In an unprecedented series of events, 2020 had definitely taken a turn with industries worldwide being impacted in ways never seen before. The property industry had also taken its fair share of hits.

The sharp economic contraction the country faced had influenced key decision making by both individuals and businesses. This saw the national demand of property in Malaysia in H1 2020 saw dip by -2.5 percent.

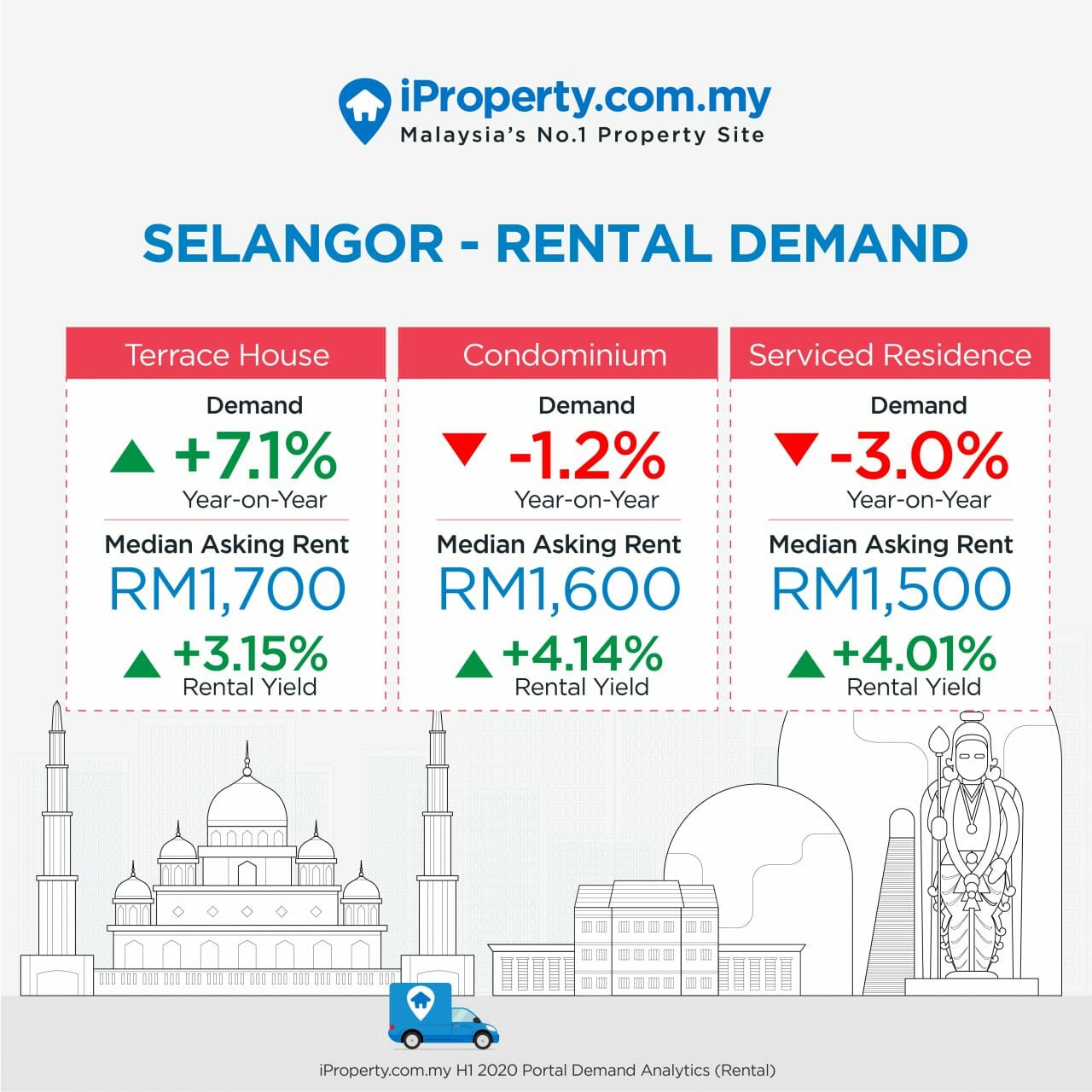

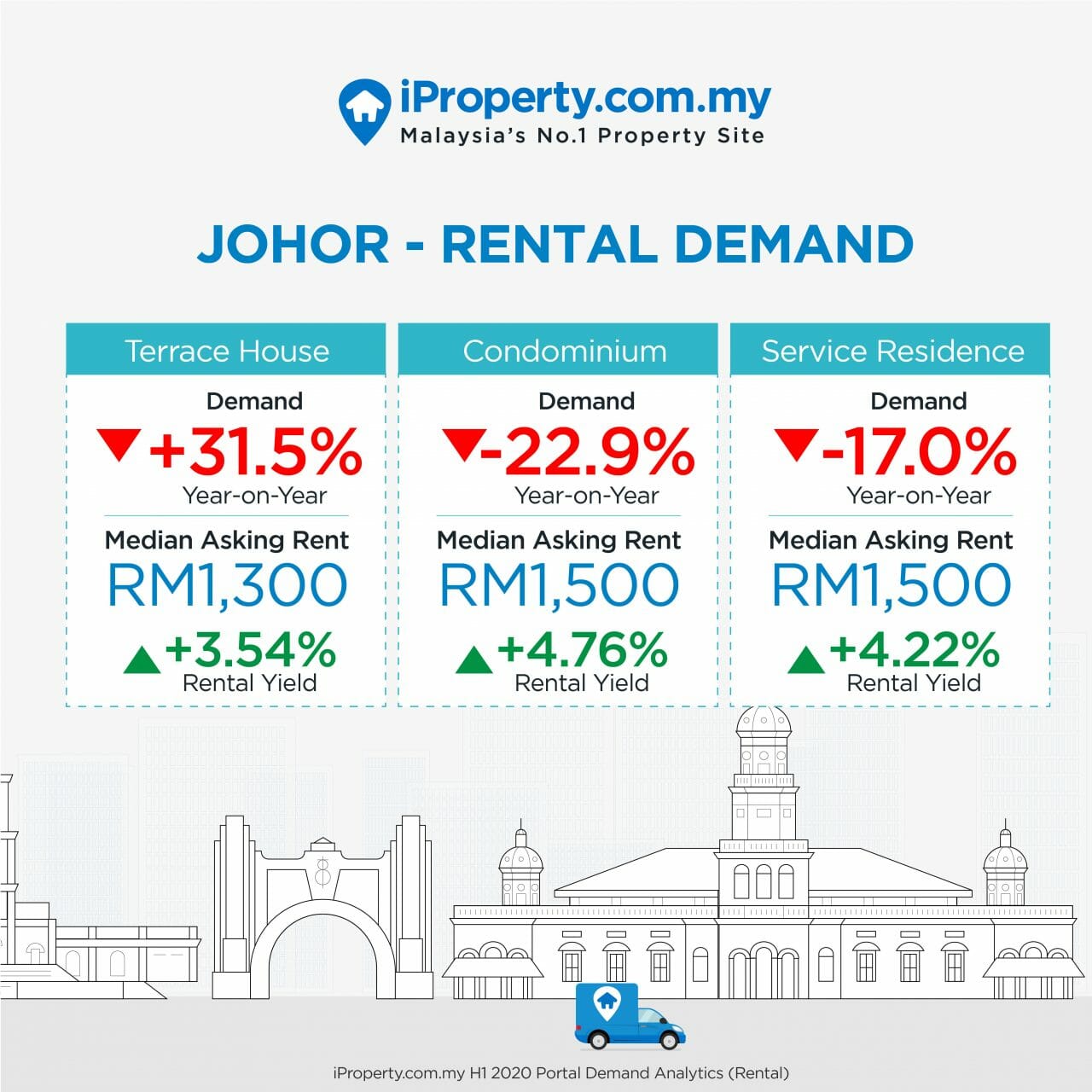

According to iProperty.com.my (iProperty) H1 2020 Portal Demand Analytics, three housing types, terrace house, condominium and service residency saw drops in demand in 4 cities; Selangor, Kuala Lumpur, Penang and Johor.

The report further highlighted both visits and listings had declined for both service residences and condominiums.

While visits and listings for terrace homes grew in H1, the listings growth outpaced the visit growth, resulting in a -3.3 percent decline in demand.

The terrace home is the only sub-category where the capital growth figure is in the positive territory, at +2.21 percent.

“Just at the end of 2019, the tides were turning. The unsold property numbers were going down and prices were stabilising. The year had good sentiments for the property market and I think 2020 would have seen a positive growth if it wasn’t for the MCO,” says Premendran Pathmanathan, General Manager, Customers Data Solutions of REA Group Asia.

Short-term outlook as tourism takes a hit

During the first half of 2020, Penang saw a minor setback with property demand declining by -6.5 percent. As tourism took one of the hardest hit, the island state saw overseas investor play safe by translating to the lower search or purchasing interest.

A similar problem was also seen in Johor as its border with Singapore was closed during the movement restriction period.

“A number of service residence units in Johor are used for Airbnb and as tourism declines, unit owners started pushing these units for long term rentals,” he says.

This resulted in increase in supply while demand was going down. “There was a surge of agents listing properties on our platforms especially service residences.”

“I would say Penang and Johor would have been slower to grow even without the pandemic due to existing issues. The pandemic had only made it worse for them,” Pathmanathan says.

According to the GM, the problem in Johor can only be tackled if the paradigm shifts to reduce the supply units. “If I look at buyer sentiment and loan applications in Johor, it’s still good. There has to be a catalyst to shift absorb the supply,” he tells BusinessToday.

The analytics show that many of the newly launched developments in Johor are priced beyond RM1 million while the median transacted price for Johor is RM370,000.

The platform further highlighted that the oversupply of higher-end units will eventually push the prices down to the benefit of buyers.

“However, developers are offering attractive packages to entice prospective home buyers towards these new properties instead, which are a direct competitor to the available subsale units for sale,” Pathmanathan says.

Demand holds steady in the capital

Capital city, Kuala Lumpur’s subsale property demand has recorded only a marginal decline of -0.3 percent.

According to iProperty, the pandemic impact is seen across demands for all building types in KL. Most noticeably, there was a negative demand for terrace house.

However, in the first half of 2019, terrace house came out tops in terms of capital growth and was the only building type to record a positive value growth.

Pathmanathan says the drop is attributed to consumer sentiment over future uncertainties such as loss of income and sudden change in lifestyle, priorities and personal circumstances.

In Selangor however, demand stayed positive at +3.5 percent and with an overall increase in visits when compared year-on-year.

According to the analytics, the work from home trend is encouraging homebuyers to explore areas further away from the city.

20 areas most in demand in the state are currently dominated by suburban townships. “The pandemic has given rise to flexible working hours which might have encouraged more consumers to look at residential options further away from their workplace,” Pathmanathan says.

“When we look at our data during the various MCO periods, we noticed that traffic had dropped because Malaysians were not able to go out. However, later on everything shot back up because the intention to buy is there,” he tells BusinessToday.

He goes on to say the low interest rates have worked to spur the market. “If we were to keep it at this rate, I don’t foresee the numbers going down unless another MCO comes in place.”