Japanese markets were reeling on Friday, with the Nikkei heading for its biggest weekly drop since October, bonds battered and the yen surging toward its largest weekly gain for five months as investors rushed out of bets on Japanese rates staying low.

Beyond Japan MSCI’s broadest index of Asia-Pacific shares ex Japan rose 0.5 per cent and Treasuries sold slightly. The Nikkei was down 1.6 per cent for a weekly drop of 3.3 per cent.

Other moves were more modest as traders wait on U.S. labour data due later in the day.

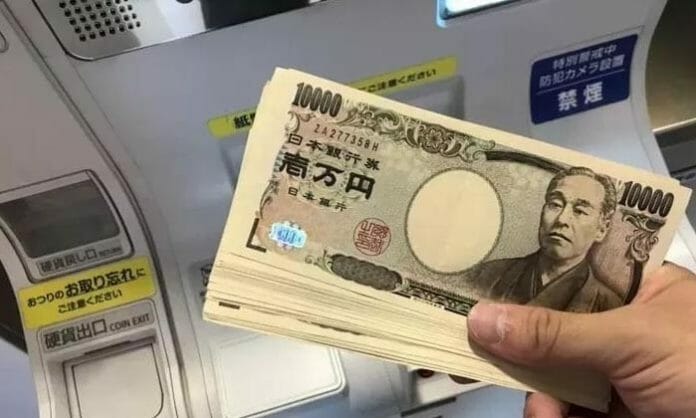

The yen leapt more than 2 per cent on Thursday and was well supported on Friday, though kept below an overnight four-month peak of 141.6 per dollar to trade at 143.39.

Bank of Japan Governor Kazuo Ueda told parliament on Thursday the central bank faces an “even more challenging” year ahead before discussing options for exiting its ultra-easy settings, which traders took as a sign of change in the offing.

The BOJ is due to set policy rates on Dec. 19.

“This may prove to be too soon for large steps to be unveiled, but… we believe it is a matter of when, not if, the BOJ jettisons its negative interest rate regime,” said Corpay currency strategist Peter Dragicevich.

Reuters