RHB Research has continued to maintain short positions on HSI futures (HSIF).

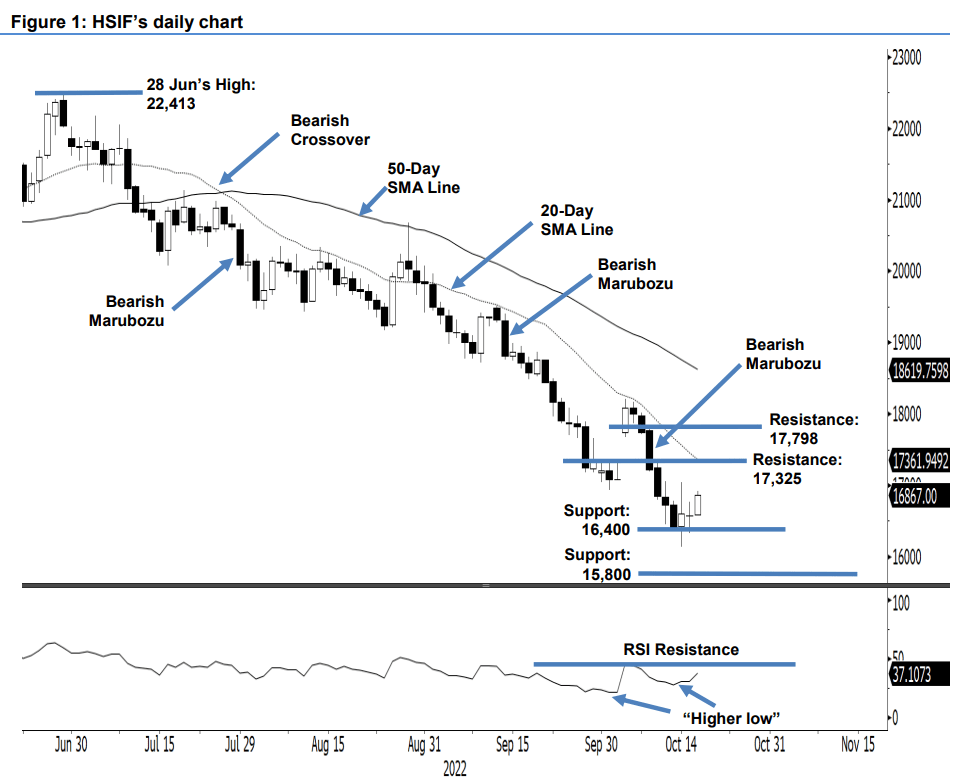

The selling pressure on the HSIF moderated yesterday, with the index rebounding from the 16,400-point support to close at 16,567 points. It opened at 16,579 points and, after whipsawing between 16,765 points and 16,321 points, it closed at 16,567 points. During the evening session, the HSIF climbed 300 points and last traded at 16,867 points. The positive price action was within expectations, the RSI charting a “higher low” – a divergence signal against the index. This suggests the HSIF may undergo a short-term counter-trend rebound. To extend the rebound, the index has to break past the 17,325-point resistance and reclaim the 20-day SMA line. If it fails to breach the threshold, selling pressure will increase again and lead to a downside correction. As of now, the research house still retains a negative bias until it breaks past the immediate resistance to form a “higher high” bullish pattern.

Traders are advised to keep the short positions initiated at 17,221 points or the close of 10 Oct. To mitigate the trading risks, the stop-loss threshold is set at 17,325 points.

The immediate support is established at 16,400 points and followed by 15,800 points. On the upside, the immediate resistance is pegged at 17,325 points – 11 Oct’s high – and followed by 17,798 points, which was the high of 10 Oct.