Bursa Malaysia bounced higher again on Thursday, one session after ending the two-day winning streak in which it had advanced almost 15 points or 1 percent.

The Kuala Lumpur Composite Index now sits just above the 1,580-point plateau and it may add to its winnings on Friday.

At 9.16am the FBMKLCI rose +1.77 points to open at 1,581.59.

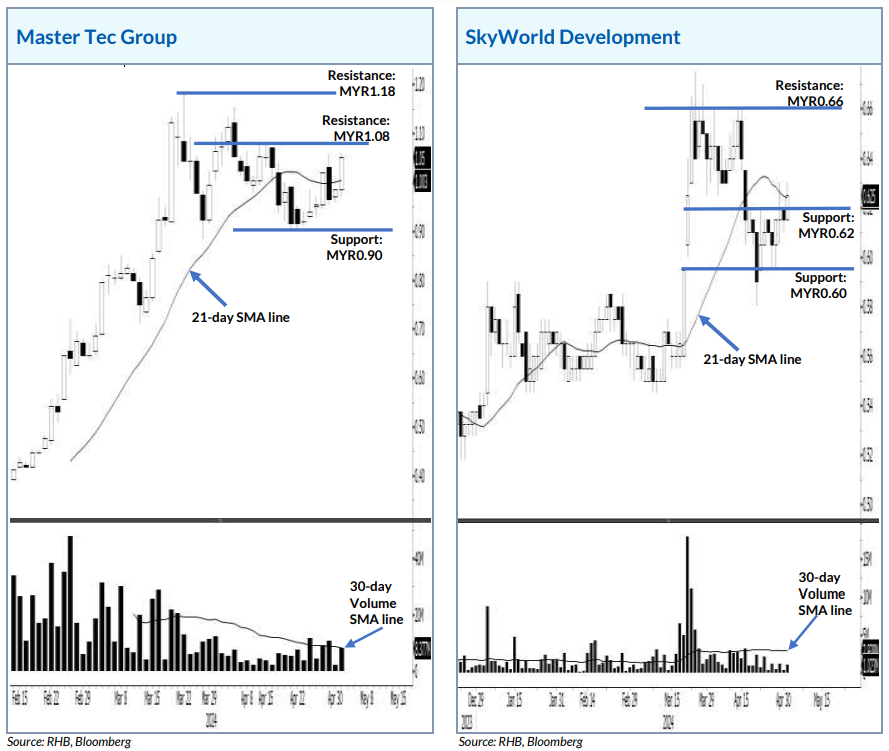

RHB Retail Research in a note today (May 3) the FKLI resumed its bullish momentum yesterday, climbing 8 pts to settle at 1,584.50 pts.

This solidifies the overall technical setup, which remains bullish.

The index initially started off trading at 1,577 pts.

After touching the 1,574.50 pts day’s low, it rebounded towards the end of the session, hitting the 1,586 pts high prior to closing.

The latest bullish candlestick reverses Tuesday’s profit-taking activities – reaffirming the FKLI’s uptrend above the 50-day SMA line.

The current bullish setup would see the index trend higher for immediate sessions, heading towards the 1,600-pt mark.

Therefore, RHB maintained their bullish bias.

Malacca Securities (MSSB) said the FBMKLCI (+0.27%) ended higher due to buying interest in selected consumer and utilities heavyweights, as the sentiment was lifted after the PM’s statement on the civil servants’ wage hikes and the RM10bn local investment from

Microsoft on AI and cloud infrastructure.

The Day Ahead

Again, the FBMKLCI has rebounded, charging towards its 52-week high with the help of selected YTL-related and Consumer heavyweights.

Over in the US, Wall Street gained momentum on the back of bargain hunting activities as the market perceived the Fed’s action to keep the interest rates unchanged and the less hawkish interest rate guidance.

MSSB believes the post-market jump in Apple and Qualcomm after their earnings beat will be able to provide decent buying support in the local exchange.

Still, the market will be monitoring closely on the jobs data that will be released later tonight. On the commodity markets, Brent oil further retraced and traded below USD84, while the CPO continues to rangebound around RM3800-3900.

Sectors focus: With the post-market bullish tone from Apple and Qualcomm, coupled with the Microsoft investments in Malaysia, these should provide decent support towards the Technology sector.

Meanwhile, the FBM Small Cap has trended positively at its 52-week high, which may suggest more upside on the overall market conditions.

They opine that the Construction, Property, Utilities, Solar and Building Material segments will trade relatively strong on the back of the domestic catalysts like (i) potential revival of mega infra projects and (ii) ongoing execution of the NETR and NIMP masterplans.

Bloomberg FBMKLCI Technical Outlook

The FBMKLCI index returned to the 1580. The technical readings on the key index, however, were positive with the MACD Histogram extending another positive bar, while the RSI maintains above 50.

The resistance is envisaged around 1,595-1,600 and the support is set at 1,560-1,565.

CGS International (CGS) said Asian stocks market finished mixed on Thursday after US Fed avoided offering a timeline for rate cuts.

The local benchmark FBMKLCI (KLCI) rebounded 4.33pts or 0.27% to end the day at 1,580.30.

Sectors wise, REIT (+0.56%) was the best performing index, followed by consumer products (+0.55%) and industrial products (+0.47%).

The top laggards were energy (-1.20%), telecommunications (-0.85%) and technology (-0.60%).

Trading volume decreased to 3.81bn (down from 4.18bn on Tuesday) while trading value fell to RM3.06bn (down from RM3.75bn previously).

Market breadth turned negative as 530 gainers lost out to 620 decliners.

The benchmark recovered from previous loss, supported by buying interest in consumer heavyweights.

The 1,570-1,583 range remains as the immediate resistance until the index can successfully close above the said levels.

The 1,600 psychological level is the next resistance.

Any pullback should find support near the 1,552-1,559 levels to keep the bullish momentum intact.

The rising 50-day EMA (1,543 currently) is the following support. Their portfolio stays in risk-on mode this week.