It is no surprise that the pandemic weariness experienced by so many communities worldwide has directly affected the way we make decisions, even when it comes to spending habits. Particularly for the generation Z and the millennial generation, “buy now, pay later” service (BNPL) proves to be a perfect finance solution during this period of financial uncertainty.

BusinessToday spoke to Jason Wong, Country Head of Financial Services for Shopback Malaysia share about why young people are adopting the pay later lifestyle and how ShopBack fits the needs of this segment of the audience. Additionally, Jason also shares how the enactment of the CCA will affect BNPL.

1. The government is imposing a Consumer Credit Act that will also affect BNPL. How will your business model be affected by this Act and how will it affect consumer behaviour?

With the enactment of the CCA, BNPL providers will be subject to authorisation and market conduct requirements. Hence, we believe it is the right step forward as it will enhance our credibility and foster consumers’ confidence when dealing with us.

We believe this is a step forward for the overall industry as it will safeguard consumer interests and prevent risks of over-indebtedness. Simultaneously, the effort should be coupled with financial education and awareness to ensure prudent spending by the consumers and the overall effectiveness of the requirements under the CCA.

ShopBack highly welcomes the regulator’s efforts as we believe a single framework could bode well to encourage fair competition across the various industries while protecting consumers from unfair practices.

2. How has the pandemic affected ShopBack’s market in Malaysia?

It is no secret that COVID-19 has had a huge impact on the industry. Nevertheless, through the first half of the year, the ShopBack team has managed to swiftly and successfully seize opportunities to grow the business despite the challenges posed by COVID-19.

As a result, we generated RM1.7 billion GMV in annual sales for our merchants last year.

During the MCO period, we noticed a surge in the number of orders paid using ShopBack PayLater, previously hoolah (600 percent from May 2020 until May 2021). We are glad that the financial flexibility brought by our Buy Now, Pay Later (BNPL) service has benefited Malaysians during the challenging times.

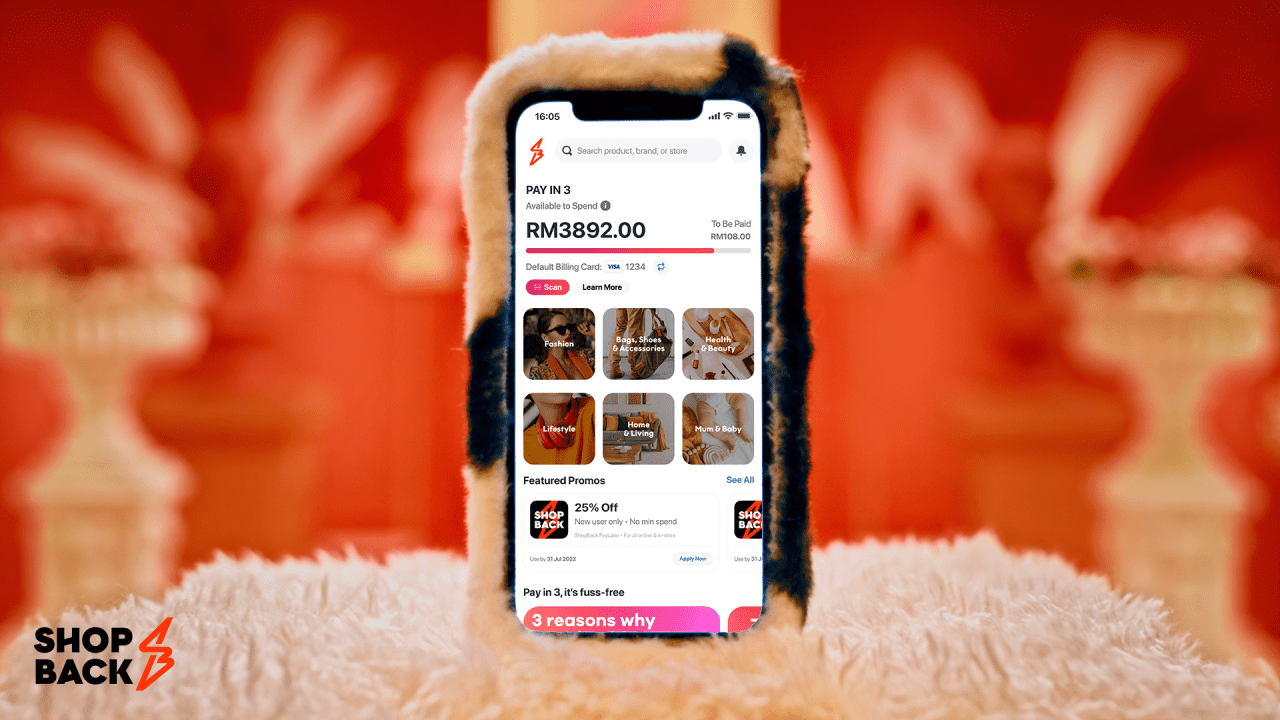

As we launch ShopBack PayLater (powered by hoolah) in the ShopBack app, not only are shoppers able to enjoy the usual BNPL benefits (i.e. splitting their purchases into three interest-free monthly repayments), but also a more rewarding experience as they can earn Cashback from eligible merchants when they redirect from ShopBack, and use the earned Cashback to offset their ShopBack PayLater bills.

ShopBack PayLater is currently available at over 2,000 online and brick-and-mortar stores. We are collaborating closely with merchants to make shopping accessible to all, while onboarding more brands to help them create opportunities to succeed.

3. What are the key trends you see happening in the BNPL scene recently?

This year, we observed a pick-up in the Fashion and Beauty as well as Travel categories, especially with merchants like ZALORA Malaysia, JD Sports, Al-Ikhsan Sports, and Malaysia Airlines.

The BNPL adoption is growing steadily in Malaysia. As businesses and borders reopen, transactions from brick-and-mortar stores have also experienced a spike, while shopping activities online and on the app remain strong.

On average, our merchants experience a 20% – 40% increase in conversion and basket size.

4. What are the reasons behind the growth of “pay later” lifestyle?

In addition to a pickup of the online shopping trend in the past few years, we believe that the many benefits of using the BNPL method has led to an increase in its adoption. It offers the financial flexibility that our shoppers need, in addition to the following:

Seamless operation – enable shoppers to afford the things they need today responsibly and pay over time via 3 zero-interest monthly instalments. Shoppers can get immediate approval as long as the spending is within their spending limit.

Convenient payment option – there are no hidden fees; shoppers only pay what they see on the retailer’s website. Shoppers can also take control of their finances by tracking upcoming bills anytime within the ShopBack app.

Rewarding experience – they can also earn Cashback from eligible merchants when they redirect from ShopBack, and use the earned Cashback to offset their ShopBack PayLater payment.

We are also committed to continue to empower our shoppers to shop smarter and spend responsibly. New users have more stringent limitations on their active orders at any one time to ensure that they do not overuse the platform.

Our business is only sustainable with long-term consumer relationships, and for that, we have a proprietary risk engine assessment that enables us to dynamically cap orders to protect consumers and prevent them from overspending.

With these in place, not only can shoppers unlock financial flexibility and rewarding experiences, but also be able to cultivate a responsible spending habit with ShopBack PayLater.

5. Is the “pay later” lifestyle only seen among the younger generation?

Not just the younger generation. Currently, the majority of our users are urban females between 18 to 35 years old, including university students, working professionals, and millennial moms.

At the same time, we do notice an increase in other categories of shoppers, for example, purchases of sports items by male users, and also flight tickets by families.

6. How does ShopBack fill the role of catering to the needs of this market, for both merchants and consumers?

Merchants are always looking for ways to improve conversion and basket size, while consumers are constantly finding ways to spend smarter.

ShopBack (regionally) drove half a billion shopping trips in 2021 alone as the entry point to rewarding shopping for our merchants; and with ShopBack PayLater, we’ll also be the last checkout point – helping merchants to gain visibility and sales through a spectrum of touchpoints.

In Malaysia, we have a sticky user base of over 5 million shoppers who have enjoyed rewarding shopping over the years. Not only does ShopBack enable merchant partners to draw in customers through our proven model and proactive initiatives, but also cross sell their services to new consumer groups i.e. shoppers with Travel and Sports interest, helping them to sustain their growth in both the short and long term.

On average, our merchants experience a 20% – 40% increase in conversion and basket size.

For shoppers, we are dedicated to making sure they gain a ‘win’ through cumulative rewards like Cashback, Vouchers, and PayLater; enjoying a smarter way to shop and pay every time they use ShopBack.

Over RM150 million of rewards have been given out to Malaysian shoppers since 2015. Now with ShopBack PayLater, they are also able to make payments via 3 zero-interest monthly instalments, and use the available Cashback to offset their ShopBack PayLater payment, while continuing to earn Cashback from eligible merchants when they redirect from ShopBack.

We are confident that ShopBack is the optimal platform for users to enjoy a rewarding shopping experience, and we also look forward to creating more business success with our merchants.

7. How does the launch of ShopBack PayLater and rebranding exercise contribute to the entire narrative of changing spending trends?

We believe big things are powered by small wins and will work relentlessly to continue returning real value to users in every transaction, as well as finding new ways to make shopping a pleasure. The spark in our new logo signifies a spark of joy. It contains the letter “S” and “B” which stands for ShopBack in short, representing our passion to bring shoppers smarter shopping and payment moments.

To achieve that, we are committed to making sure every transaction is a win with ShopBack. We want shoppers to leverage on our features and services including Cashback, Vouchers, ShopBack PayLater, and from there, leading them to more savings, smart access, and financial flexibility.

8. What is your outlook for BNPL demand and trends for the next few months and the coming year?

We believe that the medium to the long-term growth of the BNPL industry in Malaysia remains strong. Currently, there are more than 5 million shoppers using ShopBack in Malaysia, of which all of them are able to access ShopBack PayLater once they activate it. We are optimistic about the future trajectory.

In addition, Research and Markets’ Q4 2021 BNPL Survey also reveals that Malaysia’s BNPL business has an expected growth of 109.5% annually to reach US$ 601.2 million in 2022, and the BNPL payment adoption is expected to grow steadily over the forecast period at a compound annual growth rate (CAGR) of 49.0% during 2022-2028.