SoftBank has generated up to $22 billion in cash through transactions that would significantly cut its investment in Alibaba over the next several years, as the Japanese investor responds to a market collapse that has decimated its technology portfolio.

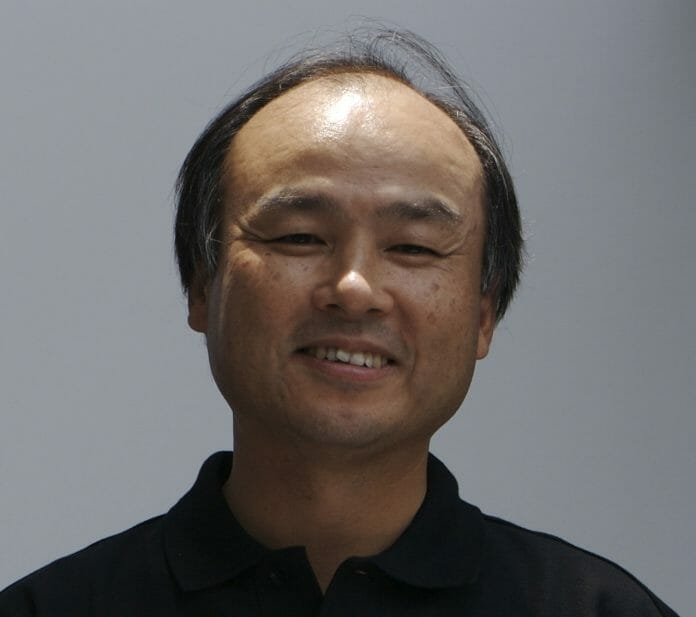

The group, driven by billionaire founder Masayoshi Son, sold approximately one-third of its Alibaba stock this year using prepaid forward contracts — a sort of derivative to which SoftBank has increasingly turned to obtain cash quickly while preserving the option to keep the shares.

Through these forward sales, SoftBank has already sold more than half of its Alibaba interests. This might reduce its investment in the Chinese ecommerce giant below the bar for keeping its board membership and prohibit the Japanese business from accounting for its portion of Alibaba’s revenue.

If SoftBank decides not to purchase back Alibaba shares, it will be the end of an era. Masayoshi Son made his wealth by heading a $20 million capital round for Jack Ma’s budding ecommerce start-up more than two decades ago, resulting in a massive return on investment.

SoftBank has been scrambling to obtain funds this year as the value of its dozens of Vision Fund assets has plummeted amid a larger market sell-off in technology equities. Son assured investors in May that he would play “defence” after revealing a $27 billion investment loss for its Vision Fund during the previous fiscal year.

The corporation also stated that it has reduced new investments and was concentrating on “raising our financial position in this uncertain market climate.” It has used its shares in T-Mobile and Deutsche Telekom to fund similar transactions.