The FBM KLCI opened at 1,468.99 as compared to last Friday’s close of 1,468.21.

The main index oscillated in the range of 1,465.15 – 1,468.99 at the time of writing.

According to dealer, Bursa Malaysia is likely to trend higher this week, supported by returning global investors, with the FBM KLCI moving between 1,460 and 1,480.

The buying interest as shown by strong support from foreign institutions is expected to lift the local bourse.

The positive news on China scrapping Covid flight suspensions and reduction on quarantine for inbound travellers would be the focus among investors, which in turn add positive momentum to the regional and mainland Chinese / Hong Kong bourses.

Technical Analysis on KLCI Futures (FKLI)

After the bullish close of last Friday’s trading day, stop-loss triggered; RHB Research initiate long positions on FKLI.

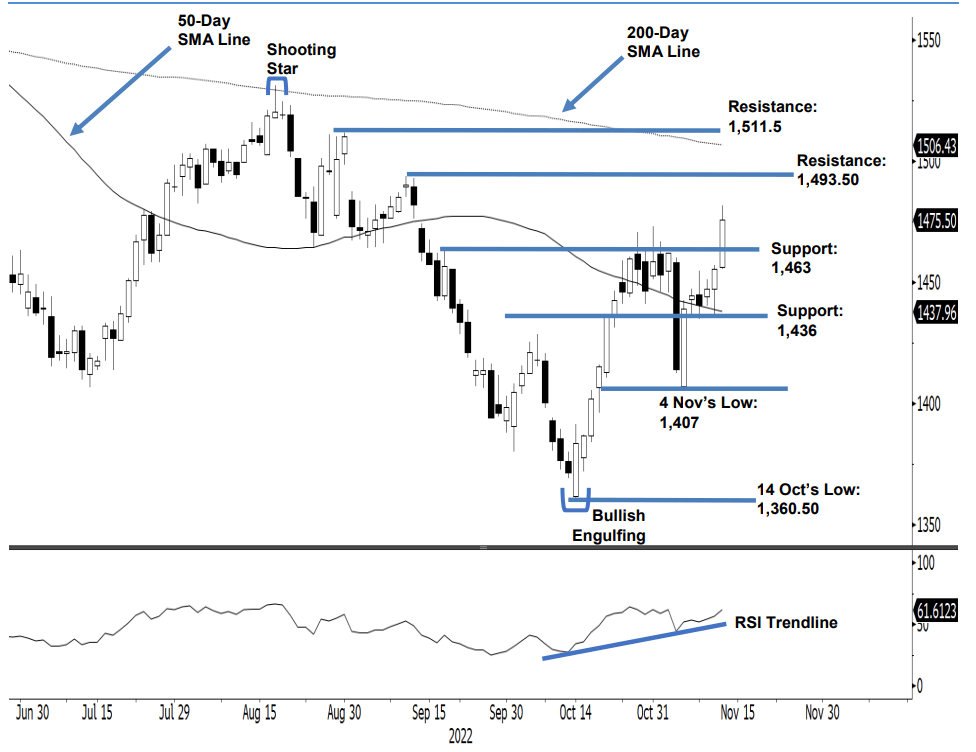

The FKLI breached the immediate resistance last Friday after closing 20 points higher at 1,475.5 points – forming a “higher high” bullish structure. The index opened on a neutral tone at 1,456 points, the immediately headed north throughout the session and hit the intraday high of 1,481.5 points before retracing mildly towards the close. The latest bullish candlestick that formed a breakout above the immediate resistance of 1,463 points indicates that the bulls are taking over the driver’s seats, and should remain so in the coming sessions.

The latest breakout also means the Bearish Marubozu formed on 3 Nov has been negated. This, coupled with the strengthening of the RSI pointing above the 60% level, compels the research house to think that FKLI may continue to trend upwards in the medium term, moving towards the 200-day SMA line. As the stop-loss level has been breached, RHB Research has shifted to a positive trading bias.

We closed out our short positions, initiated at 1,414 points or the closing level of 3 Nov, after the stop-loss at 1,463 points was triggered. Conversely, we initiate short positions at the closing level of 11 Nov at 1,475.5 points.

To mitigate the trading risks, the initial stop-loss threshold is set at 1,436 points. The immediate support is at 1,463 points – 20 Sep’s high, followed by 1,436 points or 10 Nov’s low. Conversely, the immediate resistance is at 1,493.50 points ie the high of 12 Sep, followed by 1,511.5 points ie the high of 30 Aug.