By Dr Carmelo Ferlito

With the year coming to an end, we are called to wonder what has to be expected for the year which is approaching.

However, economists should avoid a zodiac approach and should do more to make people understand that economics is not a crystal ball with a gaze on the future, but a set of intellectual tools which help us to understand reality and to imagine a causal connection between what is happening now and what could happen in the future as a consequence of the present.

But economics should also be an exercise in humility: the future remains unknown and, at a great extent, unknowable, because of the radical uncertainty surrounding each human decision which constitutes economic life.

Therefore, I will always avoid saying that the economy is going to grow between X% and Y%; such predictions are little more than well-crafted guessing; moreover, a percentage growth per se is irrelevant, as I shall try to explain.

Economic facts, furthermore, are linked with non-economic events and the so-called exogeneous factors cannot be ignored. At this regard, year 2023 has been characterized by growing international tensions which make pattern predictions more complicated.

From a purely economic perspective, instead, I believe that the most important fact to be noted is the aggressive monetary policy played by the Federal Reserve.

The policy of ultra-low interest rates paired with irresponsible fiscal policies, both consequences of the ‘Great Lockdown’, generated a sustained inflationary path that needed to be halted: the dichotomy between a (depressed) real economy and an abundance of artificially created money finally emerged. And the bill to be paid to halt inflation may take the shape of a recession.

Back in 2021, the Center for Market Education (CME) anticipated that an inflation-led post-Covid crisis had to follow the immediate post-lockdown rebound: wrong policy decisions have consequences.

Now, it remains open the question if such a crisis will be just an economic slowdown or eventually a true recession.

Signals from the housing market in the United States are not comforting: existing-home sales fell to a 13-year low in October and this is now having spillover effects for hardware stores, furniture sellers and construction firms; what happens in the property market is often a good proxy of what is going to happen to the rest of the economy.

Interest rates may be cut next year but this may create more confusion and eventually lead to new asset bubbles within a framework of price stability.

Fortunately for us, Bank Negara Malaysia followed a more prudent approach and the inflation experienced by Malaysia has been much lower than what we have observed in the West.

Malaysia may be better equipped to face the scenario of an international economic turbulence, although – it goes without saying – it cannot totally escape it.

However, the economic challenges to be faced by Southeast Asia are more related with the evolution of the Chinese economy.

Between 2014 and 2016, I wrote and talked about the inherent instability of the Chinese model of growth, centred on government direction, wrong set of incentives and an incredibly high private debt: in 2022, while Chinese public debt stood at 77.1% of the GDP (lower than US, Euro Area, Japan and the UK), private debt reached 195%.

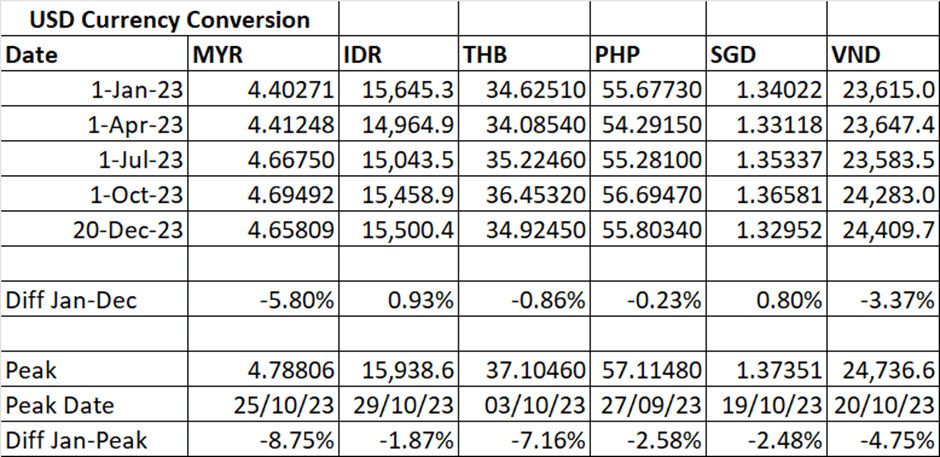

Table 1

As for most of Asean countries, China represents the largest trading partner, the economic difficulties experienced by the world’s biggest Communist country are going to weigh in dangerously.

Given the current economic evolution, it is likely that the Philippines and Indonesia will remain the best economic performers in the region, although the results of Indonesia may be affected by the election results.

Vietnam may follow closely, but the strong dependence on China as export destination is now weakening Vietnam’s manufacturing sector.

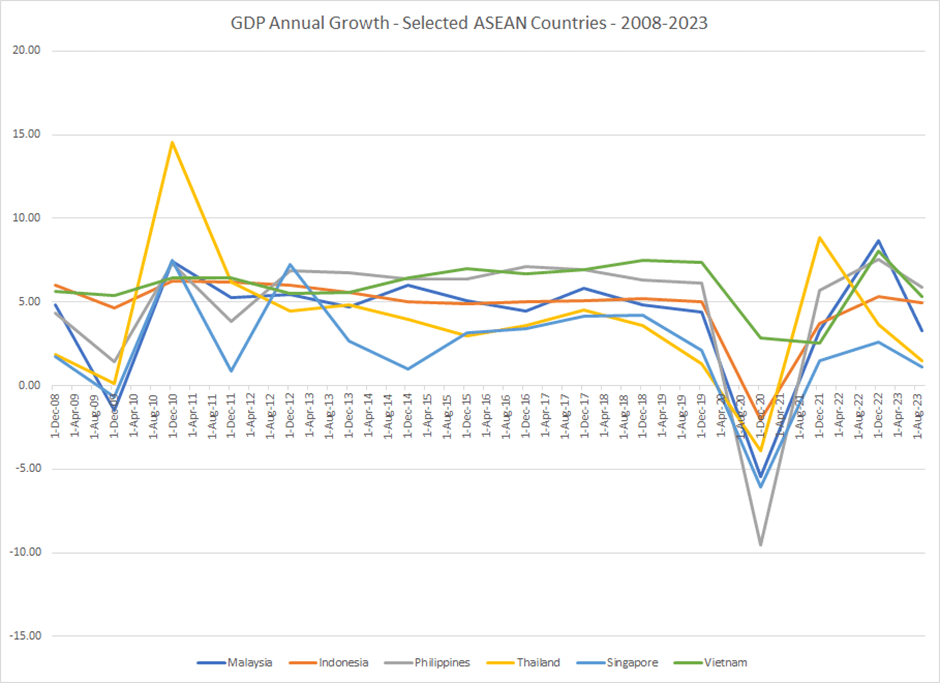

Malaysia and Singapore, instead, may experience softer growth (as shown by recent trends, see Graph 1) and the situation may be damaged by the re-emerging discussions, inside these two countries, about mask mandates and movement restrictions: measures that, while useless from a healthcare perspective, are also extremely costly.

If such discussions are not stopped immediately, they will increase the climate of uncertainty, negatively affecting the economies of the two countries, creating unemployment and poverty.

Graph 1

There is more. I truly believe it is time to move beyond GDP per se when measuring the economic performance of a country.

In fact, growth as measured by GDP may be sustainable or not; in example, if, ceteris paribus, GDP grows as a result of additional government spending financed by debt, we will experience inflation and unemployment; if, instead and ceteris paribus, GDP declines as a consequence of reduced wasteful government spending, we will experience positive effects on the economy.

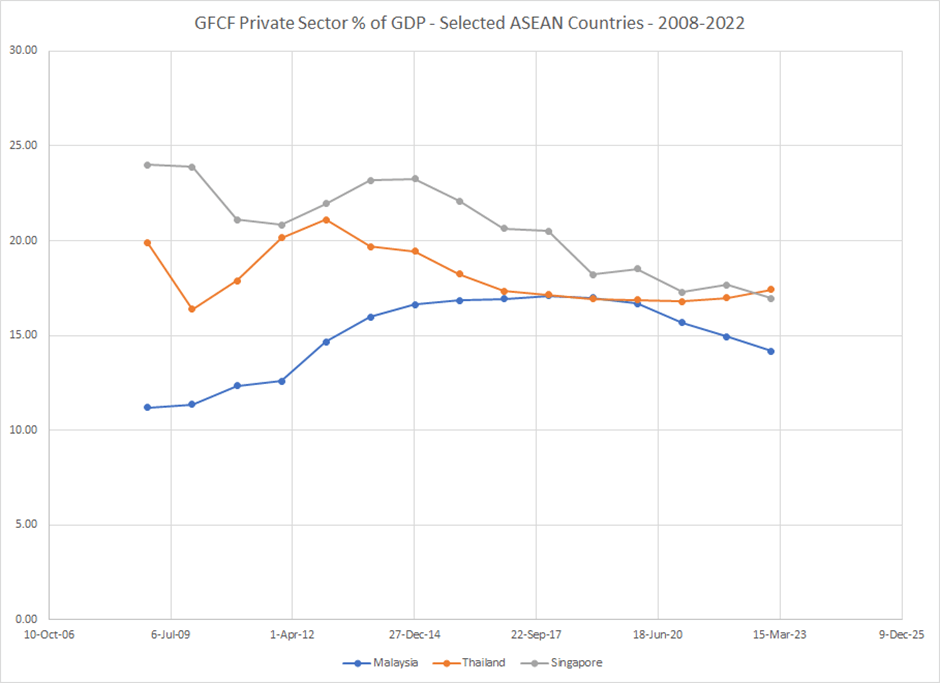

Here, we find one of the structural problems of Malaysia: a growth centred on consumption and government spending, rather than private investments financed by savings.

Some of the plans presented by the government seems to recognize the importance of promoting investments and rebuilding the manufacturing backbone of the country; however, little is still practically done to roll out a favourable institutional framework based on the primacy of markets and private initiative.

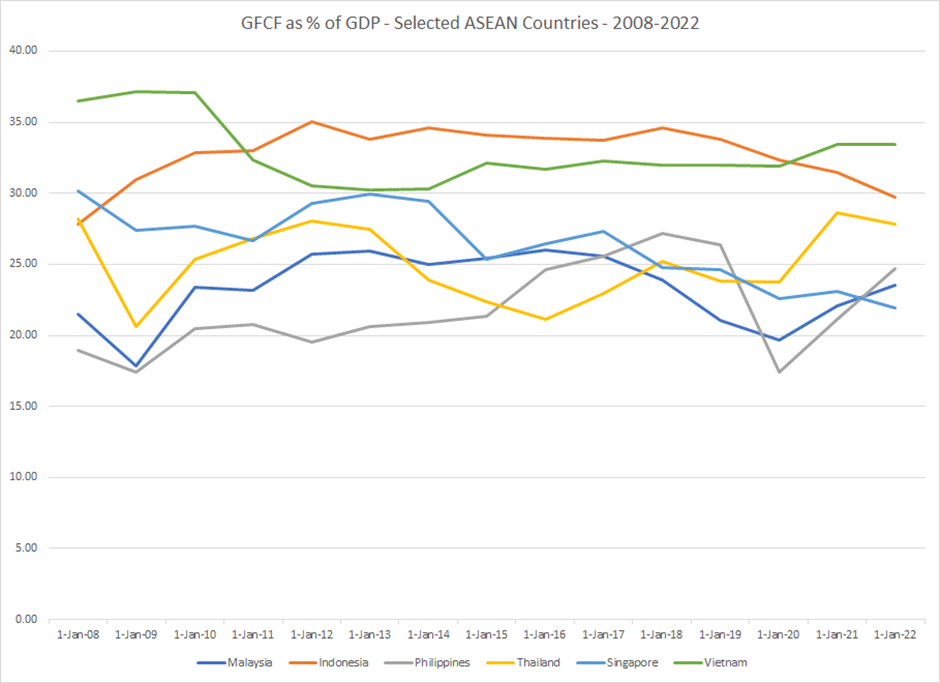

In 2022, Malaysia’s investments represented 23.51% of the GDP (14.18% generated by the private sector), while for Indonesia and Vietnam the figure was just below or above 30%. Even in Singapore, where investments were around 21% of the GDP, those generated by the private sector were above 16%.

Graph 2

Graph 3

Therefore, the real challenge for Malaysia is not growth per se, but a change in the growth model, whereby for long-term sustainable growth we must refocus on investments rather than consumption and government spending.

At this regard, it seems that Indonesia, Vietnam and Thailand are better placed in the competitiveness race.

These seems to be two of the structural challenges that Malaysia must urgently face: the too-strong relationship with China and a consumption-oriented growth model.

These issues must be faced with bold reforms; on one side, it is necessary to speed up on truly free-trade bilateral agreements, as stressed also by the Ekonomi Madani framework. On the other hand, pro-market reforms need to be implemented to favour investments.

This means to reduce the role of government interference in the market, liberalize the monopoly situations favoured by government protection, improve banking services, reform business compliances and improve the tax system.

Malaysia needs to realize that it is not the only country in the region providing a qualified and English-speaking workforce: neighbour countries (Indonesia and Philippines in particular) are rising in terms of qualified labour availability and improving infrastructures.

Furthermore, these countries can offer a wide domestic market, which is not available in Malaysia, instead (where the small domestic market is accompanied also by a rapidly ageing population).

We must therefore realize that we can remain competitive only thanks to a favourable institutional framework.

Such a set of reform can also help a suffering currency to recover. While depreciation may come to a halt, it seems more challenging to bring the ringgit back to 4.50 against the greenback.

Bank Negara is wisely run and can properly play its role, but its action will be ineffective if not paired with effective and more holistic economic reforms, which goes in the direction of more liberalizations rather than more government intervention.

At this regard, the recent extension of the “Look East” approach to China by Prime Minister Anwar Ibrahim sounds extremely dangerous and a source of concern.

The target of RM 4.50 for an American dollar within the first half of 2024 can be achieved but only at the condition of a serious commitment to a pro-market agenda.

Great expectations are placed also on the game that BNM will play on the interest rate, but I think that no revolutions must be expected. The central bank will constantly evaluate an evolving and emerging scenario.

The important thing will be to maintain the balance between economic growth and quantity of money on one side (to avoid inflation) and that between investments and savings on the other (for enhancing a sustainable growth path).

Although the Prime Minister has expressed the intention to maintain the OPR where it stands now, it is important for the government to remain outside decisions of monetary policy: while politicians pursue political consensus and can therefore take populist decisions which are detrimental to the economy, the focus of the central bank has to remain economic stability which ultimately is the main source of welfare for the rakyat.

The evaluation on the adequacy of rates needs to be done at the light of the real economic conditions, taking into account the international scenario too, as too accommodative policies may compromise the financial stability of households, enhance an asset price bubble and keep alive zombie companies.

A balanced monetary policy will also support the ringgit and preserve the purchasing power of people.

The article is written by Center for Market Education chief executive officer Dr Carmelo Ferlito.