RHB Research has reiterated its long positions on HSI futures.

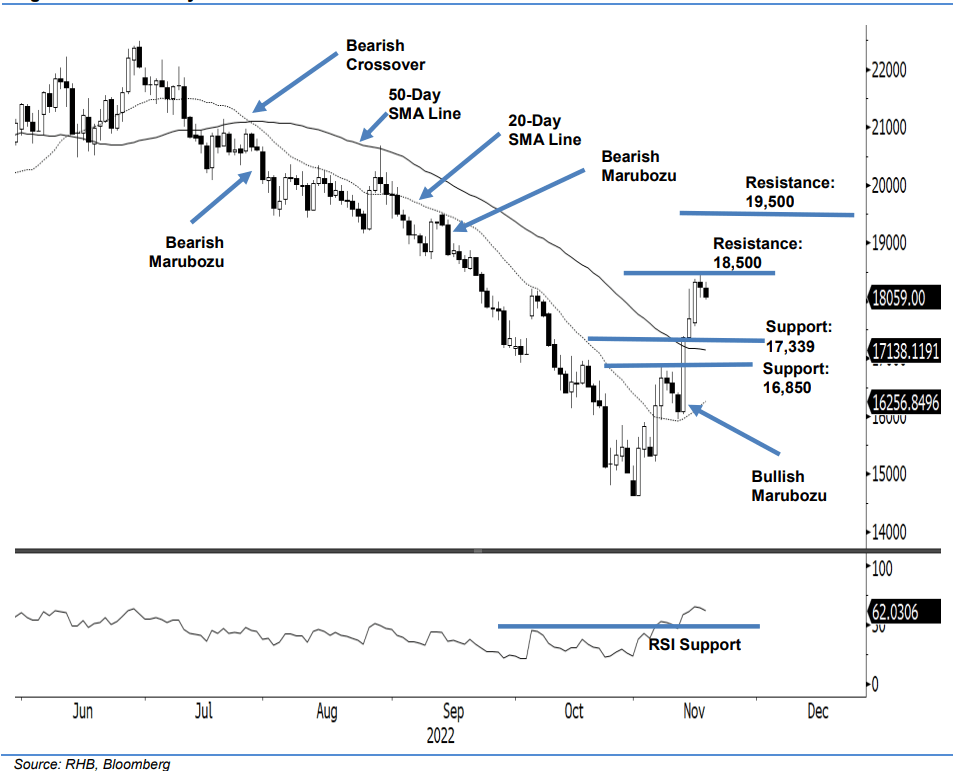

The HSIF’s bullish momentum took a breather on Wednesday as mild profit-taking occurred near the 18,500-point resistance. The index initially opened at 18,314 points and, after trading within the 18,494-point and 18,049-point range, it closed at 18,233 pts. In the evening, the HSIF retreated 174 points and last traded at 18,059 points.

The price action affirmed that 18,500 points is now acting as a strong resistance.

The index needs to climb above the immediate resistance to resume the upside movement. For the coming sessions, it is likely that the HSIF will consolidate sideways near 18,000 points before making a fresh attempt to stage a bullish breakout. In the event it extends the profit-taking activities, the HSIF may retreat towards the 17,339-point support. Meanwhile, the 50-day SMA line also provides additional support. At this stage, the research house still keeps to its positive bias.

Traders are advised to retain the long positions initiated at 16,657 points or the close of 7 Nov. To minimise the

downside risks, the stop-loss threshold is placed at 16,000 points.

The immediate support remains unchanged at 17,339 points – 14 Nov’s low – with lower support at 16,850 points. On the flip side, the nearest resistance is seen at 18,500 points and followed by 19,500 points.