According to the PropertyGuru Malaysia Consumer Sentiment Study H2 2020, more Malaysian home seekers are looking for room to grow when evaluating properties, with pricing and developer reputation as key purchasing considerations as well.

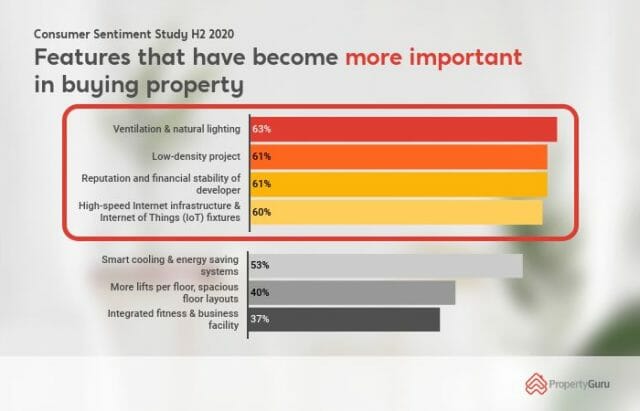

Low project density (61 percent), spacious floor layouts and more lifts per floor (40 percent) were among the project features most frequently cited by study respondents as desirable. Despite this, 42 percent shared they were more price-sensitive following Covid-19, as Malaysians safeguard spending ahead of a projected recession.

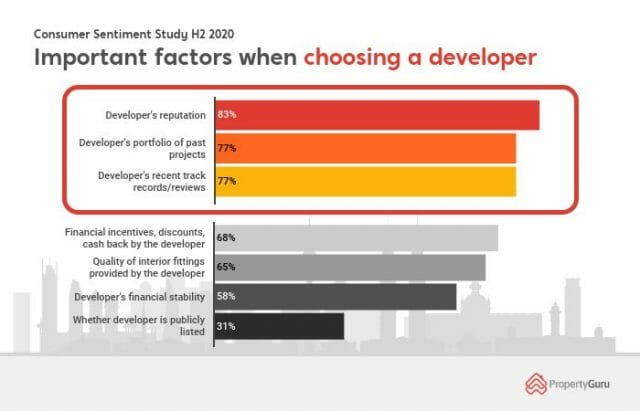

With regard to developers, Malaysians were more likely to value reputation (83 percent), portfolio of past projects (77 percent) and recent track record (77 percent) over factors such as public listing status. As property stakeholders strive to find their footing post-Covid-19, these findings underscore the need for local players to focus on value-driven offerings addressing current market gaps to remain relevant.

“The current emphasis on space and pricing among potential purchasers is attributed to months of restricted movement and income loss amid the Covid-19 outbreak. In development terms, these are usually mutually exclusive, as square footage is a fundamental component of cost,” said Sheldon Fernandez, Country Manager, PropertyGuru Malaysia.

“However, our research found that Malaysian home seeker tastes are changing with regard to what they are willing to pay for, which we look forward to sharing in the near future. Moving forward, developers hard-hit by the Movement Control Order (MCO) should ensure their products take market demand into account, to maintain healthy sales figures and to ease the residential overhang.”

Aside from space and developer considerations, respondents also cited ventilation and natural lighting (63 percent), high-speed internet infrastructure and Internet of Things (IoT) fixtures (60 percent) and smart cooling and energy savings systems (53 percent) as more important to them following the Movement Control Order (MCO).

Integrated fitness and business facilities were the least desired (37 percent) project feature. This can be attributed to the fact that many were inaccessible during the MCO period. In terms of location, the impact of localised Covid-19 outbreaks on property seeking patterns was minor, with just 20 percent of respondents sharing they would avoid designated red zones or properties placed under enhanced MCO measures respectively.

“The PropertyGuru Malaysia Consumer Sentiment Study also shows that Malaysians have become less brand-conscious in their property journeys. They are more willing to consider properties from a wider pool of developers, as long as these players can deliver the features they want at the price points they demand,” said Fernandez.

Leveraging on PropertyGuru’s reach as Malaysia’s largest property site, the study found that that developer reputation, portfolio and track record were more important than public listing status to home seekers, with just 31 percent of respondents preferring listed players when looking for a property. Younger home seekers and those living with their parents were exceptions, with these demographics prioritising listed players.

Other factors home seekers consider when evaluating developers, according to the PropertyGuru Malaysia Consumer Sentiment Study, included financial incentives, discounts and cash back offered (68 percent), quality of interior fittings provided (66 percent) and developer’s financial stability (58 percent).

“This highlights again the need for developers to change their approach, and is particularly relevant in light of recent proposals for a vacancy tax and rent and price controls, as well as the impact of the MCO on sales and cash flows. You must build what people need. Matching market supply to demand is no longer an option, but a matter of survival,” said Fernandez.

The findings come amid a surge of home ownership interest in younger Malaysians and renters post-MCO, with 34 percent of first-time home seekers considering a property purchase in H2 2020 and 51 percent planning their property journeys for H1 2021.