edotco Group, an integrated telecommunications infrastructure services company, has partnered with Aerodyne Group (“Aerodyne”), a leading Unmanned Aerial Systems (UAS) solutions provider, to implement innovative drone technology in its business operations. With Malaysia pioneering this best-in-industry practice in the region, edotco plans to roll-out the innovation throughout its presence in South Asia and Southeast Asia.

Coupled with cutting-edge artificial intelligence and machine learning processes, edotco is harnessing Aerodyne’s aerial capabilities to boost efficiencies in daily operations comprising infrastructure site audits, routine preventive maintenance surveys, network assessments, as well as monitoring for revenue assurance. This is in line with the company’s aim to future proof its business by implementing next-generation technologies, enabling a leaner, more agile, and cost-effective operations.

Suresh Sidhu, Chief Executive Office of edotco Group said, “At edotco, we understand the need to constantly innovate to stay ahead of the curve. This partnership allows us to do just that by unlocking new value drivers for both our business and customers. More than improving our capabilities to deliver continued service excellence, this also sets the stage for the future use of drones in our industry.”

Well into its pilot stage, this collaboration has garnered tremendous benefits for edotco across multiple areas including a 50% improvement in reporting time and a 35% reduction in inspection turnaround time resulting from faster data collation and report generation. In addition, the application of drones in this field has mitigated safety risks by removing the need for technicians to climb to the top of towers to conduct manual equipment inspection.

Kamarul A Muhamed, Group CEO & Founder of Aerodyne group said, “These encouraging results are testaments of the immense disruptive potential of drone-powered solutions in reshaping industries including the telecommunications sector. We are excited with this partnership and look forward to working together with edotco to drive innovation that will not only impact the business but the entire ecosystem as well.”

edotco and Aerodyne have just completed the tower preventive maintenance work for the 100 telecommunication towers in Malaysia and are planning to conduct similar for the rest of the towers in their footprint next year. Through the adoption of leading technologies as a competitive advantage, edotco is progressing towards achieving its ambition of being one of the world’s top five tower companies.

Aerodyne is a world-leading provider of drone-based enterprise solutions, and a pioneer in the use of AI as an enabling technology for large-scale data capture and analytics. Aerodyne operates on an unprecedented level in the UAS services sector. In the eighteen months to September 2018 they have completed over 48,000 flight operations, inspected more than 201,000 assets and surveyed in excess of 38,000km of power infrastructure.

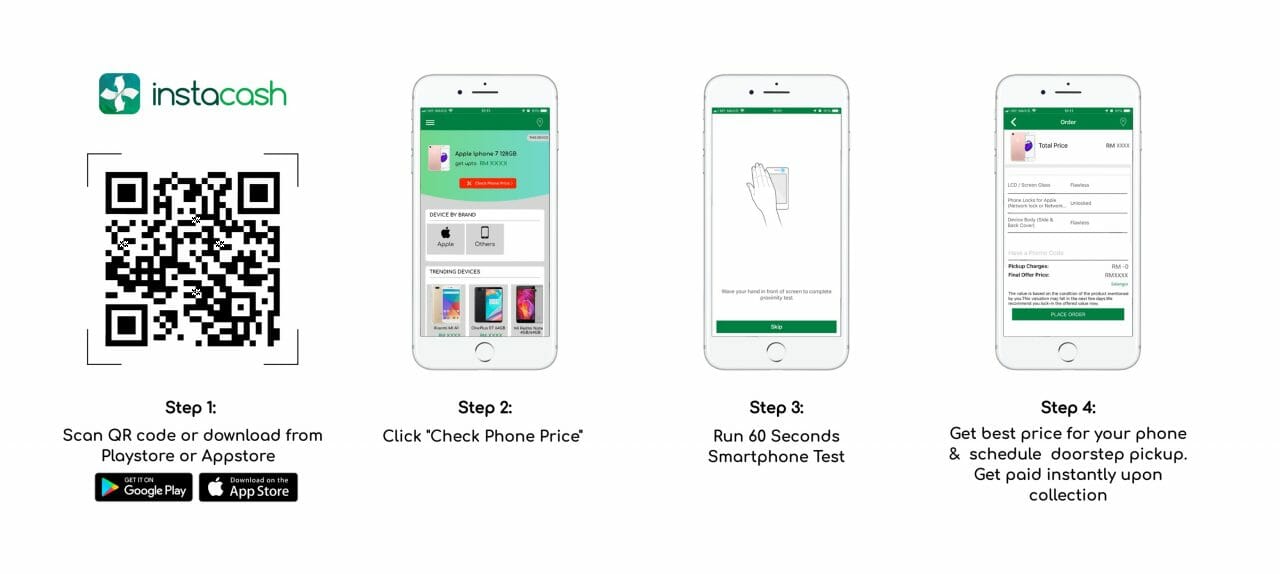

InstaCash Malaysia spokesperson Mr. Henry Ng in sharing about the background said, “Initially launched in the Klang Valley, InstaCash now supports Malaysians nationwide to trade-in their phones for a hassle-free experience. Once a customer has completed their transaction with the InstaCash App, they are contacted, and a courier would be assigned to collect the phone within 24 hours.

InstaCash Malaysia spokesperson Mr. Henry Ng in sharing about the background said, “Initially launched in the Klang Valley, InstaCash now supports Malaysians nationwide to trade-in their phones for a hassle-free experience. Once a customer has completed their transaction with the InstaCash App, they are contacted, and a courier would be assigned to collect the phone within 24 hours.