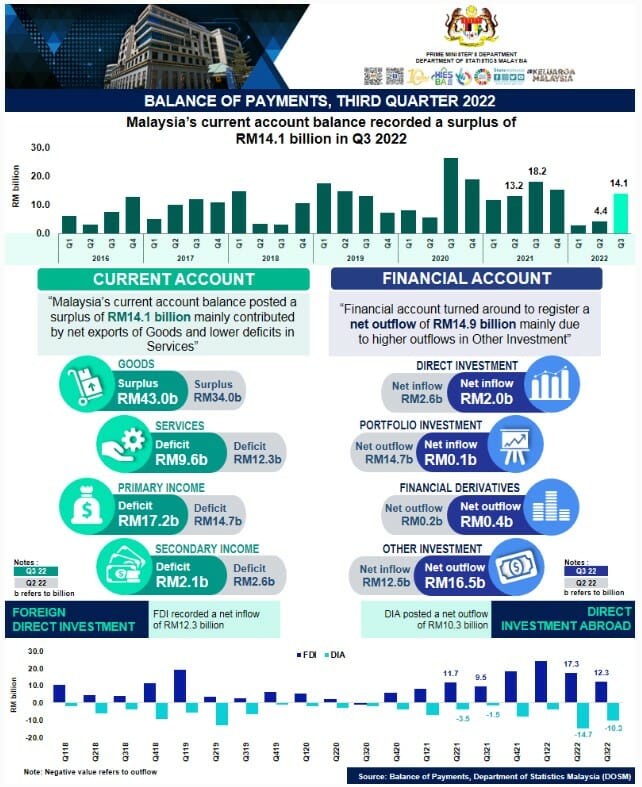

Malaysia’s Current Account Balance (CAB) posted a higher surplus of RM14.1 billion in the third quarter of 2022, primarily driven by net exports of Goods and lower deficit in Services.

The Department of Statistics Malaysia (DOSM), in its report titled Quarterly Balance of Payments, Third Quarter 2022 stated that the nation’s Financial account switched to a net outflow of RM14.9 billion from a net inflow of RM0.2 billion in the preceding quarter, mainly owing to higher outflows in other investment.

The DOSM report released today (Nov 11) cited international reserves standing at RM491.9 billion (as at end of Q2 2022: RM480.0 billion).

Foreign Direct Investment (FDI) posted a net inflow of RM12.3 billion from RM17.3 billion in the preceding quarter. Direct Investment Abroad (DIA) registered a net outflow of RM10.3 billion as compared to RM14.7 billion in the previous quarter.

Balance Of Payments Performance

Goods Account

In the third quarter of 2022, Goods account recorded net exports of RM43.0 billion compared to RM34.0 billion in the preceding quarter. Exports of goods reached RM313.2 billion, an increase of 5.9 per cent quarter-on-quarter (Q2 2022: RM295.8 billion). The major export products were Electrical & electronics (E&E), Petroleum products and Liquefied natural gas (LNG), notably to Singapore, China and the United States of America (USA). Similarly, imports of goods also grew by 3.2 per cent quarter-on-quarter, amounting to RM270.2 billion (Q2 2022: RM261.8 billion). The utmost imports was Intermediate goods, followed by Capital and Consumption goods, mainly from China, Singapore and Taiwan.

Services Account

Services account logged a lower deficit of RM9.6 billion compared to RM12.3 billion in the previous quarter. Since the reopening of international border for tourist arrivals, Travel showed a favourable performance which has led to a further narrowing deficit in Services beginning second quarter in 2022. Based on the quarterly comparison, exports of services grew at 24.4 per cent to record RM39.2 billion, while imports rose by 11.5 per cent to RM48.8 billion.

The upbeat in Services exports and imports were mainly contributed by Travel and Transport components. As exports of travel accelerated by 71.5 per cent to RM9.6 billion (Q2 2022: RM5.6 billion) higher than imports value of RM8.7 billion (Q2 2022: RM6.1 billion), Travel improved to a surplus of RM0.8 billion this quarter (Q2 2022: deficit of RM0.5 billion). Concurrently, Transport recorded a deficit of RM7.9 billion as compared to RM9.3 billion in the second quarter of 2022. The lower deficit in Transport was led by the growth of exports which grew at faster rate than imports to record RM7.8 billion (Q2 2022: RM5.6 billion). Meanwhile, imports of transport increased to RM15.8 billion (Q2 2022: RM14.9 billion).

Income Account

Primary Income account recorded a higher deficit of RM17.2 billion as compared to RM14.7 billion in the second quarter of 2022. This was mainly owing to the lower receipts of RM22.7 billion, a decrease of 10.0 per cent from the preceding quarter, primarily in Direct investment. At the same time, this account also registered lower payments of RM39.9 billion as compared to RM40.0 billion in the previous quarter, particularly in Direct investment.

Meanwhile, the Secondary Income account recorded a lower deficit of RM2.1 billion as opposed to a RM2.6 billion deficit last quarter. This account posted higher receipts of RM7.0 billion (Q2 2022: RM5.7 billion), similarly payments increased to RM9.1 billion (Q2 2022: RM8.3 billion).

Capital Account

Capital account registered a deficit of RM216.5 million as against RM90.5 million in the previous quarter due to net outflow of acquisitions/ disposals of non-produced non-financial assets at RM164.7 million (Q2 2022: net outflow RM32.4 million).

Financial account recorded a turnaround to a net outflow of RM14.9 billion as compared to a net inflow of RM0.2 billion in the preceding quarter. This was mainly led by outflows in Other investment at RM16.5 billion and Financial derivatives with RM0.4 billion. Meanwhile, Direct investment and Portfolio investment registered net inflows of RM2.0 billion and RM0.1 billion respectively.

Direct investment showed a lower net inflow of RM2.0 billion as against RM2.6 billion in the second quarter of 2022. In terms of assets and liabilities basis, Direct investment assets recorded a higher net outflow of Direct Investment Abroad (DIA)

According to the directional basis, Direct Investment Abroad (DIA) logged a net outflow of RM10.3 billion compared to RM14.7 billion in the previous quarter (Chart 4). The major contributors to the outflows were Services sector particularly in Financial activities. This was followed by Mining & quarrying and Manufacturing sectors. The top three DIA destinations were Singapore, Indonesia and Canada.

Foreign Direct Investment (FDI)

In the meantime, Foreign Direct Investment (FDI) recorded a net inflow of RM12.3 billion as compared to RM17.3 billion in the preceding quarter. Manufacturing remained the largest sector of FDI, followed by Services predominantly in Financial activities and Construction sectors. The main FDI sources were from the USA, Japan and the Netherlands.

Portfolio Investment and Other Investment

Portfolio investment turned around to record a net inflow of RM0.1 billion as compared to a net outflow RM14.7 billion in the preceding quarter. The Portfolio investment assets switched to a net inflow of RM2.6 billion (Q2 2022: net outflow RM4.4 billion), while liabilities recorded a lower net outflow of RM2.5 billion as against RM10.3 billion in the second quarter of 2022.

Meanwhile, Other investment turned around to a net outflow of RM16.5 billion from a net inflow RM12.5 billion last quarter. Other investment assets switched to a net outflow of RM30.5 billion (Q2 2022: net inflow of RM5.9 billion), while liabilities recorded a higher net inflow of RM14.0 billion (Q2 2022: RM6.6 billion).