S&P Global Ratings published its quarterly economic update for Asia-Pacific. Along with revisions to many of its forecasts for GDP, policy rates, and inflation for economies in the region, we also comment extensively on the key risks to the economic outlook for 2024 and beyond.

China is coping while its neighbors step up. A property downturn is still a pain point for the Chinese economy, but growth momentum has slightly improved because of policy support. Outside of China, economies have generally held up well. Asia-Pacific as a whole continues to grow despite meagre support from external sources. Emerging market economies with solid domestic demand are posting the strongest growth.

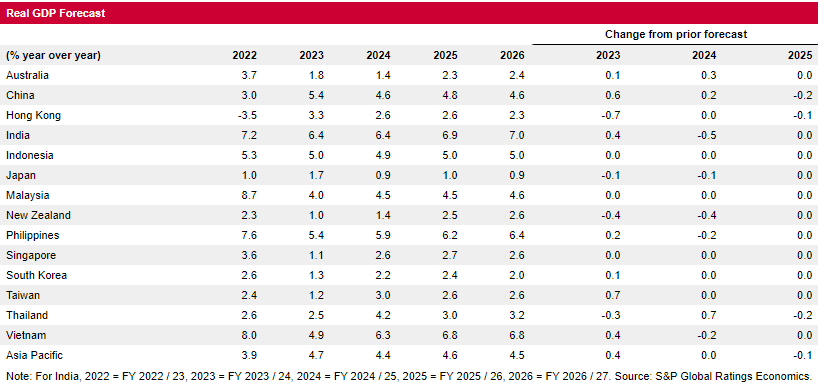

That’s according to a report published by S&P Global Ratings today, titled “Economic Outlook Asia-Pacific Q1 2024: Emerging Markets Lead The Way.” In this latest quarterly economic update, we have raised our GDP forecasts for Australia, China, India (for 2023 only), Taiwan, and Thailand (for 2024 only) and lowered them for Hong Kong and New Zealand. We kept forecasts broadly unchanged for Japan, Malaysia, the Philippines, South Korea, and Singapore.

“China’s outlook has improved, but obstacles remain. With the property sector struggling and confidence subdued, the growth outlook remains moderate,” said S&P Global Ratings chief economist for Asia-Pacific Louis Kuijs.

“Overall, growth this year and next is on track to be the strongest in emerging market economies with solid domestic demand: India, Indonesia, Malaysia, and the Philippines,” said Mr. Kuijs.

We expect growth to be the lowest in developed economies particularly exposed to the weak global trade conditions (South Korea, Taiwan, Singapore) or where the central bank has raised interest rates a lot to fight inflation (Australia, New Zealand). Still, we project 2023 GDP growth to exceed 1% in all Asia-Pacific economies.

Key Takeaways

• China’s property weakness continues to weigh on the economy. We predict the country’s GDP growth will be 5.4% in 2023, and slow to 4.6% in 2024. The latter figure aligns with our estimate of potential growth, suggesting economic slack will persist next year. • Asia-Pacific economies outside of China remain resilient. Growth this year and in 2024 should be the strongest in emerging market economies with solid domestic demand: India, Indonesia, Malaysia, and the Philippines. • With core inflation continuing to ease, the region’s central banks are unlikely to have to tighten monetary policy again. Still, given the pressure from higher-for-longer U.S. interest rates, we expect no meaningful falls in policy rates for the next six months.