The Kuala Lumpur-Singapore High Speed Rail (KLHSR) Project is a mega-infrastructure development project that has been in the making for almost fourteen years. Originally proposed by the Malaysian government as a High-Impact Project in Malaysia’s 2010 Economic Transformation Programme Roadmap, the KLHSR was considered to be a highly effective means for spurring economic activity and growth within both regions.

The first proposal for the project was jointly announced in 2013 by the Singaporean and Malaysian governments, after fruitful discussions took place during a Leaders Retreat where both heads of state were in attendance. The project was intended as a 350Km High Speed Rail Line, which would run along the West Coast of Peninsular Malaysia, with a total of 8 stations running from the Bandar Malaysia Terminal in KL to the Jurong East Terminal in Singapore.

The project was estimated to cost RM70 billion and was expected cut travel time between KL and Singapore to 90 minutes. In addition to supporting greater facilitation of business activities within the various designated regions, the KLHSR project was expected to transition Malaysia towards a high-income nation and contribute RM 21 billion in GDP to the Malaysian and Singaporean economies.

After the initial agreement between both parties to carry out the planning phase and subsequent establishment of a consortium to handle its management and operational considerations, the project began to face challenges. These stemmed mainly for an inability of both parties to reach an agreement surrounding some of the project’s key terms, which included the appointment of the designated operator for the project and its official construction timeline.

When newly elected Prime Minister Tun Mahathir Muhamad announced in 2018 that project would be too costly for the Malaysian government, this ultimately led to the termination of the agreement and involved the payment of damages to the Singaporean government for costs incurred up to that point.

However, as of July 2023, the project has been put back on the table, with MYHSR Corp, the project delivery vehicle for the KLSHSR, calling for concept proposals for its revitalisation. Will the new KLHSR be able to deliver upon its original premise of supporting economic growth and prosperity within its targeted Southeast Asian region?

Potential Economic Benefits of the KLHSR Project

With the renewed interest surrounding the development of the KLHSR Project, there is a need to consider the opportunities and challenges involved in its development. The KLSHSR Project has the potential to bring a wide range of benefits to the economies of both Malaysia and Singapore. The HSR has been projected to contribute an amount within the region of RM21 billion to the Gross Domestic Product of both Malaysian and Singapore and to create 111,000 jobs by 2060.

Singapore and Malaysia were the second largest trade partners in 2022, with bi-lateral flows between the two countries amounting to RM85.53 billion in 2023. Singapore was also one of Malaysia’s top sources of foreign direct investment, contributing to 8.3% of its total investments for that year. In light of the significant level of trade that takes place between both nations, the introduction of a rapid and seamless means of transport would support further opportunities for mutual trade and economic development between in both regions.

Furthermore, with plans to establish Special Economic Trade Zone between in the state of Johor, the existence of the KLSHSR will further support efforts at facilitating greater economic activity between both countries. The project will help to support cross-border flows of goods, investments and people between the two countries and empower both nations to face the challenges posed by global economic headwinds moving ahead.

The benefits of the KLHSR Project extend towards a range of areas. The greater accessibility afforded by the system would lead to improvements in human capital, consumption patterns and economic activity in a continuous virtuous cycle of growth. Both nations would experience significant levels of population growth with the increased level of mobility as well as improvements in labour skills due to the mutual sharing of knowledge and resources. A corresponding increase in per capita wages would likely follow and lead to increased consumption patterns. These factors would in turn contribute to improvements in industrial productivity, particularly within the manufacturing, services and tourism sectors, as a result of access to better labour resources and to meet increasing demand for goods and services.

In addition to the above-mentioned benefits, the KLSHSR would also drive regional competitiveness and attract high value investments. The link between both nations would connect Malaysia to a catchment of RM 268.5 billion of total output impact. It would also provide competition to the High-Speed Rail Projects in both Thailand and Indonesia, the latter of which has already been completed.

Furthermore, the KLHSR has the potential to promote inclusive state development and close the growing income gap between the southern states in Malaysia. It could also catalyse growth along the HSR corridor, unlocking up to RM19 trillion in wider economic impacts. The project also has the potential to improve talent pool accessibility by attracting talent from across the country into the HSR corridor and contribute to higher income jobs and an overall enhancement in the standard of living.

By facilitating job creation and enabling greater opportunities for business activity, the KLHSR project would help to transition Malaysia towards becoming a high-income nation. It would also help to bring isolated regions within the country closer together, support growth and development, and help towns to increase their hidden potential by making them highly accessible to workers, investors and tourists.

The KLHSR project also has the potential to provide additional benefits in terms of environment and safety. With its annual ridership expected to reach 15.2 million in 2030 and increase to 37.8 million in 2060, the savings this would afford in terms of carbon emissions is considerable. MyHSR corp has estimated the HSR service would result in 19 million litres of fuel saved from fewer vehicles on the road and 55 million Kilograms of CO2 emissions prevented from entering the atmosphere. It would also reduce exposure to road traffic accidents by a significant amount.

As there are plans to connect the HSR to the Pan-Asian Railway and other rail networks in nations such as Thailand, Vietnam and Laos, the long-term benefits afforded by the KLHSR are indeed potentially far reaching. The project would allow both Malaysia and Singapore to develop deeper interconnectedness with neighboring countries, enabling manifold opportunities for commercial and economic growth to take place, as well facilitating better tourism potentials. The HSR would also provide Malaysia and Singapore with access to the CHINA-ASEAN Economic Trade Zone, the Eastern Economic Corridor in Thailand, and sub-regional economies like the Greater Mekong sub region.

Potential Challenges/Risks Associated with the KLHSR Project

While the potential economic and socioeconomic benefits of the KLHSR Project are certainly promising, there remain a number of key risks associated with the development of the project. These mainly centre around the cost of the project and its ability to attract the necessary long-term returns to justify its development.

As per the recently released Request for Information notice by MyHSR Corp, the newly proposed KLSHSR Project is intended to be delivered as a Public-Private Sector Partnership engagement. In a PPP initiative, the government partially finances the project and manages concerns with include land acquisition, facilitation of regulatory approvals, and the granting of incentives such as tax breaks and credit guarantees. The private sector, on the other hand, finances the construction and handles the risks involved in execution. On balance, the greater risk in PPP arrangements is shouldered by the government, who is responsible for ensuring that the project is carried out effectively and operates successfully.

The newly proposed KL-Singapore High Speed Rail Project has a projected financial cost of RM 100 billion. This constitutes nearly 25% of the proposed Malaysian budget for 2024 and is equivalent to the country’s total budget allocation for development in 2024. Large-scale infrastructure project of this type can face unforeseen challenges in the construction phase, as is evidenced in the Indonesian HSR project which was completed with a cost of US$ 8 billion in contrast with its initial US$5.5 billion projected cost.

In 2020, the cost for the HSR project was estimated at RM 72 billion, an amount that is 40-50% higher that the industry average when compared to the High-Speed Rail Projects in countries such as Europe and China. According a European Union audit on HSRs in the region, the KL-Singapore HSR should have cost approximately RM42 billion. Similarly, a 2019 World Bank Report on HSRs in China indicates that the maximum cost for KL-Singapore HSR should have RM 33 billion. Thus, there are inherent concerns with regards to the optimised appropriation of finances for the project. However, these should be weighed in reasonably with consideration of the unique financial factors impacting the KLHSR project, such as the cost of materials, services and other resources within the KL and Singapore regions.

In light of these issues, the actual utilisation of the HSR will be a key determining factor in its success. The project would have to receive a substantial number in terms of annual ridership in order to justify its costs, which can be a challenging proposition. With ticket fares likely to be within the RM200 to RM 400 range, the line will likely be utilised primarily by the higher income earning groups, business passengers and international tourists.

Furthermore, the upcoming Gemas-Johor Bharu Electrified Double Track (EDT) will be complete in 2025, and while it will be unable to match the KLSHSR in terms of speed and travel time, the line will offer a more economically affordable alternative for travel between the North and South of Peninsular Malaysia.

Additionally, there would need to be guarantees made by the government that the KLSHSR would be utilised by the industrial sector for trade purposes. If trade commitments can be established among private sector entities both here in Malaysia as well as in Singapore to ensure utilisation of the KLSHSR, this would support the justification of its costs.

With Malaysian Debt currently estimated at RM 1.39 trillion and the debts associated with the IMDB case yet to be fully financed, the need to exercise a level of prudence with regards to financial expenditures is still very much present. As the financial burden of the KLSHSR will rest mainly on the government, and therefore on taxpayers’ money, it will need to be demonstrated that the project will be able to attract the necessary long-term utilisation require to justify the substantial investment.

The Original Concept for the KLHSR

The Kuala Lumpur-Singapore High Speed Rail Project was originally intended as a high-speed rail system which would run from the Bandar Malaysia Station in Kuala Lumpur to the Jurong East Station in Singapore. High-Speed Rail systems are type of rail transport network utilising trains that run significantly faster than those of traditional rail, and which use an integrated system of specialised rolling stock and dedicated tracks. As the fastest and most efficient mode of ground-based commercial transportation, high-speed rail systems are used to connect major cities around the world in countries such as Japan, South-Korea, Norway, the United Kingdom and the United States.

The KLHSR system would be a 350Km long double track route with 335 Km running through the Malaysian region and 15Km running through the Singaporean region. The trains would have a maximum running operating speed of 320km/h and would reduce travel time between Malaysian and Singapore to 90m minutes. The line would have 8 stops in total and cross over a bridge with a height clearance of 25 metres to connect both countries.

The length of the train would be 10 cars long, with total capacity of 100 passengers per car. The line would have 3 services being run by two operators, one designated for international passengers and another for domestic passengers. The operator would run Express and Shuttle services under the international line and Domestic Service under the domestic line.

The existence of two separate lines for international and domestic passengers would allow the operator to cater to the needs of different passenger profiles and give the domestic line the flexibility to regulate its own service. The Express and Shuttle services, which would run from KL to Singapore and Iskandar Puteri to Singapore respectively, would be given priority over the domestic service, which would run from KL to Iskandar Puteri.

Under the agreement, each country would be in charge of its own stations and infrastructure, with the Singaporean and Malaysian government responsible for developing, constructing and maintaining the civil infrastructure within their own countries. In Malaysia, the MYHSR Corporation would oversee the project’s infrastructure management while the Land Transport Authority (LTA) would be responsible for the same in Singapore.

A Bilateral Committee would be established to oversee all matters affecting the express and shuttle services. Additionally, a working level joint-project team would handle all matters that require coordination and joint engagement between Singapore and Malaysia.

Singapore and Malaysia Customs, Immigration and Quarantine (CIQ) facilities would be co-located at three locations – Kuala Lumpur, Iskandar Puteri and Singapore. International bound passengers would need to go through CIQ clearance by both Singaporean and Malaysian authorities only at the point of departure, ensuring swift and seamless travel.

The Original Project Delivery Structure for the KLHSR

The original agreement for the KLHSR was signed by Singapore and Malaysia on the 13th of December 2016. Under the agreement, a consortium was established comprising of WSP Engineering Malaysia, Mott MacDonald Malaysia, and Ernst and Young Advisory Services, who would act as the Joint Development Partner for the project beginning February 2017. The consortium would provide project management support, technical advice, develop technical and safety standards for the HSR and assist with the preparation of all relevant tender documents.

Under the agreement, the Land Transport Authority of Singapore (LTA) appointed AECOM Singapore to provide architectural, engineering and other design services for the infrastructure on the Singapore side of the HSR. MyHSR Corporation of Malaysia (MYHSR) appointed a joint venture of Systra and Meinhard in May 2017 as reference design consultants for the Malaysian side of infrastructure development works.

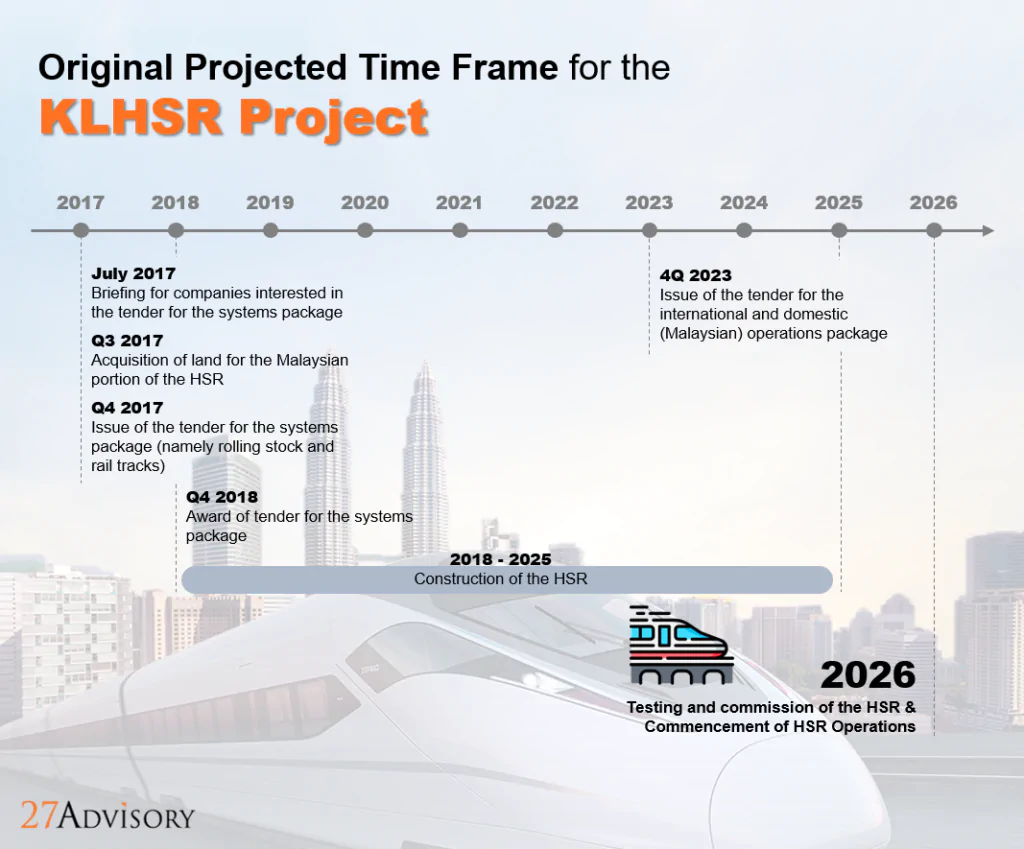

The planning of the original KLHSR project commenced shortly after an agreement was reached between both governments in 2013. The project moved ahead with the development of Consortium to manage project’s planning and development works, with ongoing discussions taking place surrounding its construction and operational aspects.

However, the project ran into obstacles when the representatives of both countries were unable to agree on certain terms, and was further challenged by the Malaysian governments reluctance to move forwards due to budgeting considerations. Outlined below is the sequence of events between the inception and termination of the origninal KLHSR project, leading up the recent initiatives with respect to its revitalisation.

The Malaysian-Singapore High Speed Rail project is an ambitious infrastructure development plan that has been waiting in the wings for more than a decade now. With its potential to contribute to significantly towards economic growth and development within the regions across Peninsular Malaysia and in Singapore, the KLHSR could serve as a viable means to provide both nations with the necessary economic support to face the global economic challenges ahead.

Nevertheless, while its potential advantages remain attractive, governments and private sector stakeholders should be cautious in committing resources to its development, particularly in light of the challenges that were faced in the execution of the original project. The Malaysian government in particular should be prudent with regards to committing expenditures and ought to demonstrate how ridership levels can be achieved to meet the long-term financial targets of the KL-Singapore HSR.

Efforts aimed at creating greater connectivity among the nations of the world should certainly not be dismissed out of hand, as such trends conform to the growing movement of globalisation that has been experienced across our recent history. With greater sharing of skills, knowledge and expertise, the global community increases its likelihood of facing collective challenges such as climate change and food security well into the foreseeable future.

With the necessary due diligence and coordinated efforts between all stakeholders to ensure that the project is carried out with the level of quality and integrity required, the KL-Singapore high speed rail project can enter the arena of successful large scale infrastructure projects that promote economic security and prosperity within the targeted region.

This review is by 27 Group, a business consultancy and advisory organisation geared towards project development and socioeconomic transformation strengths. They provide project management and master planning services for clients within multiple industries and are also keenly involved in the development of socioeconomic initiatives within the public sector. Their guiding ethos of ‘Rebuilding Humanity’ drives them to deliver transformative projects with the right amount of care and attention, meeting both stakeholder expectations and the essential needs of the wider communities that the group serves.