The disruptions brought on by the Coronavirus has changed the way we live our lives, and lockdowns imposed worldwide has had citizens opt for different ways of performing their day-to-day activities.

Grocery shopping behaviors were one of the more obvious changes that took place. Fear of contracting the virus outside, many turned to mobile applications and online stores to get their weekly grocery supplies sent to their doorsteps.

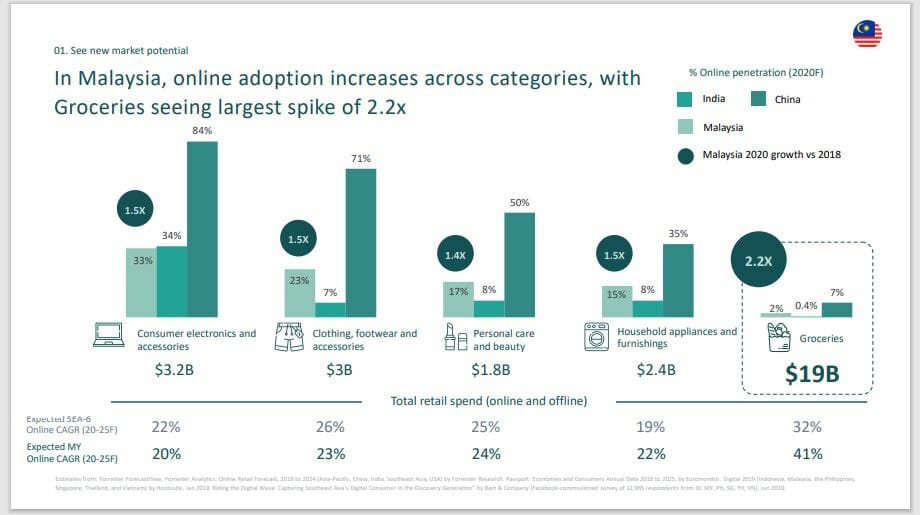

According to a report by Facebook and Bain & Company, Digital Consumers of Tomorrow, Here Today, online adoption in Malaysia increased across categories, with groceries seeing the largest spike of 2.2x.

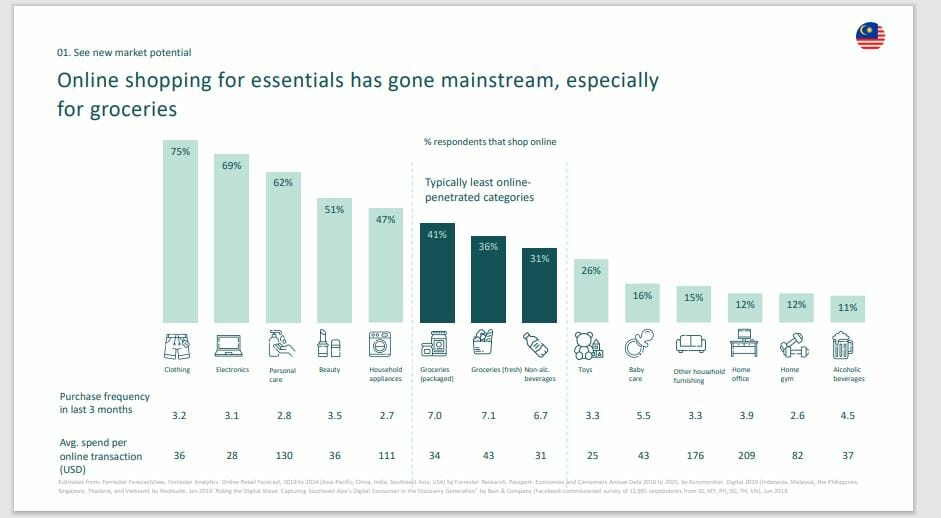

The report observed that online shipping for essentials had gone mainstream, especially for groceries. Prior to the period of March to May this year, groceries were the least penetrated online categories, however with the arrival of the Coronavirus, the grocery segment saw a surge.

This was also made possible with the rising cashless ecosystem in the country. In July this year, Mastercard had reported that in terms of contactless penetration, Malaysia is one of the fastest-growing countries in Asia Pacific.

“The country has over 83% of internet penetration, 97% smartphone ownership, 76% of smartphone penetration and 85% of Malaysians are already banked. For a country of 32 million people, there are currently 48 mobile wallets players vying for their patronage. The market is well served by online banking, debit cards and credit cards,” Devesh Kuwadekar, vice-president and head of market development, Mastercard Malaysia highlighted.

“We believe we will see an ascending trend that will continue to grow in the years to come. This could be down to various reasons, among them being the convenience of shopping seamlessly from their smartphones that will translate into more returning customers in the future,” says Hunhui Hu, Managing Director of Happy Fresh.

He believes that while it is only natural to be conservative when shopping for groceries online for the first time, customers tend to gradually ease past their hesitance with a pleasant first experience and better understand how to maximise the many features within the app.

“It was challenging at first since online grocery shopping was uncommon within the ASEAN region. Unlike generic online shopping, online grocery shopping is much more complex,” Hunhui says, adding that this process also involves personalised requests from customers. To tackle the issue, Happy Fresh employed personal shoppers, who are specially trained to pick the best products and items from the stores and to liaise with customers appropriately should the need arise.

“Changing the long embedded culture of shopping for groceries at physical stores to online grocery shopping is a huge task, one that remains a major obstacle until this day,” he tells BusinessToday.

According to a research done by the Happy Fresh team, Malaysians are rather particular when it comes to grocery selection. Shopping for their groceries online would mean that customers are unable to touch, feel and ultimately judge the groceries for themselves, raising scepticism and reluctance from using their services.

Despite the doubt among Malaysians, Happy Fresh which has been experiencing substantial growth over the past four years admitted that orders were overwhelming during the initial MCO period.

Everleaf Eco Solutions, an online platform that helps to connect local farmers to consumers and educates them on healthy farming practices and sustainable sourcing says prior to the MCO, many still opted to buy groceries offline. “People do not have the trust, not only when it comes to picking fresh produce and food, but also with logistics handling,” says Joey, one of the platform’s co-founders.

“During the MCO, they had no choice but to start purchasing groceries via online. Many had tried and started to change and eventually adopted the new norm,” she added

While Everleaf saw a boost in user traffic by 300 percent, Joey still believes that many Malaysians are not happy with the online experience. She attributes the downside to the early stage the industry is in.

With a young demographic of customers visiting the site, Everleaf’s customer age demography falls between the age 28 and 39. While this particular age group has had an easier time adapting to the online grocery purchasing, Joey points that the real challenge lies with the older age group.

“It takes longer to convert them because they are less tech savvy and they are used to buying groceries offline. They are still not confident with regards to the freshness of the product as well as the logistics of delivering it to their doorsteps,” she says.

Newcomer to the industry, MyGroser, which turns 1-year-old this month, says the move towards online grocery shopping with physical retail supporting the space is one that had begun some years ago, “There were some false starts, and different models had been tried with various levels of success over the years,” says co-founder Stephen P Francis.

“The current global pandemic accelerated the use of online grocery services beyond just first movers and into the general space, especially among middle income and mid to high income families. We have also seen local and regional supply chains adapting to the needs of a nimbler retail experience and this has resulted in a smoother, closer-to-physical-retail experience for consumers,” he adds.

Frances further opines that these and other factors, including traffic, cost of living, dual income families, overpriced retail stores and lack of real choices are ensuring that the demand for online grocery services are not only here to stay but to also grow further.

Francis’ optimism reflects on the site, which has seen a steady double-digit growth in the number of users and the GMW on a month-to-month basis for the past 12 months. “We expect to see this accelerating in the coming year as consumers increasingly enjoy the convenience, freshnessand everyday value that MyGroser offers them,” he says.

“We started out slowly when we launched commercial operations last year and the MCO period saw us facing a tremendous demand for the service. Today, our traffic is significantly higher and maintains its growth organically as well,” he says.

However, adding onto the competition, brick and mortar players like Tesco and Aeon are joining the ecosystem, offering long-time customers the convenience of having the groceries sent to their homes during the MCO.

Francis says that while there are more players in the field, it is not a problem. “The industry is so young so this allows us to serve consumers together, helping them to learn about the advantages of buying their groceries online,” he points out. The team at MyGroser has also accelerated their expansion plans to better meet the demand for convenient fresh and affordable produced by increasing the range of products on the site, and this also includes ready-to-cook meal kits.