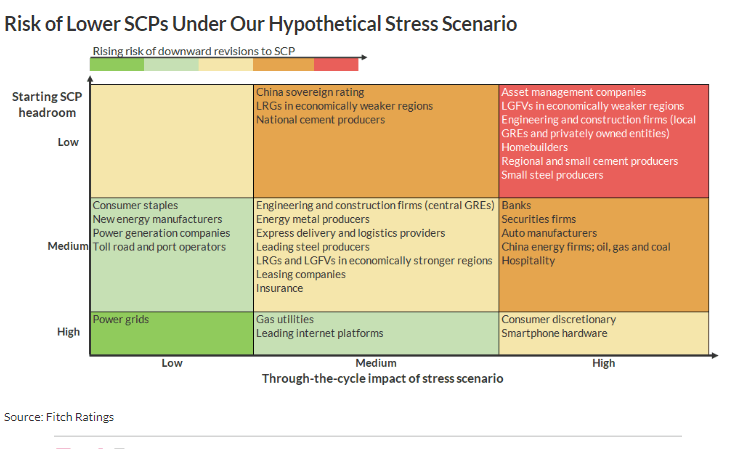

The following heatmap lays out the assessment of the impact of the hypothetical stress scenario. It compares risks to rated entities’ standalone creditworthiness. Most issuers would face a medium to high risk, while pressure on China’s sovereign rating would also affect IDRs that are directly driven by the sovereign rating as well as some of those that benefit from sovereign support.