China’s residential real estate crisis is undermining demand for domestic property and pushing Chinese investors overseas.

Since the property market looks like it may remain stalled for years, the situation is giving impetus to a new Chinese overseas investment boom – although one likely to be more restrained than what took place from 2014 to 2018.

In 2017, at the peak of the Chinese outbound investment boom, Chinese buyers acquired US$119.7 billion of international residential and commercial property. That dropped to US$49.6 billion in the following year.

The Covid pandemic pushed it down even further. If current trends continue, it may climb again.

The Impact of Covid on Cross-Border Buying

The outbreak of the Covid pandemic had an immediate impact on Chinese cross-border buying intentions. In the first quarter of 2022, when the pandemic was still limited to China itself, Chinese buyer demand for offshore properties soared.

The longer-term impact of the pandemic, however, has been to create obstacles to international travel and transactions has been to reduce Chinese demand for residential property in other countries.

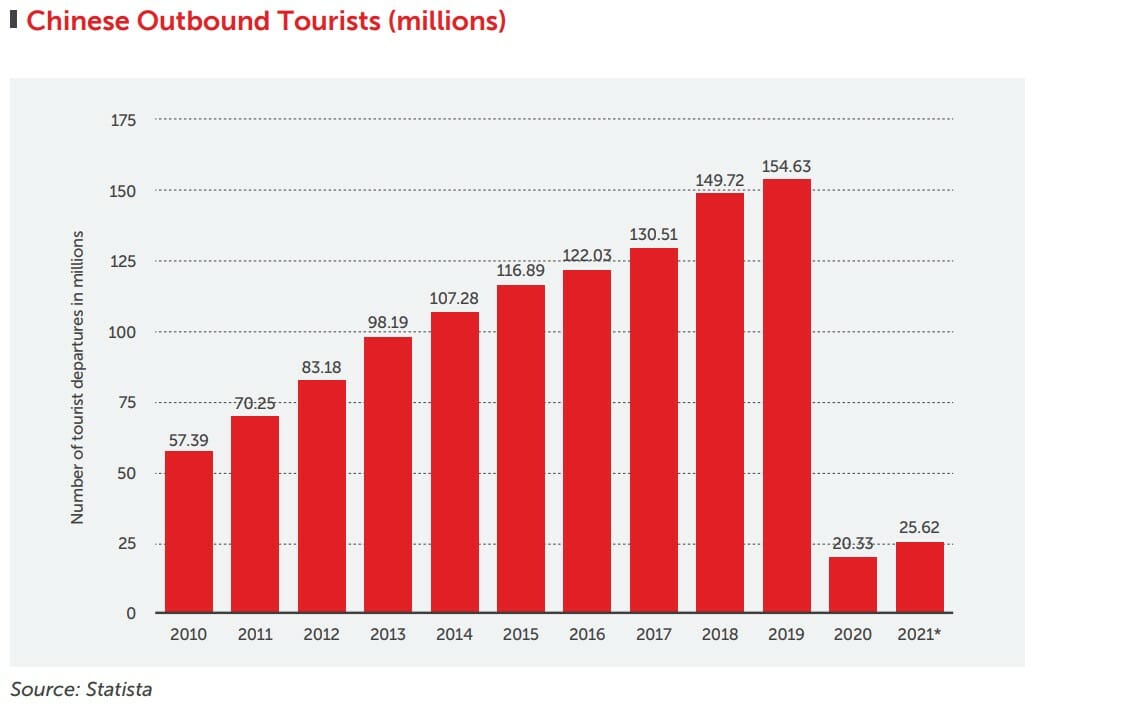

One indication of the impact that Covid has had on Chinese overseas investment is the massive drop in the numbers of Chinese outbound tourists, as tourism is closely related to property investment.

From 154.6 million outbound tourists in 2019, the number plummeted to just 20.3 million in 2020 and 25.6 million in 2021.

China’s Home Market Stalls

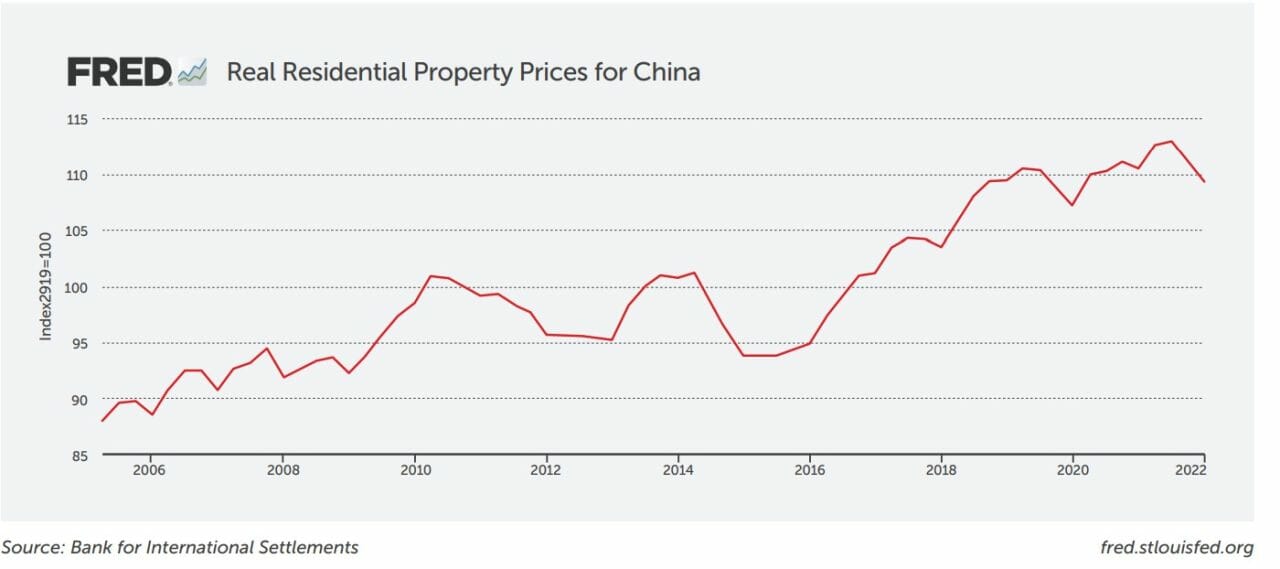

China’s home prices are falling, the production of new housing is stalling, and Chinese households are losing faith in a home market that has provided stunning economic gains.

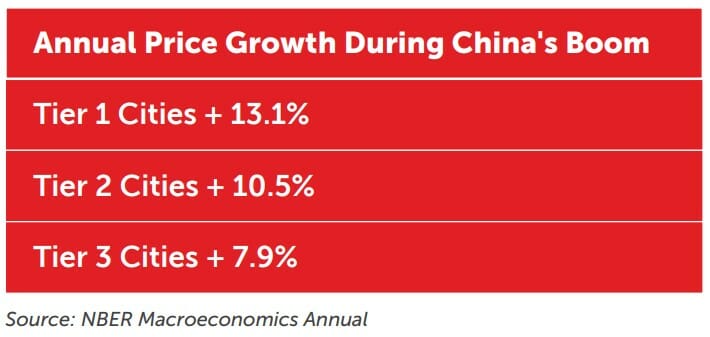

This state of affairs represents a total about-face for the Chinese home market, where first-tier cities such as Beijing, Shanghai, Guangzhou, and Shenzhen saw average real house prices growth of 13.1% per year during the boom of the previous decades.

China has become a country of homeowners and investors. More than 90% of Chinese households own homes and more than 20% own multiple homes, according to an October 2020 paper in the Cities journal.

The Chinese housing market accounts for 30 per cent of GDP, twice the share in the USA. It has helped drive global economic growth for the last 20 years through demand for everything from household appliances to steel girders.

It is now the biggest asset class in the world and, at US$55tn to $60tn, is worth more than the total capitalisation of the US stock market.

Behind the housing stall are deliberate government policies. Chinese President Xi Jinping has declared that China’s “houses are for living in, not for speculation,” and the government in Beijing has implemented policies to make domestic property investment more difficult and less attractive.

Beijing has set out to tame house prices, shift investment to more productive sectors, and reduce the debt risk in the real estate sector. At the same time, it hopes to eliminate speculation and make homes more affordable for middle-class families.

The result is a 40% decrease in sales this year, as buyers hold back from the market. Consumers may have stopped payment on approximately 5% of all mortgages, worth some 1.8 trillion to two trillion Chinese yuan (US$270bn-US$300bn), in a mortgage strike by buyers who fear construction on the new homes they are paying for may never be completed.

S&P Global Ratings estimates property prices will fall by 30 percent this year – a steeper drop than during the 2008 Global Financial Crisis. And many analysts believe China’s housing market could be “in for a protracted slump in the coming years.”

Chinese Buyers Look Overseas, Again

Chinese buyers are discouraged by the prospects for the residential real estate market at home. An increasing number are looking overseas for property investment, second homes, or primary residences.

On China’s popular social media platform WeChat, users post about runxue or “run philosophy,” a euphemism for emigration.

WeChat users searched for the term “emigration” more than 100 million times

on a single day in May, according to the company.

Meanwhile, investment migration agency Henley & Partners estimates some 10,000 high-net-worth Chinese will seek to relocate from China this year, taking an estimated US$48 billion with them. Only Russia is likely to lose more HNWI this year.

UK government data reveals that the number of settlement grants issued to Chinese nationals has climbed by 29%, rising from 3,491 in 2020 to 4,500 in 2021.

Lona Wang, Head of Sales for Juwai IQI’s Shanghai-headquartered IQI China team, agrees that Chinese demand for overseas property has increased significantly in 2022.

“We see our clients looking overseas as an alternative because they expect better returns than here in China,” she said.

“Prices are falling in many cities across China, especially in second tier cities, and the new developments market looks risky. Investors have decided they prefer to invest overseas.”

The result of all this is a reversal of the Zero Covid-driven decline in offshore investment. Chinese investor interest in overseas property is again climbing.

Juwai IQI is the international real estate technology group that powers property transactions and ownership locally and globally.