By Poovenraj Kanagaraj

Bank Negara Malaysia continues to highlight the growing intensity and frequency of climate-related events that are increasingly posing physical and liability risk to the economy.

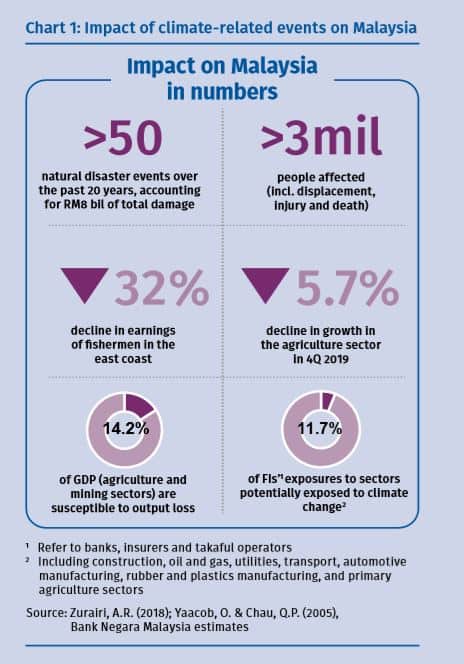

According to BNM, the country has experienced more than 50 natural disasters, affecting more than three million people through displacements, injury and death.

Between 1998 and 2018, the Malaysian economy suffered a total damage of RM 8 billion due to climate-related events.

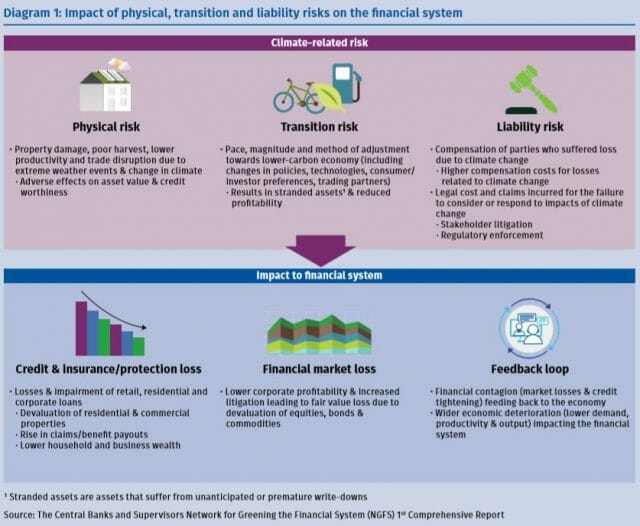

The central bank stated that immediate transition towards a greener future will put jobs and industries at risks and changes in policy, technology and market changes without caution can affect asset valuations and significantly increase business risks in the coal and energy industries for instance.

BNM has also pointed out that the banks, insurance and takaful operators are also exposed to liability risks, asset impairment and rising claims.

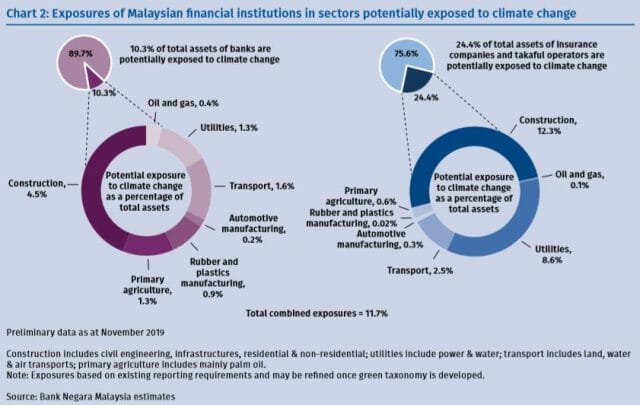

“With about 11.7 percent of their assets in sectors potentially exposed to climate change, it is important that the Malaysian financial institution treat climate risk like any other financial risk which has the potential to affect their profitability and balance sheets that in turn may affect the ability of financial institutions in raising funds,” the central bank stated.

“A recent example is the prolonged drought last year which led to supply disruptions in palm oil production and had a visible impact on the growth of the Malaysian economy particularly in the fourth quarter of 2019,” BNM stated.

The central bank late last year issued the Climate Change and Principled based Taxonomy Discussion Paper to solicit feedback on the classification of assets associated with fun raising and investment activities in, based on their exposure to climate risk.

According to BNM, taxonomy, backed with better date and insights into climate-related risks, it is expected to increase financial flows to activities that will support the transition to a low-carbon and climate resilient economy.

The central bank has partnered with Putrajaya, industry and other domestic regulators in responding to climate risk. September last year saw the central bank and Securities Commission Malaysia establish the Joint Committee on Climate Change (JC3) to drive and coordinate the financial industry’s collective response to climate risks.

Furthermore, BNM is also part of the Malaysian Green Financing Taskforce,which is chaired by Securities Commission Malaysia to spur private sector financing in the renewable energy sector.