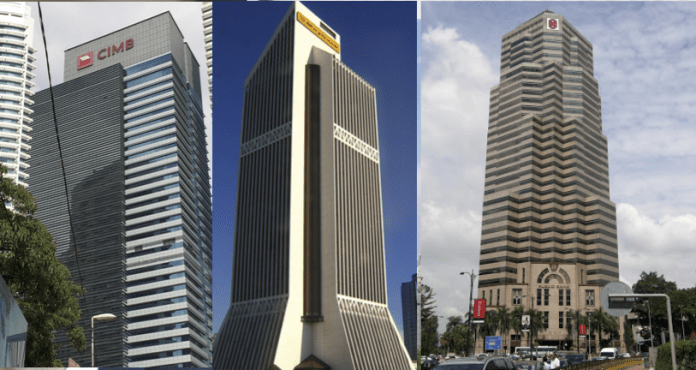

Hovering close to -1SD to mean, banks’ PER valuations are attractive, says Maybank IB, coupled with ROEs that are expected to average 10% amid earnings growth of 5.8%/6.5% in 2024/25E and dividend yields averaging about 5%, the house remains positive on the sector with BUYs on AMMB, CIMB, PBK, ABMB, HLBK and HLFG.

With valuations close to pandemic low, the banking sector PERs (on a one-year forward rolling basis) are currently hovering close to pandemic valuation levels, which Maybank IB believes is unjustified. Banking stocks it said under its coverage currently trade at an average PER valuation of just 9.3x, which is close to the pandemic trough PER of 8.3x in Oct 2020. In fact, average valuations are even lower than the longt erm -1SD (standard deviation) to mean PER of 10.1x.

Earnings growth over the past 10 years has been relatively subdued, averaging just 4.7% from 2013 to 2022. Even so, forward PER valuations over this period has averaged 11.8x. Currently, forward PER valuations average just 9.5x for 2024 despite expectations of faster aggregate earnings growth of 5.8% in 2024E and 6.5% in 2025E.

Post GFC (from Dec 2009 onwards), foreign shareholding levels have trended down over time. Where the house has seen some foreign interest in recent months, has been in the likes of Maybank and CIMB, which have seen their foreign shareholding levels claw back up from their troughs. It is still early days to determine whether Malaysia banks can attract foreign interest, but with attractive valuations, decent earnings recovery, sustainable ROEs (MIBG estimates: 10.2% in 2024/25E), commendable dividend yields of 5% or more, expectations of stable interest rates, coupled with the prospect of a stronger MYR ahead, there are value.