RHB Research has maintained short positions on HSI futures.

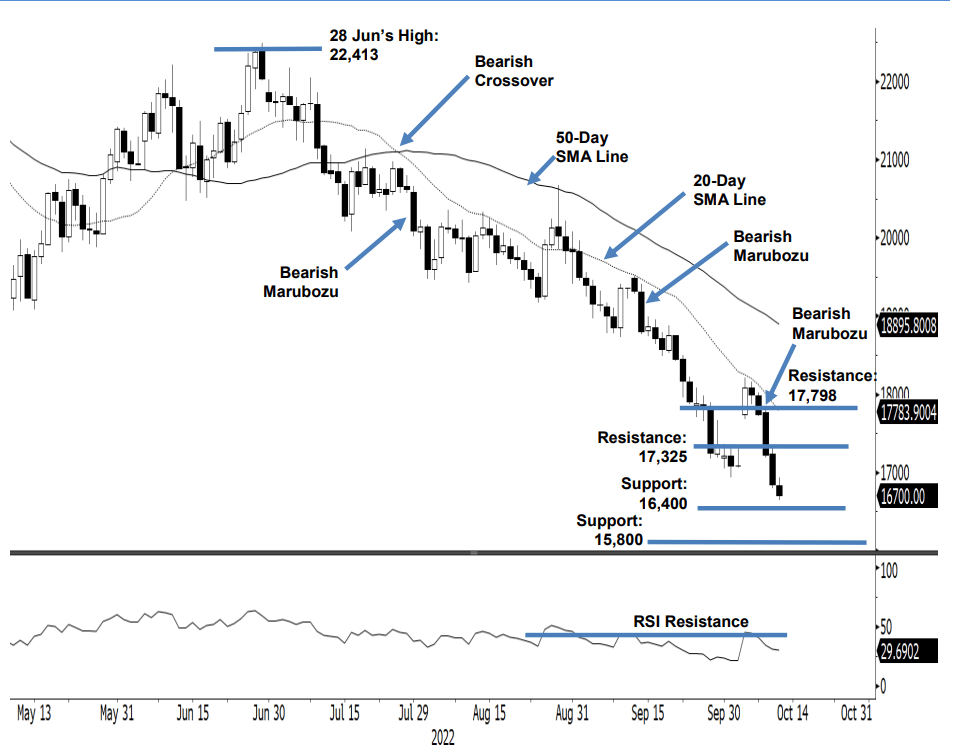

The HSIF extended its downtrend yesterday, and retraced 372 points to close at 16,849 points. The index opened at 17,240 points, progressed lower throughout the session, then recorded the day’s low of 16,793 points before closing in negative territory – thereby charting a fresh “lower low” bearish candlestick. In the evening, the index retraced 149 points and last traded at 16,700 points. The latest price action confirms that the bears are in control now. With the RSI is rounding downwards now, the negative momentum should be picking up pace again – so the index may head towards the support of 16,400 points, followed by 15,800 points. The correction will continue until the bullish reversal candlestick can be formed near the support. Should the index stage a counter-trend rebound, it will meet strong selling pressure at 17,325 points. As the negative momentum is in play now, the research house is maintaining its bearish bias.

Traders are advised to maintain the short positions initiated at 17,221 points or the close of 10 Oct. To minimise

the trading risks, the initial stop-loss threshold is set at 18,205 points.

The immediate support is now at 16,400 pts, followed by 15,800 points. Conversely, the nearest resistance has been

revised to 17,325 points – 11 October’s high – followed by 17,798 points or the high of 10 October.